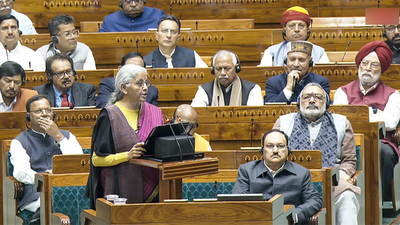

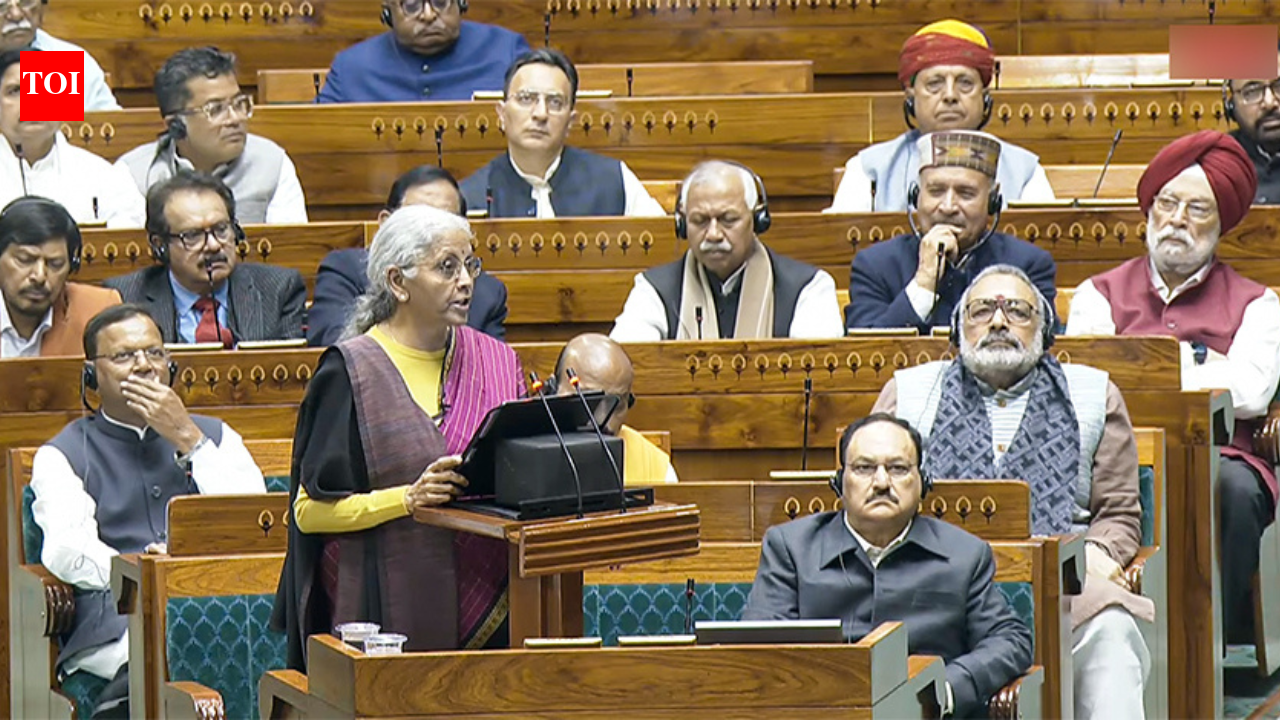

NEW DELHI: Union finance minister Nirmala Sitharaman is presenting the Budget for the financial year 2026–27 in the Lok Sabha during the ongoing Budget session of Parliament. This marks Sitharaman’s ninth consecutive Union Budget presentation.

On Thursday, she tabled the Economic Survey of India, which is considered the government’s official annual ‘report card’ on the economy, evaluating major developments across sectors over the previous 12 months.“The Indian economy has sustained strong momentum, with the First Advance Estimates projecting real GDP growth at 7.4% for FY 2025–26. This underscores India’s position as the fastest-growing major economy for the fourth consecutive year,” Goyal said in a post on X on Thursday.He also noted that India recorded an inflation rate of 1.7 per cent during April–December 2025, largely due to a decline in food prices of key commodities such as vegetables and pulses, highlighting effective inflation management.

Here are the highlights of the Union Budget 2026-2027:

Rail corridors

Seven environmentally sustainable passenger corridors planned including Mumbai–Pune, Pune–Hyderabad, and Hyderabad–Bengaluru.

Rare earth corridors, chemical parks

The government announced three dedicated chemical parks in every state using a cluster-based plug-and-play model to enhance domestic chemical production. – Rare Earth Corridors: Four states including Odisha, Kerala, Andhra Pradesh and Tamil Nadu to establish dedicated rare earth corridors.– Chemical Parks: Support to states for three dedicated chemical parks through a challenge route on a cluster-based plug-and-play model.A large portion of the world’s rare earth refining capacity is controlled by China, who keep tightened export controls on critical minerals.

Gold, silver prices decline

Gold prices plunged sharply, dropping by nearly 20 per cent in the last two days amid extreme volatility in commodity markets, according to Multi-Commodity Exchange (MCX) data. The decline continued on Sunday, which coincided with Budget day, with 24-carat gold on the MCX falling to around Rs 1,36,185 per 10 grams. The metal had opened the session at about Rs 1,46,800 per 10 grams, highlighting persistent selling pressure and sharp intraday fluctuations. The weakness was reflected in global markets as well, with international gold prices falling by more than 9 per cent to around USD 4,887 per ounce, further weighing on domestic bullion rates.Selling pressure was also seen in the silver market. Silver prices on the MCX dropped to about Rs 2,65,900, registering a decline of nearly 9 per cent in a single trading session on Sunday. The sharp correction followed strong weekly gains recorded over the past two months.Market experts said a large number of investors had entered gold and silver trades during this period, drawn by the sustained upward momentum in prices. Much of the rally was supported by leveraged positions, which benefited from consistent weekly gains in both gold and silver.