Donald Trump’s sanctions on Russia’s oil majors are unlikely to prompt India and China to completely stop buying Russian crude, though short-term disruptions are expected according to an analysis by Kpler, a global real-time data and analytics provider.India and China may see crude inventory depletion and potential refinery operational adjustments in the upcoming weeks due to short-term reductions. However, given their combined Russian seaborne crude imports of 2.7-2.8 mbd, complete substitution remains improbable, particularly considering geopolitical factors, the Kpler analysis says.Also Read | Sign of oil trade disruption after Trump sanctions? Russian crude oil tanker headed for India takes a U-turn; now idling in Baltic Sea

US sanctions on Russia’s Rosneft , Lukoil

Last week the Donald Trump administration announced sanctions against Russia’s leading oil corporations, Rosneft and Lukoil, marking the first Ukraine-related sanctions actions on Russian energy entities during Trump’s second term.The two oil majors collectively generate more than 5 mbd of crude oil and condensate, supplying at least 2 mbd to Russia’s maritime crude exports, including varieties such as Urals, ESPO, Sokol, CPC Blend, and Varandey, according to Kpler.Adding to the earlier sanctions imposed by former President Joe Biden in January on Russia’s third and fourth-largest oil firms, Gazprom Neft and Surgutneftegaz, these new restrictions under the Trump leadership are anticipated to create an immediate, brief interruption in Russian crude exports.

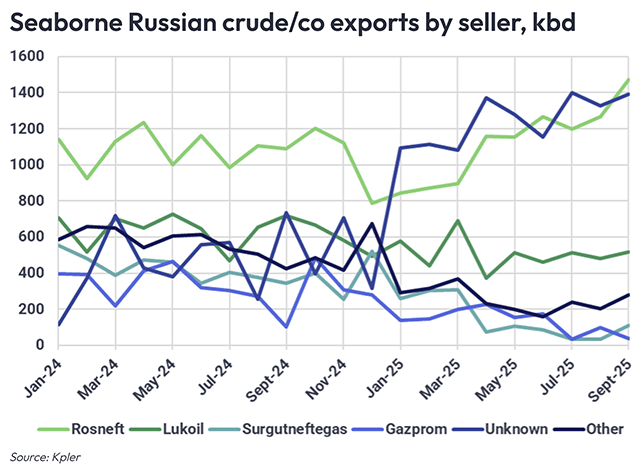

Seaborne Russian crude/co exports by seller, kbd

Sellers will require time to reorganise and reconstruct their trading operations to bypass limitations and address purchaser concerns. According to Kpler data, Gazprom Neft and Surgutneftegaz have notably decreased their crude exports since Q2, indicating possible redirection of production to domestic markets and/or sales through alternative, non-sanctioned trading organisations.Due to ongoing Ukrainian drone strikes on Russian refineries, Russia’s crude processing is expected to stay at 5.2 mbd through November–December, lower than the 5.4–5.6 mbd recorded at the same time last year.The sanctions on Rosneft and Lukoil might result in producers storing additional barrels, either on land or at sea, possibly leading to reduced production if alternative export routes aren’t quickly established, Kpler said.The US sanctions followed shortly after the UK’s decision to blacklist Rosneft and Lukoil, along with China’s Yulong Petrochemical and India’s Nayara Energy. Subsequently, Chinese state refiners have reportedly stopped Russian crude purchases, whilst Indian refiners have maintained their trading activities, Kpler said.

What are the alternatives to Russian crude oil?

Given their quality similarity to Urals, shorter transportation distance, and competitive pricing this month, Middle Eastern crude varieties including Basrah Medium (available for November loading), Abu Dhabi’s Upper Zakum, and Qatar’s Al-Shaheen are expected to see increased demand.The current Brent-Dubai EFS parity and relaxed Brent structure are favourable conditions for Chinese and Indian refiners to increase their Atlantic Basin long-haul cargo acquisitions, the analysis said.Also Read | Trump hits bulls’s eye with US sanctions? Why India, China may stop buying Russian oil – explainedThis is particularly relevant for PetroChina’s facilities in northeastern and northwestern China, which predominantly utilise domestic oilfield supply and Russian pipeline crude (~800 kbd), should term contracts become compromised.Beijing’s energy security priorities suggest PetroChina will maintain Russian pipeline imports, particularly following the US sanctions on Rizhao port.

