On 20th January last year, when Donald Trump was sworn back into office, the H-1B programme entered a period of deliberate ambiguity. Within months, familiar fault lines reopened: renewed scrutiny of employer filings, sharper compliance signals from federal agencies, revived debate around higher fees and wage-linked eligibility, and a policy mood that made long-term planning harder for both companies and workers. At the same time, the demand for skilled labour—particularly in technology, healthcare, research and infrastructure-adjacent sectors—did not recede. Employers continued to file, even as the ground under the programme shifted.The result, a year into the administration, is not a single policy verdict on the H-1B, but a system in flux. The visa has become simultaneously more expensive to use, more closely watched, and yet more essential to key parts of the US economy. For global talent, this has translated into uncertainty not just about selection or renewal, but about outcomes after arrival—how pay, mobility and bargaining power actually play out on the ground.As Trump completes one year in office, and as employers and workers adapt to a more compliance-heavy, costlier H-1B regime, the most revealing shifts are no longer visible only in Washington. They are showing up in metro wage floors—where the same visa now produces sharply different pay, mobility and leverage.A new metro-by-metro analysis by Manifest Law, using US Department of Labor Foreign Labor Certification Performance Data on certified H-1B applications for 2025 (Q1–Q3), ranks US metropolitan areas by median annual wage—and it shows how sharply pay changes by location.This matters because the H-1B is not merely a visa; it is a wage system with rules. Employers must pay the higher of the actual wage paid to similarly qualified workers at the firm or the prevailing wage for that occupation in that geography. This means the “city” is not background, it is the formula.So the real question is not just who gets hired. It’s where the visa still pays like a premium ticket and where it behaves more like a staffing tool.

The metros going up: Where the wage floor is already high

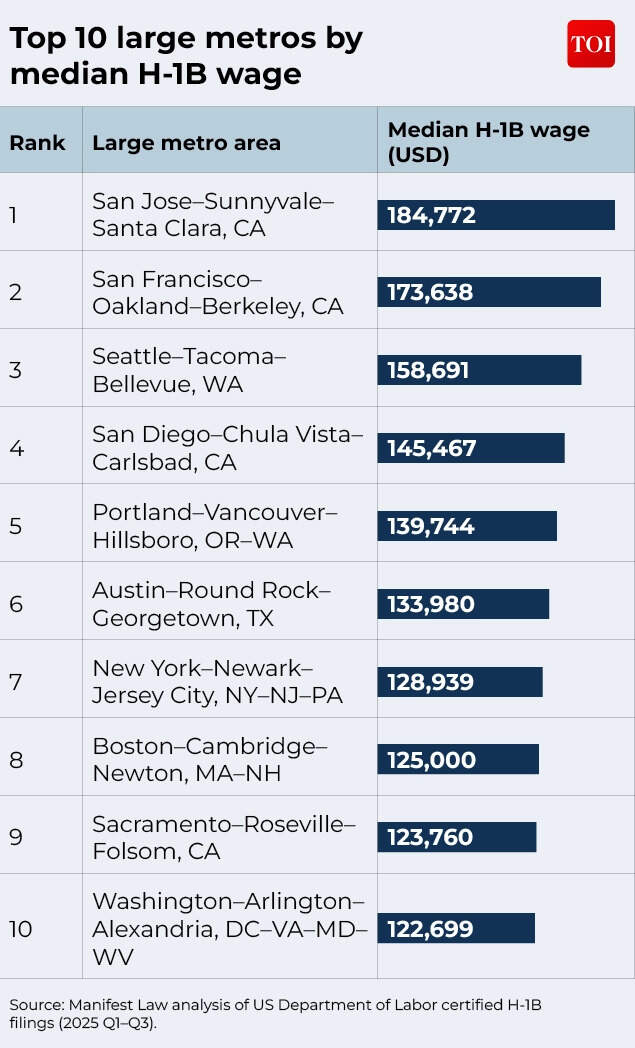

The top 10 “large metros” (defined by Manifest Law as metros with a population over one million) read like a familiar American power map—until you notice what the numbers are really saying.

Top 10 large metros by median H-1B wage

Yes, San Jose and San Francisco sit at the top. Yes, the West Coast dominates. But the bigger signal is this: These are not outlier salaries driven by a handful of elite roles. They are medians—the middle of the distribution. A high median suggests the centre of the market is expensive, not just the peak.This matters because these are places where skilled workers are hard to replace. When many firms compete for similar profiles — engineers, researchers, data specialists — salaries don’t just rise; they stick. Over time, that becomes the wage culture of the city.Austin’s presence in this list is telling. It is not Silicon Valley’s shadow anymore. For many workers, it is now a place where the H-1B can still translate into savings, upward mobility, and bargaining power — not just survival.What is also interesting is the quiet reshuffling inside the winners’ list:

- Seattle is third, reflecting a market anchored by large-scale cloud and enterprise ecosystems.

- San Diego being fourth is a reminder that defence-adjacent innovation and specialised biotech clusters can produce a high wage floor, not just brand-name Big Tech.

- Austin lands at sixth: the “new hub” that is no longer new, increasingly priced like a primary market.

The unexpected turn in this list is Austin. For a decade, it was sold as the affordable alternative to Silicon Valley: a younger tech scene, cheaper living, a softer landing. But its place in this top-pay list suggests the city has crossed a threshold. Employers are no longer hiring there because it is cheaper; they are paying up because the talent market is tightening. In H-1B terms, Austin is starting to behave like a primary hub, not a satellite.

