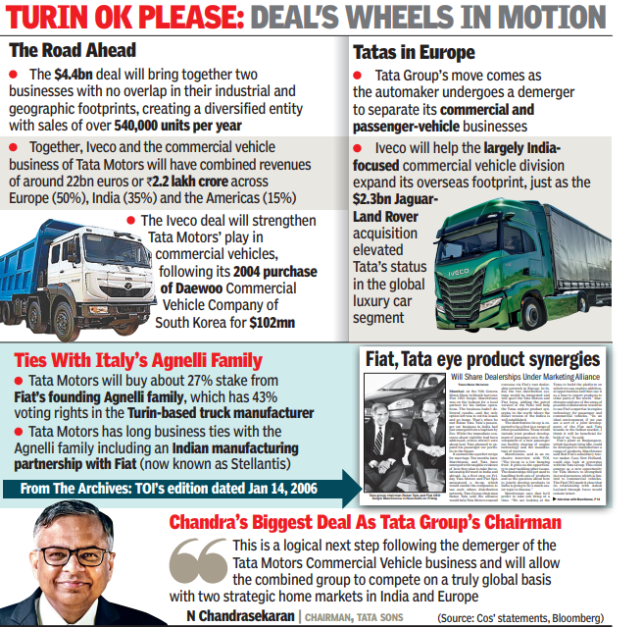

MUMBAI: In its biggest overseas deal and a strategic play aimed at expanding footprint in Europe, Tata Motors will buy Italian truck manufacturer Iveco for Euros 3.8 billion ($4.4 billion). Iveco will also be the biggest acquisition under Tata Group chairman N Chandrasekaran after Bhushan Steel and Air India. Chandrasekaran briefed the Tata Sons board on Wednesday about the deal.Tata Motors will launch an all-cash tender offer on Iveco’s shares, subject to the sale of the Italian company’s defence business, at 14.1 euros apiece. The defence business will be sold to Leonardo.Iveco’s largest shareholder Exor will sell its 27.1% stake and 43.1% of voting rights to Tata Motors. Exor is owned by the Agnelli family, one of the founders of Fiat. The tender offer is subject to a minimum acceptance level of 80% of shares tendered.Iveco is active in more than 30 countries, including India, China, United States and Russia. It designs, manufactures, and sells trucks, buses and defence vehicles.It also offers financial products and services to dealers and customers.

Tata Sons won’t incur any debt unlike past takeovers Tata Motors and Iveco said, “The offer would bring together two businesses with highly complementary product portfolios and capabilities and with substantially no overlap in their industrial and geographic footprints.”The combined group would have a significant global presence, with sales of over 5.4 lakh units per year and revenues of around 22 billion euros split across Europe (50%), India (35%) and the Americas (15%). Tata Motors’ move follows the demerger of its commercial vehicle unit, which virtually has no manufacturing footprint in the European commercial vehicle industry.Tata Motors, which will route the acquisition through TML CV Holdings, incorporated under Dutch law, intends to delist Iveco from Euronext Milan stock exchange. Morgan Stanley Bank, Morgan Stanley Senior Funding and MUFG Bank have jointly underwritten the financing facilities of euros 3.8 billion for funding of the tender offer, Tata Motors said.Unlike previous major acquisitions, Tata Sons, the holding company of Tata Group, will neither incur debt nor provide financial guarantees for this transaction. This shift follows RBI regulations which prevent unregistered core investment companies from accessing public funds directly or indirectly. Tata Sons has already applied to relinquish its core investment company status. Previously, Tata Sons supported acquisitions of Tetley, Corus, VSNL (now Tata Communications) by raising debt on its books and offering letters of comfort to lenders on behalf of its subsidiaries.Chandrasekaran briefed the Tata Sons board about the deal on Wednesday. The 20-minute Tata Sons board meeting occurred without a pre-distributed agenda.According to industry observers, Tata Motors is facing storms with Jaguar Land Rover moving to electric vehicles, US tariffs affecting luxury models, and big spending needed to comply with new European rules. They believe the Iveco deal will increase borrowing as Tata Motors’ current cash flow cannot adequately cover the M&A transaction.