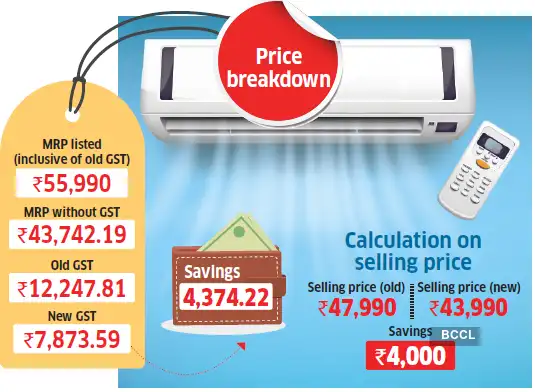

Diwali shoppers may feel the excitement of GST 2.0, with headlines promising lower taxes on televisions, air-conditioners, cars, and other goods. At first glance, the new GST slabs — simplified to 5%, 18%, and 40% — appear to deliver a straightforward win for buyers. The government hopes the reform will reduce prices, simplify compliance, and bring more goods into the formal economy. But the reality of the savings reaching consumers may be more complicated, according to an ET analysis.History warns: Savings often absorbed before reaching youPrevious GST rationalisations have rarely translated into meaningful benefits for households. A LocalCircles survey in 2019 found that following major rate cuts in 2018–19, only two in ten consumers actually benefited, according to the ET report. Most reported that brands, distributors, or retailers absorbed the reductions. That survey drew 36,000 responses from 319 districts. Even with the recent GST 2.0 cuts, the trend persists for packaged goods: only three out of ten consumers reported seeing any reduction in their prices, according to a LocalCircles survey released on September 29. Everyday essentials show limited relief, whereas electronics and automobiles have seen clearer price reductions.GST 2.0: What’s changed and where the savings lieThe reform’s most visible effect is on essentials. Medicines previously taxed at 5% are now exempt, and dairy products such as ghee and butter have moved from 12% to 5%.For discretionary items, the savings are more pronounced. Air-conditioners are cheaper by Rs.2,800–5,900, while large-screen televisions drop by a few thousand rupees at entry-level and up to Rs.85,000 on premium models. Dishwashers now cost up to Rs.8,000 less.Automobiles have benefited most. Entry-level hatchbacks are Rs.40,000–75,000 cheaper, with effective GST rates dropping from 29–31% to 18%. Compact SUVs fall by up to Rs.85,000, mainstream SUVs by over Rs.1 lakh, and luxury models see reductions of up to Rs.4.5 lakh. Two-wheelers with engines under 350cc — the mainstay of India’s commuter market — have dropped from 28% to 18%, saving buyers Rs.7,000–18,800.Reality check: Discounts meet inflated MRPsTracking pre- and post-GST prices shows that benefits are being passed on in certain sectors, particularly automobiles. “Companies like Maruti, Hyundai, Mahindra, and Tata are reducing prices, which is driving strong festive demand. Bookings are happening within minutes. Even though margins are lower, higher volumes make up for it,” said Bhavik Joshi, Business Head, INVasset, ET quoted him as saying.However, the government’s mandate for retailers to display both pre- and post-GST prices has revealed mixed compliance. While listed prices drop, maximum retail prices (MRPs) in some cases have been increased. For example, an LG 1.5-tonne AC tracked by ET Wealth was listed at Rs.47,990 (MRP Rs.55,990) on 21 September. By 22 September, the selling price fell to Rs.43,990, but the MRP jumped to Rs.78,990 — unrelated to GST.

Photo credit- ET

“This strategy is not new,” said Haris Mirza, Founder and CEO of UPCLUB. “Retailers inflate MRPs to advertise bigger discounts and create urgency. The savings you see advertised may not match what you actually pay.” Kashif Ansari, Professor at OP Jindal University, notes that MRPs are often inflated months before festive discounts, making consumers feel they are getting more value than they actually are.Psychology of spending: GST as a triggerLower tax rates can create a psychological boost, prompting people to go buy items they may have otherwise deferred for purchase. RBI data indicates that electronic payment transactions jumped from Rs.1.18 lakh crore on 21 September to Rs.11.31 lakh crore on 22 September — illustrating the impact of GST cuts combined with festival shopping.But the reality is nuanced. “Interest rates are unchanged, as is income. For most households, purchasing power hasn’t increased,” says Ritesh Srivastava, Founder & CEO, FREED. While prices may feel lower, wallets have not grown.Credit can amplify perceived savings — or debt riskFestive financing options make GST savings feel bigger. Retailers, banks, NBFCs, and fintech platforms offer 0% EMIs, buy-now-pay-later schemes, and pre-approved loans. A Rs.50,000 TV split into 12 monthly instalments of Rs.4,167 feels affordable, and GST cuts amplify the perception of a bargain.

Graphic – ET

“The truth is that consumers are spending more because credit lets them defer costs,” warns Satish Mehta, Founder of Athena CredXpert. Unmanaged EMIs carry interest rates up to 40%. Household debt-to-GDP remains modest, but rapid growth in unsecured loans signals caution. Crisil notes that GST cuts paired with healthy income growth are sustainable, but rising EMIs without higher income can strain finances.GST 2.0’s broader impact on consumptionStructurally, GST 2.0 is a significant reform. Rationalised slabs reduce disputes, simplify compliance, and bring more goods into the formal system. Crisil analysis shows that 11 of the top 30 items in an average household’s monthly spending now have lower GST, covering roughly one-third of total household expenditure.Yet, lower taxes alone cannot drive sustained demand. Real consumption growth depends on rising household incomes, prudent borrowing, and transparent supply chains. The government has nudged consumption with earlier interest rate cuts, and GST 2.0 complements broader efforts to boost disposable income. “The government’s focus is shifting from capital expenditure to putting more disposable income in people’s hands,” said Bhavik Joshi.As consumers enter showrooms this Diwali, GST benefits are visible, particularly in electronics and automobiles. However, buyers must check MRPs, understand credit implications, and compare pre- and post-GST prices carefully. Only informed choices ensure that the discounts are real, not just perceived