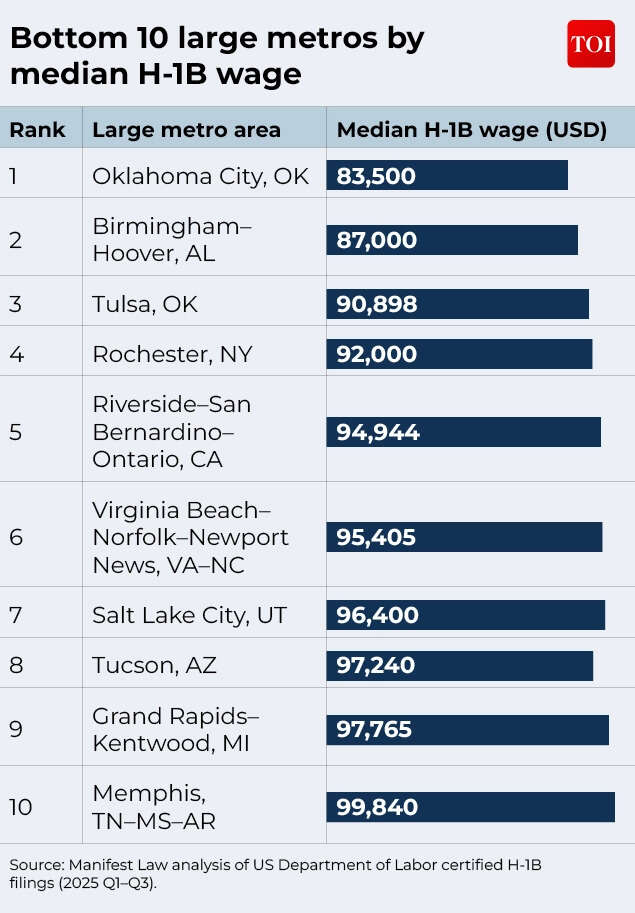

The metros falling behind: Not failing cities, just low-bargaining ecosystems

Now flip the map. The bottom list is where the H-1B story stops being a West Coast victory lap and becomes a structural warning. These are still large metros—not tiny towns, not remote counties. Yet their median wages fall below $100,000 across much of the list, with Oklahoma City at $83,500.

Bottom 10 large metros by median H-1B wage

Lower wages here do not automatically signal hardship. Living costs can be lower, careers stable. But the H-1B plays a different role. In these metros, it is less about competing for scarce talent and more about keeping operations running. Employers hire to fill roles, not to outbid rivals. Pay rises to meet rules, not to test limits.The structure then closes in on itself. Because prevailing wages are local, modest pay becomes the benchmark for future filings. Over time, the median turns into a ceiling. Nothing breaks, nothing collapses—but little moves upward either. The visa works, but it works quietly, without leverage. For the worker, it offers access to the system, not command within it.The table carries a quieter message than the rankings suggest. The bottom ten is not a random sprawl across America, it clusters in particular labour markets, with Oklahoma and Alabama appearing more than once, hinting at where wage bargaining power thins out. The presence of Riverside–San Bernardino–Ontario is especially telling: Geography alone does not confer prosperity, even in a high-pay state like California. And the narrow spread—from $83,500 to just under $100,000—shows not collapse, but containment: wages that move, but only within carefully set limits

Why geography is becoming destiny in the H-1B system

The H-1B was conceived as a national instrument, but in practice it has always been administered locally—and that distinction is now decisive. Because wages are benchmarked to geography, the visa increasingly behaves less like a uniform entry pass and more like a location-weighted contract. Where local labour markets price skill highly, the H-1B amplifies that advantage. Where they do not, it quietly caps outcomes.

Why geography is becoming destiny in the H-1B system

This is why the gap between metros matters more than headline salary figures. A high-wage city does not merely pay more; it creates a labour ecosystem where mobility is easier, counteroffers are credible, and career risk can be absorbed. Lower-wage metros, by contrast, channel the visa into narrower roles and tighter margins. The same legal framework produces different lived experiences—not by accident, but by design.In effect, geography has become the shadow policy of the H-1B system. Without changing a single rule, it determines who has leverage, who has options, and who merely has compliance.

For Indian professionals, the H-1B no longer delivers equal outcomes

Indian nationals dominate H-1B approvals year after year, but this dominance masks a growing internal split. Two Indian professionals with similar degrees, similar employers, even similar salaries on paper, can experience very different futures depending on where they work. The metro matters—to job mobility, to wage growth, to how long one can afford to wait in a green card queue.In high-floor metros, an H-1B often brings negotiating power: The ability to switch employers, to withstand layoffs, to plan a family life with some confidence. In lower-wage metros, the same visa can feel narrower—stable, but limiting. Job changes carry more risk. Pay growth is slower. The margin for error shrinks.This is not a question of talent or ambition. It is a structural inequality inside the visa itself. For Indian professionals, the H-1B is no longer a single bet on America. It is a bet on a particular city’s labour market—and some bets now pay far more reliably than others.

Why this divide may harden, not soften

There is little reason to believe this divide will narrow on its own. Policy discussions already point towards higher compliance costs, stricter wage thresholds, and mechanisms that privilege higher-paying roles. If the H-1B becomes more expensive to use, employers with thin margins will quietly retreat first.The result will not be a sudden collapse, but a slow sorting. Premium metros will absorb higher costs because they already operate at high wage baselines. Lower-wage metros may find the visa harder to justify. In that scenario, geography will not just shape outcomes—it will lock them in. And the H-1B, once imagined as a national ladder, will function increasingly like a set of local ceilings.