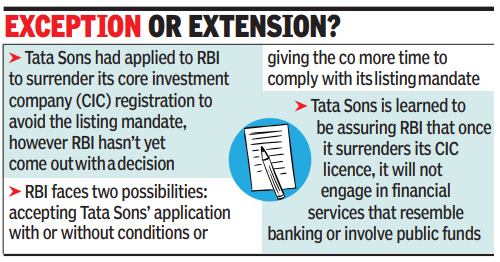

MUMBAI: As the Reserve Bank of India-mandated listing deadline for Tata Sons expired, all eyes are on the regulator’s stance concerning the holding company of India’s largest conglomerate, the Tata Group.Although Tata Sons had applied to RBI to surrender its core investment company (CIC) registration to avoid the listing mandate, the banking regulator has not yet come out with a decision on its application.In response to an RTI query, RBI had said that Tata Sons’ application was under consideration.Sources indicate that Tata Sons has been awaiting RBI’s decision on its application submitted in March 2024, and since no word from the regulator came before the Sept-end listing deadline, the deadline naturally expired.According to lawyers, there are two possibilities: either RBI accepts Tata Sons’ application with or without conditions or gives the company some more time to comply with its listing mandate.

Exception or extension

The central bank’s FAQs, however, highlight the structural challenge. While a CIC must keep 90% of its investments within the group, current norms cap group exposures for upper-layer NBFCs at 25-40% of capital. This makes a clean shift from NBFC-CIC difficult without breaching net owned funds, capital adequacy or concentration rules, since most of the business is tied up in subsidiaries.RBI says exemptions may be considered case by case if full details are furnished. Tata Sons is learned to be assuring RBI that once it surrenders its CIC licence, it will not engage in financial services that resemble banking or involve public funds. Such an undertaking could clear the way for de-registration and negate the need to list.