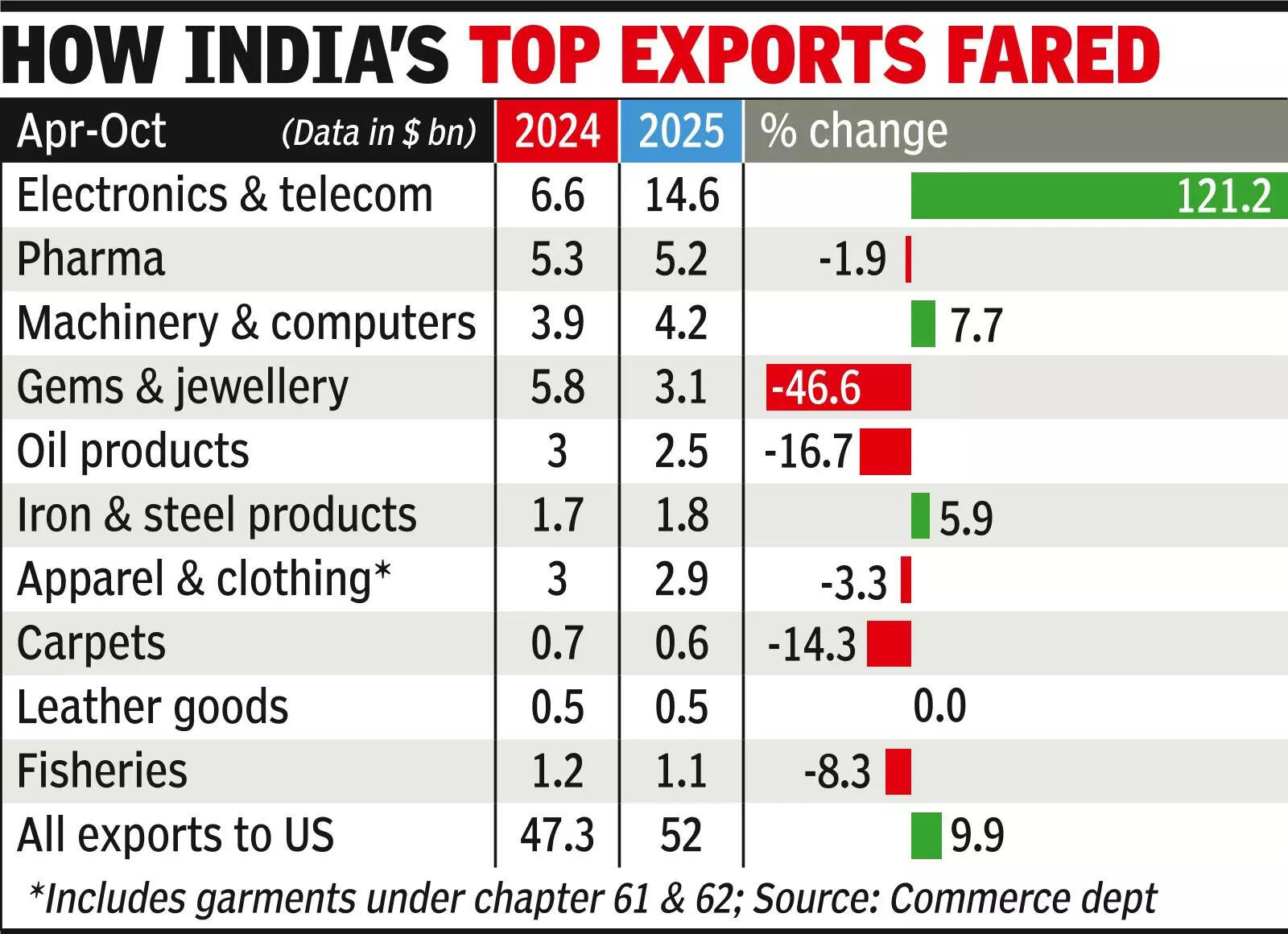

NEW DELHI: With spring-summer dispatches to the US lined up in the next few weeks, a leading leather goods exporter has planned visits to Europe and America to book orders for the next season.The exporter has significant dependence on the American market and has been offering around 20% discount while the buyer has reduced its margin by 7-8% to ensure that made-in-India goods are not disadvantaged compared to rival sources, where tariffs are in the range of 15-20% compared to 50% on Indian products entering the US.“The buyers know that we cannot sustain this as this is more than the profit that we make. These are tough times to keep the order book up,” said the exporter.He is not alone. Several Indian garment and footwear companies decided to bear a part of the additional burden and also managed to convince the American buyer to reduce the margin, in the hope that they would be able to sustain for a few months before the trade deal, which has been in the pipeline, is finalised.

American Buyers Evaluating Other Mkts Too: Industry Execs

With no clarity on the deal, and US President Donald Trump only ratcheting up the noise on tariffs, exporters are worried about the next season’s orders.An industry executive said that some of the American buyers are looking to evaluate India and other comparable markets. “If the deal is done then they will stick with the Indian seller, otherwise some of them may shift,” said the executive.An industry veteran said that leather and textiles, both employment-intensive sectors, will be the worst hit if orders move.With a free trade agreement with the European Union in sight, Indian exporters are eyeing opportunities, although it may take several months for the treaty to be ratified after it is finalised by both sides.For exporters, the US remains the focus market. “You can expect to get an order for 500 pieces with 20 designs from one American buyer. In Europe, you will need 10 buyers and many more designs to reach that number,” said an exporter.Govt officials indicated that Trump administration officials have gone through what they described as a “good offer” but there is no further word on it, leaving exporters to deal with a fresh round of uncertainty just as they prepare for the next season.