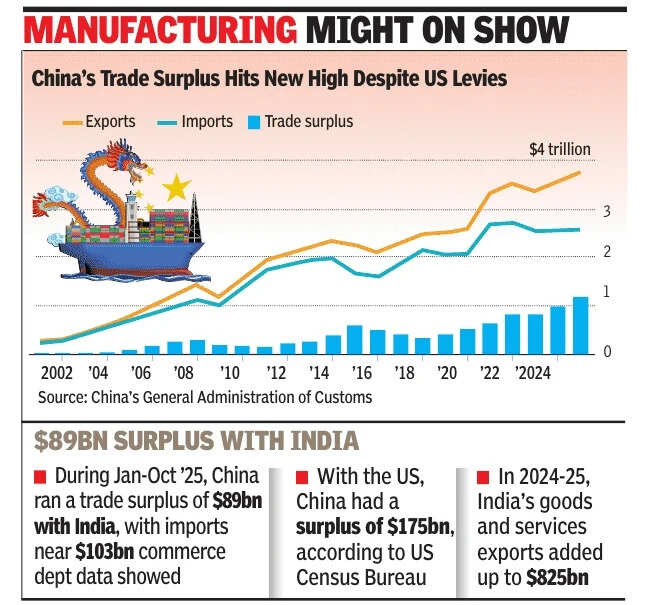

China’s exports ended last year with a growth spurt and sent its trade surplus to a record $1.2 trillion in 2025, extending a boom that’s seen factories escape Donald Trump’s tariffs by making deeper inroads into markets beyond the US.The resilience was the biggest surprise for an ailing Chinese economy and could cushion it in the months to come. Defying expectations for a slowdown, exports picked up last month — a feat given a high base of comparison from a year ago, when Trump’s re-election to the presidency sparked panicked front-loading of orders.The 6.6% gain in Dec was the quickest in three months, official data showed on Wednesday, and faster than any forecast in a Bloomberg survey of economists.“We expect export resilience to extend into this year, with exports remaining an important growth driver and partially offsetting weaker domestic demand,” Barclays economists wrote in a report.The combined increase in shipments to Southeast Asia and Europe more than offset a deepening contraction in sales to the US last year.A surge in exports of highend goods shows the headway China has made in moving up the value chain, which also led to its shrinking imports for products like cars. And as supply chains shift overseas, the construction of factories elsewhere — partly driven by Chinese investment — is pushing up demand for Chinese components, equipment and machinery. The factors driving China’s booming trade and large surpluses are unlikely to fade soon.

The country’s current account surplus — a measure of trade in goods and services — was projected by the International Monetary Fund at 3.3% of gross domestic product last year. That would be the highest level since 2010, when the country’s last great export upswing was tapering off following its ascension into the World Trade Organization in the early 2000s.The swelling trade surplus also underscores the imbalance between China’s manufacturing strength and stubbornly weak domestic consumption. It’s a vulnerability likely to persist into this year and beyond.While exports have powered the world’s second-biggest economy, its years-long property slump and falling investment are restraining the country’s appetite for foreign goods, reducing imports such as crude oil. Deflation at home also led to depreciation of the yuan in inflation-adjusted terms, making Chinese products more appealing elsewhere. But as China navigates tariffs and growing economic protectionism around the world, it’s stirring anxiety abroad as it pours exports into Africa, Latin America and beyond.Chinese authorities are taking steps to address the rising trade tensions, including by reducing export tax rebates for hundreds of products such as solar cells and batteries. In another sign of easing frictions, the European Union is considering a minimum price system for Chinese electric vehicles to replace import tariffs. As exports surge ever higher, the domestic implications are also far-reaching. The strength of external demand will likely weaken urgency for Chinese policymakers to boost domestic consumer spending and investment.Bloomberg