Finance Minister Nirmala Sitharaman will present the Union Budget 2026 on February 1, 2026 and like every year common man and taxpayers, especially salaried are watching out for possible changes on the income tax front. One big factor when it comes to income tax is the regime under which you choose to file your income tax return.Ever since the new income tax regime was introduced a few years ago, one question that has played in the minds of taxpayers is: will the old income tax regime cease to be an option soon?In a pre-Budget 2026 survey, most tax experts who spoke to Times of India Online said that the government may look to eventually do away with the old income tax regime, though the transition is likely to happen in a phased manner.

New vs Old Regime: The Fundamental Differences

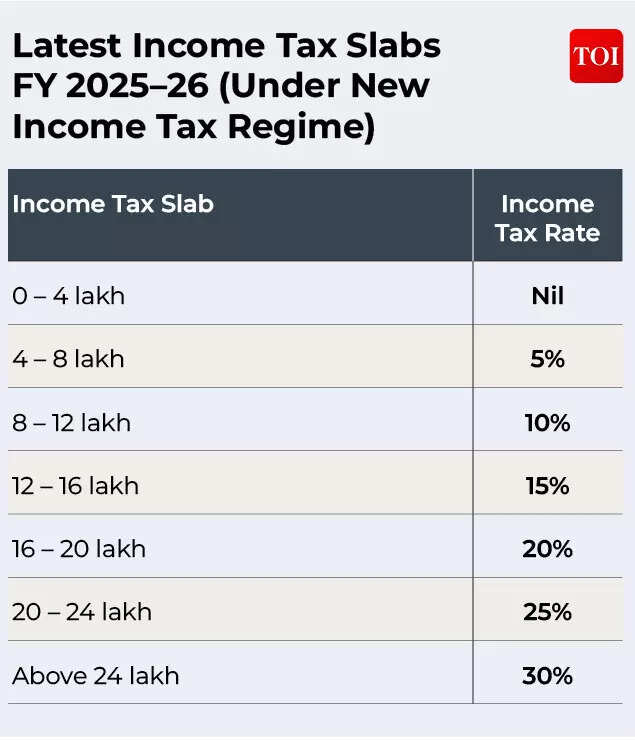

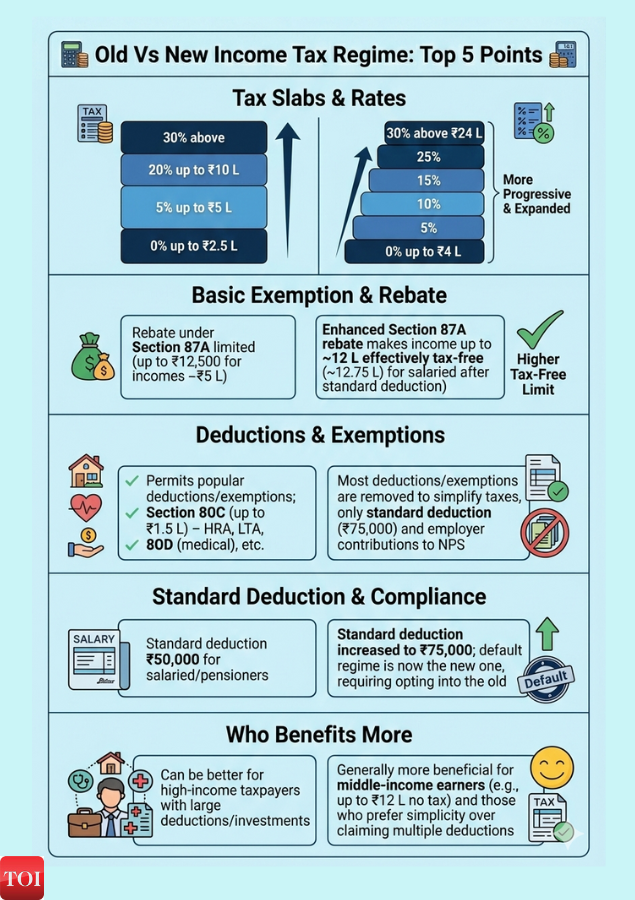

The new and old income tax regimes differ on one basic fundamental: the former has lower tax rates at higher levels of income compared to the old tax regime and fewer deductions and exemptions.For example; the basic exemption limit under the new tax regime is higher. With the Section 87A rebate, the level of tax free income for salaried taxpayers goes to Rs 12.75 lakh (including standard deduction)! Simply put; an individual earning Rs 1 lakh a month needs to pay ZERO tax!

