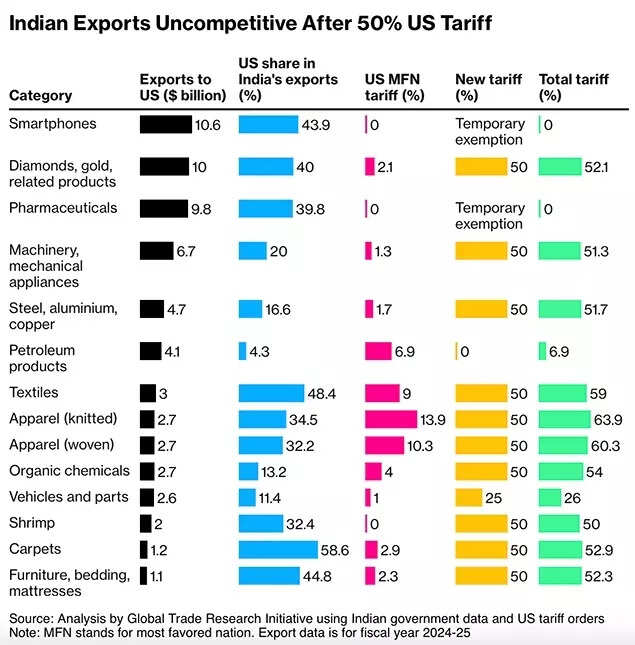

US President Donald Trump’s escalation of trade tussle with India – doubling tariff rate on India from 25% to 50% in just a week – has left Indian exporters hunting for alternatives to deal with the blow.Indian export businesses, which thrived on providing cost-effective products to American consumers, are now forced to revise their business approaches and seek alternative solutions.

The 50% tariffs on Indian products exported to the US makes them steeply expensive in the US market. This could severely impact exports, particularly affecting smaller enterprises, according to a Bloomberg report.

Trump’s tariffs: ‘Worse than Covid’

“This is worse than Covid for us,” Lalit Thukral, founder of apparel exporter Twenty Second Miles was quoted as saying in the report. “At least, there seemed to be an end to it. This tariff situation is just getting worse.” Thukral expressed concerns about having to sell products at a loss due to these heightened tariffs.Also Read | Tariff pe tariff’: Trump tantrums jolt US-India ties. Will Quad fall apart?As rising tariffs threaten the survival of smaller businesses such as Twenty Second Miles, major companies are exploring various strategies, including shifting manufacturing to nations with reduced tariff rates, seeking customers in different markets and looking at potential US-based acquisitions.

Indian exports uncompetitive after 50% US tariff

Gokaldas Exports Ltd., which generates approximately 70% of its earnings from the US market and ranks amongst India’s biggest clothing exporters, intends to increase production at its facilities in Kenya and Ethiopia, where US duties are only 10%.“Africa is looking like a good source at the moment,” Gokaldas’ Managing Director Sivaramakrishnan Ganapathi told Bloomberg. “We are seeing a huge amount of inquiries for production from that region from American customers.”

How will Trump’s tariffs hit India?

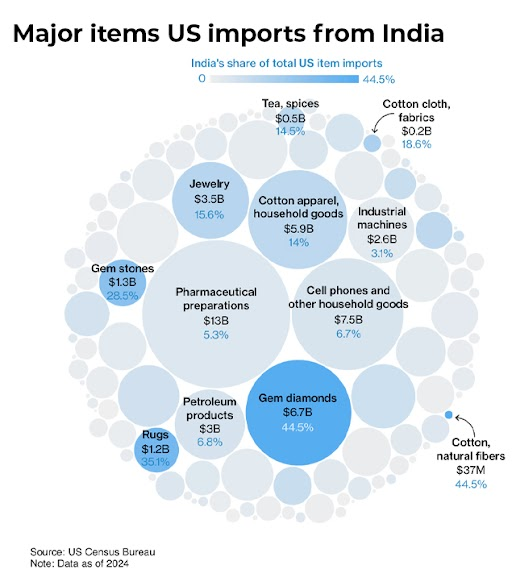

As exporters look to manufacture in other markets, the report said that the move could severely impact PM Narendra Modi’s signature ‘Make in India’ programme and hit India’s aspirations to emerge as a manufacturing alternative to China. Some economists suggest that the imposed Trump tariffs could reduce India’s gross domestic product by up to 1%, the report saidTrump’s tariff offensive has been accompanied by critical comments, describing India’s trade restrictions as “obnoxious” and its economy as “dead”, prompting counters from RBI and commerce minister Piyush Goyal who has asserted that India is the fastest growing major economy in the world.Also Read | Explainer: Donald Trump’s 50% tariffs – will India budge on Russia crude oil trade? The business community expects the government to come to their aid.Trade associations representing various sectors including apparel, gems and jewellery, and shrimp exports are increasingly seeking governmental assistance. The Confederation of Indian Textile Industry is urging for expedited governmental measures to assist local apparel exporters, whilst the shrimp export sector is requesting export incentive schemes.Chairman Kirit Bhansali of the Gems and Jewellery Export Promotion Council has issued a statement requesting duty drawbacks, pre-shipment loans and working capital interest deferrals.

