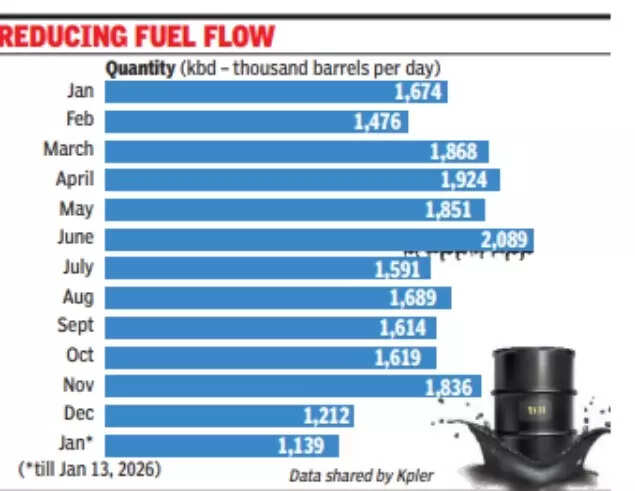

NEW DELHI: India’s import of Russian crude recorded a sharp 29% month-on-month decline, falling to the lowest volumes since implementation of the price cap policy, but is making a strong turnaround in January this year, Centre for Research on Energy and Clean Air (CREA) said in its monthly analysis of Russian fossil fuel exports for December.The report said the decline occurred despite total imports growing marginally. The drop was driven by a sharp reduction in imports by Reliance’s Jamnagar refinery – to the tune of nearly 49% – and a 15% cut by state-owned refineries in Dec. According to Kpler, a global real-time data and analytics provider, India imported over 20.4 million barrels of crude from Russia in 2025. The month of Dec saw imports of 1.2 million barrels, compared with 1.8 million barrels a month earlier. Till Jan 13 this year, India had already imported over 1.1 million barrels of crude oil from Russia.

In terms of value, India was the third-highest buyer of Russian fossil fuels – displaced by Turkiye from the second position – importing a total of EUR 2.3 billion of Russian hydrocarbons in Dec, CREA said in the report. While crude oil constituted 78% of India’s purchases, totalling EUR 1.8 billion, coal (EUR 424 million) and oil products (EUR 82 million) constituted the remainder of India’s monthly imports. India’s import of crude oil was recorded at EUR 2.5 billion in Oct and EUR 2.6 billion in Nov.The report added that the Jamnagar refinery cut its imports from Russia by almost half in Dec. “The entirety of their imports were supplied by Rosneft, albeit from cargoes purchased before the OFAC (Office of Foreign Assets Control in the US) sanctions came into effect. State-owned refineries also cut Russian imports by 15% in Dec,” the report stated.As per CREA analysis, Russia’s monthly fossil fuel export revenues saw a marginal 2% month-on-month decline to EUR 500 million per day – the second-lowest figure since the full-scale invasion of Ukraine. Monthly export volumes also witnessed a similar 2% month-on-month reduction. Total crude oil export revenues dropped by 12% to EUR 198 million per day.Russia’s fossil fuel exports remain highly concentrated, with China dominating coal and crude oil purchases, Turkiye dominating purchases of oil products, and the EU remaining the largest buyer of LNG and pipeline gas. While China remained the largest global buyer of Russian fossil fuels in Dec, accounting for 48% (EUR 6 billion) of Russia’s export revenues from the top five importers, The EU was the fourth-largest buyer of Russian fossil fuels, accounting for 11% (EUR 1.3 billion) of Russia’s export revenues from the top five importers.In December, five refineries in India, Turkiye and Brunei that use Russian crude exported EUR 943 million of oil products to sanctioning countries. The importers included the EU (EUR 436 million), the US (EUR 189 million), the UK (EUR 34 million) and Australia (EUR 283 million).