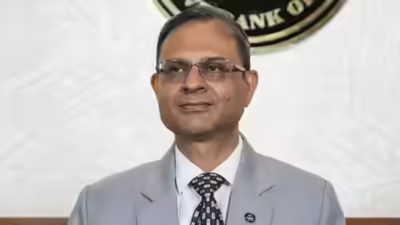

MUMBAI: RBI governor Sanjay Malhotra said that the regulator plans to increase offsite surveillance of banks in real-time. Historically, RBI has been conducting onsite supervision of the records of banks largely through annual financial inspections and targeted inspections under a risk-based supervision framework focusing on core areas like capital adequacy, asset quality, management, earnings liquidity and systems (Camels).RBI’s real-time offsite supervision, powered by offsite monitoring and surveillance (Osmos) and advanced data analytics, continuously monitors banks’ financial health between onsite inspections through automated daily/weekly/monthly data submissions, enabling early detection of stress in asset quality, liquidity, and capital.

Offsite supervision helps faster risk identification, resource optimisation by shifting 70-75% of efforts to techdriven analysis, improved data integrity, and quicker RBI interventions like quarterly checks for weak banks.Pointing out that RBI collects vast amount of data updated by banks through platforms provided by RBI, Malhotra said there is scope for more effective use of this data. He was delivering the keynote address at the third annual global conference of the College of Supervisors, Mumbai, an institution that launched in May 2020 and started its function in a virtual mode because of the pandemic.“For example, department of supervision can build stronger analytics and supervisory dash boards for enhanced offsite surveillance, to support more continuous monitoring and early risk detection. Our endeavour should be to make supervision more offsite than onsite and as near real-time and not periodic. Increasingly, this will also mean using SupTech and AI-enabled tools more deeply, while retaining judgment and accountability, firmly with supervisors,” said Malhotra.He said that systemic resilience was described as a shared responsibility between supervisors and regulated entities. Regulation and supervision were characterised as collaborative rather than adversarial, with long-term growth, stability, integrity and credibility of the financial system seen as common objectives. Stability was highlighted as essential for sustainable innovation, with banks and financial institutions encouraged to view supervisors as partners in resilience rather than fault-finders, an approach seen as critical for a bank-led system supporting inclusive growth. On supervisory action, the governor said enforcement should be viewed as corrective and part of a continuum of tools, not a standalone response.In recent years, RBIs capability of assessing asset quality of banks has improved vastly thanks to the creation of databases like CRILIC.