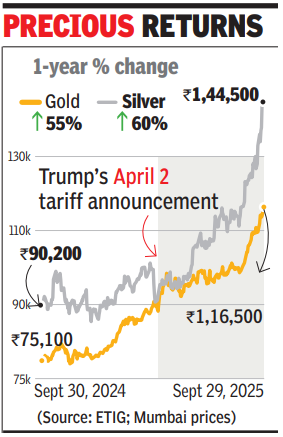

MUMBAI: Gold and silver prices continued to record new all-time highs in the domestic market on Monday. It was backed by rallies in international prices on the likelihood of a US govt shutdown, trade-related jitters, and the continuing weakness of the rupee against major currencies.In the local spot market silver hovered around the Rs 1.5 lakh/kg mark, while gold was nearing the Rs 1.2 lakh/10gm mark. In international markets, the price of the yellow metal neared the $3,900/ounce (Oz) mark, a new all-time peak while the white metal traded above the $47/Oz mark after more than 13 years.The recent gains in gold and silver prices also came due to the expectation that US Federal Reserve will lower interest rates by an additional 50 basis points (100bps = 1 percentage point) this year, said Renisha Chainani of Augmont, a precious metals research and advisory firm.

On Monday, silver in Delhi’s spot market went above the Rs 1.5-lakh-mark for the first time, an agency report said. In some other parts of India, the price of the white metal was slightly lower. on MCX, silver futures price for Dec delivery touched a high of Rs 1.44 lakh while for Sept 2026 delivery it was at Rs 1.5 lakh.In the spot market, gold prices traded above the Rs 1.15 lakh mark, a late evening report from India Bullion & Jewellers Association showed. On MCX, gold futures price for Oct delivery had breached the Rs 1.15 lakh mark, while for Dec delivery, the price was close to that level. Reports regarding US shut down also led to safe haven buying in precious metals and this could gain strength if the debt bill in the world’s largest economy is not passed before Oct 1, said Manav Modi, from Motilal Oswal Financial Services.Sensex falls for 7th dayAfter a bounce back in early trades, the sensex settled 62 points lower at 80,365 points on Monday as foreign funds continued to sell domestic shares. FPIs were net sellers at Rs 2,832 crore.