New Regime Tax Slabs

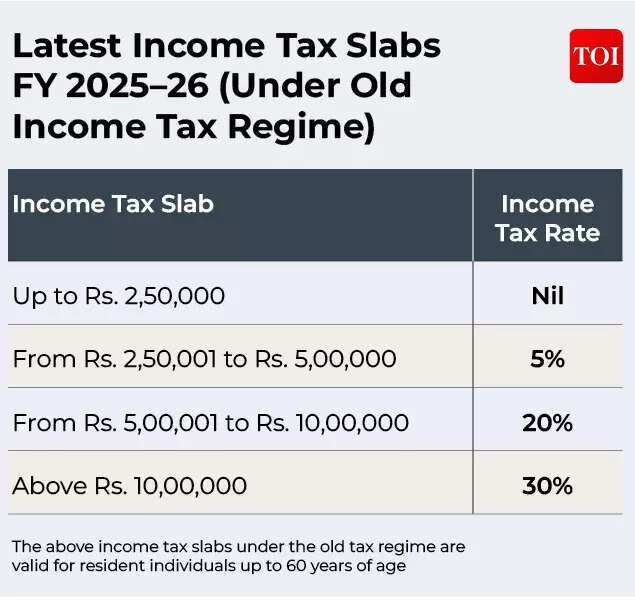

On the other hand, the option to avail deductions and exemptions under the old income tax regime work in its favour, though over the last few years the government has increasingly made the new income tax regime more lucrative.Some of the common income tax exemptions and deductions available under the old income tax regime are: Section 80C benefits (up to Rs 1.5 lakh for popular investments such as Provident Fund, PPF), Section 80D for medical insurance, NPS contributions, House Rent Allowance (HRA), Leave Travel Allowance (LTA), Section 80 TTA (interest on bank deposits etc.), home loan benefits.

Old Tax Regime Slabs

Why Was The New Income Tax Regime Introduced?

To get a better understanding of the future of the old income tax regime, let’s understand why the new income tax regime was introduced. Fundamentally, the government wants to move towards an income tax return regime with minimal deductions and exemptions to simplify the filing process and reduce the need for maintaining records and paperwork.In her Budget 2020 speech FM Nirmala Sitharaman had introduced the new income tax regime saying, “Currently the Income Tax Act is riddled with various exemptions and deductions which make compliance by the taxpayer and administration of the Income Tax Act by the tax authorities a burdensome process. It is almost impossible for a taxpayer to comply with the Income-tax law without taking help from professionals. In order to provide significant relief to the individual taxpayers and to simplify the Income-tax law, I propose to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forgo certain deductions and exemptions.”As Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax at KPMG in India explains: When the new tax regime was introduced for the first time from FY 2020-21 it was then indicated by the government that there was a long-term intent to phase out the plethora of exemptions/deductions. Over the years, the government has in fact made the new tax regime – which disallows many widely claimed exemptions/ deductions under the old tax regime – increasingly more lucrative for individual taxpayers over the years.

New Tax Regime & Its Growing Popularity

Surabhi Marwah, Tax Partner at EY India points out: recent data shows that for Assessment Year 2024‑25, around 72% of filers opted for the new tax regime, indicating broad acceptance of the simplified framework.“Given this trajectory, any move to retire the old regime, if considered, would likely be phased, allowing a cooling‑off period to support a smooth transition for taxpayers,” she tells TOI.The past two Budgets have reinforced the trends of trying to make the new income tax regime more popular, through more favourable new personal tax regime changes, including higher basic exemption and rebate limits in 2025, and increased standard deduction and NPS employer-contribution benefits in 2024. What’s interesting to note is that if 72% of taxpayers had opted for the new income tax regime by FY2025, the number will likely go up for FY 2025-26 after FM Nirmala Sitharaman tweaked tax slabs under the new income tax regime in last year’s Union Budget, and also made income up to Rs 12 lakh tax free.

Will The Old Tax Regime Be Phased Out?

