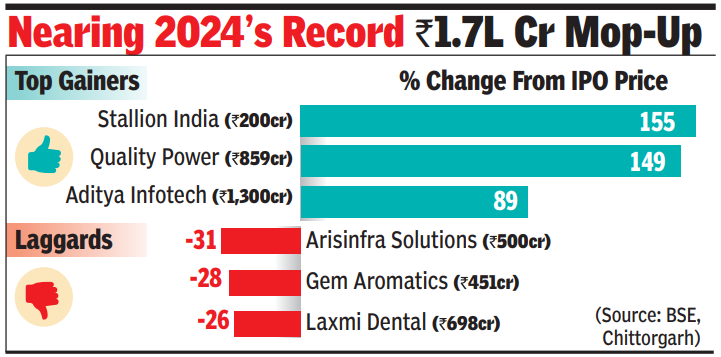

MUMBAI: The year 2025 is on track to top the previous year’s record for IPO fundraising. Following a record Rs 1.7 lakh crore raised in 2024 through maiden public offers, the final tally for 2025 could either come close to the previous year’s record figure or even surpass that.The first nine months of the current year, 68 companies have gone public through IPOs, with the combined fundraising at nearly Rs 1.1 lakh crore. Another 13 companies, aiming to raise a further Rs 23,100 crore, are at various stages of the IPO process: awaiting listing, open for bidding and set to close this week, or all set to open soon. On Tuesday itself, four companies were listed on the exchanges.Data from BSE and Chittorgarh, an IPO data company, showed that more than half of these IPOs (38) made money for investors. While five companies are languishing at their IPO prices, there are another 25 stocks that are in the red compared to their IPO price.

Top gainers and laggards

Of the 38 that made money, two — Stallion India Fluorochemicals and Quality Power Electrical Equipments — have more than doubled the money for their IPO investors. In Jan, Stallion India closed its Rs 200-crore IPO with the offer price set at Rs 90. On Tuesday, the stock on BSE closed at Rs 230, an appreciation of over 155% or 2.5 times the offer price.A month after Stallion India’s offer, Sangli, Maharashtra-based Quality Power Electrical Equipments closed its Rs 859-crore IPO with the offer price at Rs 425. On Tuesday, the stock on BSE closed at Rs 1,057, an appreciation of nearly 150% or 2.5 times the offer price.What makes a good IPO? According to Mahavir Lunawat, founder & MD, Pantomath Capital, a home-grown investment banking outfit, one should look for businesses that are not only scalable, but sustainable. “While taking a company public, we look for those with strong moats, differentiated capabilities, and long-term competitive advantages. Such businesses inherently command a premium, and rightfully so, given their ability to create enduring value,” Lunawat said.The year’s IPO performance tally showed that in the first nine months, along with the two top performers, six issues gave returns between 40% and 90%, another 20 have given double-digit returns, 10 have given returns in single-digit, and the balance 30 have either given no return or have lost money for investors.