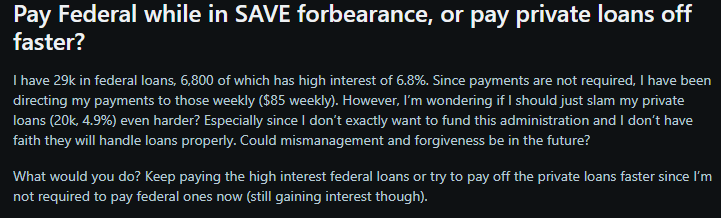

With federal student loan payments still on hold through the SAVE forbearance, students and new graduates are being left with no choice but to make repayment decisions without clear guidance. Though federal student loan payments are not currently due, interest is still accruing, and private student loans are fully in effect. This has created a confusing situation for borrowers who have both federal and private student loans, leaving them wondering whether to continue making voluntary payments on federal loans or make payments on private loans that are not very flexible.A recent Reddit discussion captures this uncertainty. The post, shared by a borrower with a mix of federal and private student loans, sparked responses from other borrowers who outlined how they are approaching repayment during the forbearance period. Their suggestions reflect the real-time choices students are making as they try to balance interest costs, financial risk, and uncertainty around federal loan handling.

The student loan situation behind the debate

According to the post, the borrower holds $29,000 in federal student loans, including $6,800 with a high interest rate of 6.8%, along with $20,000 in private loans at 4.9% interest. Although federal payments are not required at present, the borrower noted that interest is still accumulating.To stay proactive, the borrower has been making weekly voluntary payments of $85 toward the higher-interest federal loan. However, this raised a key question: should those payments continue, or would they be better used to aggressively reduce private loan balances?

What students are advising: Private loans take priority

Some of the commentators who responded to the post highlighted the fact that there are no protections associated with private student loans. According to the discussion, private student loans do not have any forgiveness programs and flexible repayment terms.Some commenters also highlighted concerns around co-signers, noting that missed payments on private loans could directly affect family members. As a result, many advised prioritising private loan repayment, even if federal loans carry higher interest rates.

Build a financial cushion before aggressive repayment

Another important suggestion that was raised in the comments, which is related to financial preparedness, is that one of the commenters asked whether the borrower had an emergency fund of six months, which means that students should first have basic financial stability before spending a lot of money on repaying the loan.This approach reflects a broader concern among borrowers about managing unexpected expenses or income disruptions during an already uncertain repayment period.

How SAVE forbearance shapes repayment strategy

Commenters acknowledged that although payments on federal loans are temporarily stopped, the accrual of interest under SAVE forbearance makes it difficult to repay the loans. Others emphasized that it is essential to have a strategy for federal loans when normal repayment is resumed.Others pointed out that while a plan for federal loans is necessary when normal repayment is resumed, federal loans still have features that private loans do not, which affect how students manage their loans during the pause.

The solution students are arriving at

Taken together, the Reddit discussion points toward a solution that many students appear to be adopting during SAVE forbearance:

- Ensure that an emergency fund is established before accelerating debt payments

- Pay off private loans first due to the absence of forgiveness and limited consumer protections

- Take advantage of the flexibility offered by federal loans while planning for the future of debt repayment

Why this matters for students now

The conversation points to a change in the way students think about repaying their student loans. Instead of being concerned only with interest rates, students are considering risk, flexibility, and financial security as they think about where to allocate their funds.With SAVE forbearance extending and interest accumulating, conversations like this one among students are becoming an increasingly valuable resource for those trying to navigate the uncertain world of student loans.