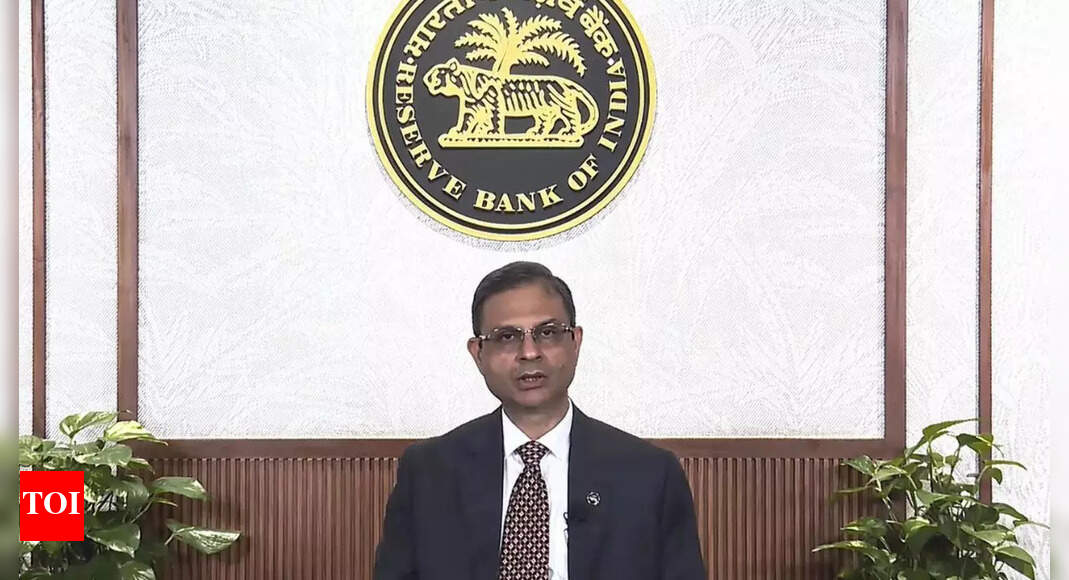

MUMBAI: RBI governor Sanjay Malhotra on Tue unveiled the biggest regulatory overhaul in nearly a decade, aimed at strengthening banks, expanding credit flow to corporates including for acquisitions, enhancing consumer protection, and advancing the internationalisation of the rupee. The reforms are expected to help the economy achieve the 6.8% higher growth forecast by RBI on Wednesday even as its monetary policy committee kept repo rates unchanged at 5.5%.The governor announced 22 measures that seek to strengthen the resilience and competitiveness of the banking sector, improve the flow of credit, promote ease of doing business, simplify foreign exchange management, enhance consumer satisfaction, and advance the internationalisation of the Indian rupee.The reforms include risk-based deposit insurance, new provisioning frameworks, an overhaul of foreign exchange regulations, and fresh incentives for lenders to fund businesses. Malhotra said the measures will “align our guidelines with international standards while adapting them to India’s national priorities” and prepare the financial system to manage risks from global headwinds.

Stronger banks, better risk management

At the heart of the reform package is a new provisioning system, the Expected Credit Loss (ECL) framework, which will apply to all scheduled commercial banks and All India financial institutions from Apr 2027, with a glide path till 2031. “This is to smoothen the one-time impact of higher provisioning, if any, on existing books of banks,” Malhotra explained.Alongside, revised Basel III capital adequacy norms will also kick in from Apr 2027. Lower risk weights for lending to MSMEs and home loans are expected to ease capital requirements, encouraging banks to expand credit in these sectors.Another significant change is the shift to risk-based deposit insurance. Currently, all banks pay a flat 12 paise per Rs 100 of deposits. “We propose to bring in a risk-based premium. This will incentivize sound risk management by banks and reduce the premium for stronger institutions,” Malhotra said.

More credit to businesses

The RBI has moved to widen credit access and lower financing costs. Banks will now be able to fund corporate acquisitions more freely, lend against listed debt securities without regulatory caps, and extend higher limits on loans against shares and IPO financing.The central bank also scrapped a 2016 framework that discouraged lending to large borrowers with exposures above Rs 10,000 crore. “Concentration risks at the system level will be addressed through macroprudential tools, rather than blunt restrictions,” Malhotra said.NBFCs financing infrastructure projects will benefit from reduced risk weights, while a long-pending reform—licensing of new urban cooperative banks—will finally be reconsidered after a two-decade pause.

Simplifying rules, boosting exports

On ease of doing business, the RBI will consolidate nearly 9,000 circulars and directions into subject-wise compilations across 11 categories of regulated entities. Malhotra said this “should certainly aid simplification.”For exporters, the central bank has extended the repatriation window for foreign currency accounts in IFSCs, lengthened timelines for merchanting transactions, and simplified reconciliation of outstanding entries in trade reporting portals.External commercial borrowing rules will also be rationalised, and FEMA regulations for non-resident businesses setting up in India will be simplified.

Consumers and the rupee

On consumer protection, RBI will expand services available to holders of basic savings accounts to include digital banking. The internal ombudsman system within banks will be strengthened, while the RBI’s own ombudsman scheme will be revised to cover rural cooperative banks as well.Internationalisation of the rupee is another theme. Authorised dealer banks will be allowed to lend in rupees to non-residents in Bhutan, Nepal, and Sri Lanka; transparent reference rates will be introduced for currencies of major trading partners; and Special Rupee Vostro balances will be eligible for investment in corporate bonds and commercial paper.

Coordinated policy for resilient growth

Malhotra noted that the global environment had worsened since Aug but said India remained on track to deliver strong growth. “The sobering of inflation has given greater leeway for monetary policy to support growth without compromising our primary mandate of price stability,” he said.Looking ahead, the governor emphasised the need for policy coordination. “As India strives towards achieving Viksit Bharat by 2047, it will need the coordinated support of fiscal, monetary, regulatory and other public policies,” he said. “We will remain vigilant of incoming data and stay focused on our objective of maintaining price stability while supporting growth.”Calling the reforms “a proactive step towards building stronger banks, better consumer safeguards, and a global role for the rupee,” Malhotra added that RBI would back its words “with credible actions and consistent communication.”