Trump sanctions impact: Will India, China stop buying Russian crude?

Although the OFAC statement didn’t explicitly mention secondary sanctions, Chinese and Indian companies typically exercise caution regarding US sanctions, mindful of potential broader implications.The US measures announced on Wednesday are likely to lead to lower crude oil procurement from Russia by Indian refineries.Indian refiners are examining bills of lading for Russian oil shipments arriving after November 21, when the wind-down period concludes.

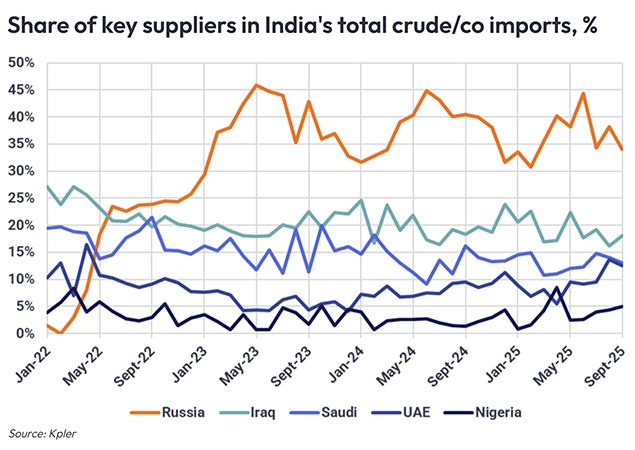

Share of key suppliers in India’s total crude/co imports (%)

Refiners in India, China, and Türkiye are conducting internal risk evaluations regarding transactions with sanctioned Russian companies while awaiting governmental guidance, as decisions about continuing Russian oil purchases may involve more than economic factors, Kpler said.This situation could result in delayed shipments or resale of oil at significant discounts to risk-tolerant buyers, including sanctioned entities or Chinese teapot refineries.Term-contracted buyers like Reliance and PetroChina are expected to temporarily decrease their purchases from sanctioned Russian suppliers Rosneft and Lukoil, but will likely resume large scale procurement once supply routes are reorganised.According to a Bloomberg report, RIL has switched to purchasing substantial volumes of oil from the US and Middle East suppliers, marking a shift from being the main importer of Russian oil this year.According to traders who spoke to Bloomberg, the company’s recent acquisitions include various oil grades: Khafji from Saudi Arabia, Basrah Medium from Iraq, Al-Shaheen from Qatar, and West Texas Intermediate from the United States. These deliveries are expected to arrive in December or January.Also Read | Easing trade tensions with Trump: India’s crude imports from US surge to highest since 2022; diversification away from Russian oil?An official company spokesperson issued a statement regarding compliance with European import regulations: “We have noted the recent restrictions announced by the European Union, United Kingdom and the United States on crude oil imports from Russia and export of refined products to Europe. Reliance is currently assessing the implications, including the new compliance requirements. We will comply with the EU’s guidelines on the import of refined products into Europe.“Chinese and Indian refineries will seek immediate cargo availability to compensate for decreased Russian supply, Kpler said. According to a TOI report, Indian oil refiners are likely to continue purchasing Russian crude oil as US sanctions specifically target Russian suppliers rather than the oil itself.Officials noted that while sanctions affect four Russian oil companies, India’s primary supplier Rosneft, which manages about 45 per cent of India’s Russian crude imports, functions as an aggregator rather than a direct producer, enabling non-sanctioned entities to maintain supply.During a post-earnings analyst call, IOC Director (Finance) Anuj Jain confirmed that the company plans to maintain Russian crude purchases whilst adhering to sanctions. “We are absolutely not going to discontinue (buying Russian crude) as long as we are complying with the sanctions. Russian crude is not sanctioned. It is the entities and the shipping lines which have got sanctions,” he said according to TOI.“If somebody comes to me with a non-sanctioned entity, and the (price) cap is being complied with, and the shipping is okay, then I will continue to buy it”, Jain added.Kpler believes that the US sanctions are expected to trigger short-term hiccups as buyers reassess their risk tolerance.“However, a major disruption to Russian crude exports appears unlikely, as the imposed measures are not secondary sanctions. Purchases by non-US entities — such as Indian, Turkish, or Chinese refiners — directly from Rosneft remain legally permissible,” it concludes.