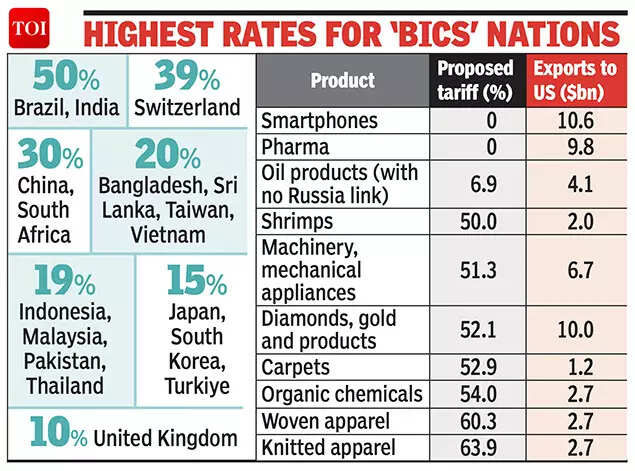

Highest rates for ‘BICS’ nations

According to Rohit Kumar, founding partner at public policy consultancy The Quantum Hub, the business sector had anticipated “there would be more predictability.”The potential US tariffs pose an immediate challenge to India’s strategy of positioning itself as an alternative manufacturing hub to China. The long-term implications could be more severe as policy frameworks evolve, according to Kumar’s assessment of supply chain restructuring efforts.Also Read | India in crosshairs: Trump’s Russia tariffs- How it could make China great againBloomberg Economics analysis by Chetna Kumar and Adam Farrar says, “The additional 25% oil penalty tariff would take the hit to US–bound exports to 60%, dragging GDP by 0.9%. This drop would be concentrated on the key items impacted by these tariffs such as gems and jewelry, textiles, footwear, carpets and agricultural goods — all labor-intensive industries.”The new 25% US tariffs, imposed as a response to India’s Russian oil purchases, will become effective in 21 days, allowing for intensive diplomatic discussions between New Delhi and Washington DC.

Dealing with US tariffs: What exporters are planning

Businesses are actively developing contingency plans. According to a Reuters report, Titan Ltd, a Tata Group jewellery manufacturer, is exploring options to relocate some production facilities to the Middle East, where US import duties are more favourable.Indian pharmaceutical companies are developing contingency plans in response to potential US tariff implementations, despite awaiting formal clarity on the matter.“We’ll be putting a initially small tariff on pharmaceuticals, but in one year — one and a half years, maximum — it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” Trump had said Tuesday in an interview on CNBC.

Major items US imports from India

Alembic Pharmaceuticals Ltd., which generates approximately 30% of its revenue from US operations, is considering acquisitions in America to enhance its manufacturing presence, according to Joint Managing Director Pranav Amin’s statement to Bloomberg News.Aurobindo Pharma Ltd., with nearly half its sales from the US market, has secured the purchase of Indiana-based Lannett Co. on July 30, strengthening its American manufacturing capabilities.The automotive sector faces significant impact, with $3 billion in component exports at risk, as reported by the Automotive Component Manufacturers Association. The proposed 50% tariff places India at a disadvantage compared to competitors like Vietnam, Indonesia and China.Also Read | Donald Trump’s 25% additional tariff on India: What are ‘secondary tariffs’ and how do they differ from ‘secondary sanctions’? ExplainedCompanies are actively seeking to expand their non-American customer base to establish a more diverse market presence globally.

Looking beyond US

Welspun Living Ltd., a prominent home fabrics supplier to the US market, recently disclosed to analysts its strategy to expand into the UK, European Union, Middle East, Australia, New Zealand and Japan, aiming to decrease its US market dependency.SNQS International, operating from Tiruppur’s textile centre in southern India, currently derives 20% of its revenue from US operations. Its founder V. Elangovan has outlined plans to enhance focus on European markets.According to Thukral of Twenty Second Miles, major textile producers are now accepting smaller, lower-value orders to maintain operational continuity, potentially affecting smaller enterprises’ market share.