Some experts are of the view that exemptions and deductions are important especially when it comes to encouraging savings and providing home loan related tax benefits. However, a gradual phasing out of the old tax regime, with stagnation is seen.Preeti Sharma, Partner – Tax and Regulatory Services at BDO India told TOI, “The government has clearly shown its preference for the new income tax regime and has made it the default tax regime. However, an immediate abolition of the old tax regime is unlikely.”

New Vs Old Income Tax Regime

Why is the old income tax regime still relevant for many? The old tax regime continues to be beneficial for a certain group of taxpayers, particularly those who claim deductions such as House Rent Allowance (HRA), home-loan interest and benefits under Sections 80C and 80D, and especially for salaried taxpayers who claim deductions under Chapter VI-A. “As a result, the government is expected to follow a gradual approach, continuing with both tax regimes while nudging taxpayers towards the new tax regime,” she said.As Parizad Sirwalla of KPMG points out: many of the deductions (allowed under old regime) are basis long term commitment (e.g., renting a house/ buying a house, PPF, Life Insurance premium etc.) and hence complete deletion of old tax regime may have an impact on these long-term savings/ investment/ expenditure by the common man.“Additionally, prior to the New Income Tax Act being published there was expectation that the new Act may be a signal to do away with the old regime – however the final Act that has been passed continues the old tax regime as optional,” she says.Chander Talreja, Partner at Vialto Partners says that the government has given flexibility to the taxpayers to choose the best regime applicable for their case depending upon their personal situation and individual circumstances. “Few may find the old regime beneficial as a lot of deductions and exemptions help them to save tax and also ensure that they don’t hit the income ceiling where the surcharge becomes applicable,” he tells TOI.“Moreover, the government would also factor that there is a huge market for housing loans, various investments etc. which qualify for section 80C benefit and not allowing tax benefits for these may hamper their market demand. Hence, the flexibility to opt between the regimes would continue for some time,” he adds.On the other hand, Tanu Gupta, Partner at Mainstay Tax Advisors LLP finds merit in ending the old income tax regime to avoid confusion.She notes that while the government may not completely eliminate the old tax regime from the law, it is already moving toward making the new regime so attractive that the old regime could automatically become redundant. “Although the old regime still finds a place in the newly enacted Income Tax Act 2025, the changes introduced in last year’s budget—such as tweaking the slabs, raising the Section 87A rebate to Rs 12 lakh, and capping the surcharge at 25% for incomes above Rs 5 crore, while leaving the old regime unchanged—represent a significant step toward making the new tax regime beneficial for most taxpayers,” she told TOI.“For FY 2023–24, 72% of taxpayers opted for the new regime, and this percentage is expected to be significantly higher for FY 2025–26,” she adds.Tanu Gupta is of the view that two income tax regimes cause confusion, beating the purpose of simplification of tax filing. “Evaluating options by comparing the old and new regimes, and for business income taxpayers being allowed to switch only once in a lifetime, only adds to the confusion, contrary to the tax policy objective of simplification,” she says.“There have even been instances where tax officers, while processing returns under Section 143, inadvertently applied the old regime despite the taxpayer choosing the new regime, causing inconvenience and additional administrative burden. Therefore, there is merit in putting a final end to the old tax regime rather than letting it fade naturally by becoming redundant,” she explains.Radhika Viswanathan, Executive Director, Deloitte India sees a gradual stagnation of the old income tax regime. This is evident from the fact that one has to not only explicitly opt for the old income tax regime, it has not seen periodic updates to its slab rates and standard deduction.“The introduction of the Income Tax Act 2025 aims for simplicity. Keeping two parallel systems forever contradicts the goal of simplification. Hence, we may expect the old regime to remain for another 2-3 years to allow long-term investors (with 15-year PPF accounts or longer period home loans) to transition smoothly. However, it is increasingly becoming a legacy option unattractive for most taxpayers,” she tells TOI.Akhil Chandna, Partner and Global People Solutions Leader, Grant Thornton Bharat anticipates a gradual phase-out of the old regime over time. “Recent budget announcements have consistently enhanced the attractiveness of the new regime—through higher rebate limits and inclusion of standard deductions—while leaving the old regime unchanged. Consequently, the old tax regime is expected to become redundant in the coming years,” he says.