NEW DELHI: Moody’s Ratings on Monday affirmed India’s sovereign rating at Baa3 and maintained the outlook as stable, citing a fast-growing economy, sound external position, and a stable domestic financing base for ongoing fiscal deficits.The ratings agency said India was and will remain the fastest-growing G20 economy through at least the next two to three years. “We project economic growth to be sustained at 6.5% in fiscal 2025-26 as govt’s continued emphasis on capital expenditure, lower inflation, and the consequent easing of monetary policy will support robust domestic consumption and investment,” Moody’s Ratings said.

Moody’s affirms India’s sovereign rating at ‘Baa3’

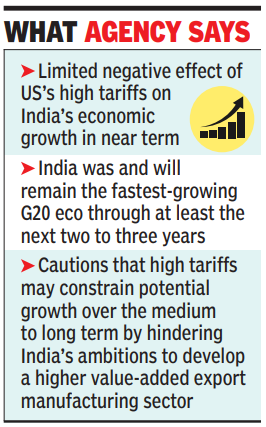

It said that the US’s imposition of high tariffs (currently at 50%) will have limited negative effects on India’s economic growth in the near term. However, it cautioned that it may constrain potential growth over the medium to long term by hindering India’s ambitions to develop a higher value-added export manufacturing sector.Earlier, Morningstar, DBRS, and S&P Global Ratings upgraded India’s sovereign credit rating, and this was followed by Japanese credit ratings agency RI, which upgraded India from BBB to BBB+. The rating upgrades will help boost investor sentiment and ease borrowing costs for companies.The agency also said that at this stage, it expects subsequent negotiations between India and the US to result in less punitive rates and domestic market-oriented foreign investment to remain robust. “We do not expect other US policy shifts, including those related to new applications for skilled worker visas and potential levies on US businesses that outsource operations offshore, to significantly weigh on workers’ remittances or India’s services exports. Consequently, risks of a significant widening of India’s current account deficits will remain limited,” said Moody’s Ratings.The agency said that the stable outlook incorporates India’s gradually improving fiscal metrics and resilient growth prospects compared with peers. “However, fiscal accommodation in the context of the uncertain global macroeconomic outlook, including revenue-eroding measures, could impede progress towards debt reduction and exacerbate already weak debt affordability,” said Moody’s Ratings.