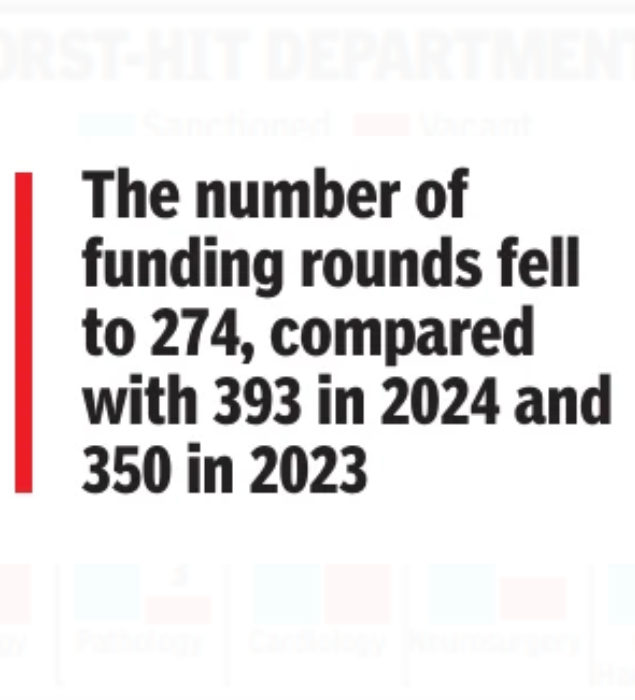

BENGALURU: India’s deeptech funding rose in 2025 even as investor risk appetite tightened, with capital flowing to fewer companies, at later stages, and in larger cheque sizes. The shift lifted overall funding levels despite a sharp fall in the number of deals, highlighting a move towards selectivity and concentration rather than a broad-based return of earlystage risk capital, according to data from Tracxn.Total deeptech funding climbed to $1.6 billion in 2025, up from $1.2 billion in 2024 and $1.1 billion in 2023. Meanwhile, the number of funding rounds fell to 274, compared with 393 in 2024 and 350 in 2023, marking the lowest deal count in 5 years.

Deal concentration was most pronounced at the top end. The 5 largest deeptech rounds accounted for a significant share of total capital, led by logistics-focused clean transport platform GreenLine and conversational AI firm Uniphore, which together raised over $500 million.They were followed by defence and aerospace startup Raphe, legal technology company Spotdraft, and spacetech firm Digantara.The mix of sectors—clean transport, AI, defence, enterprise software, and spacetech—underscores how funding clustered around a small set of scaled or scaling companies, rather than being spread across early-stage experimentation. Stage-wise trends show a clear recalibration of risk. Early-stage funding rose sharply to $971.9 million in 2025, the highest level tracked by Tracxn, while late-stage funding recovered to $345.5 million after a weak 2023. Seed-stage funding, however, declined to $268.8 million from $302 million in 2024, reflecting tighter screening at entry level.