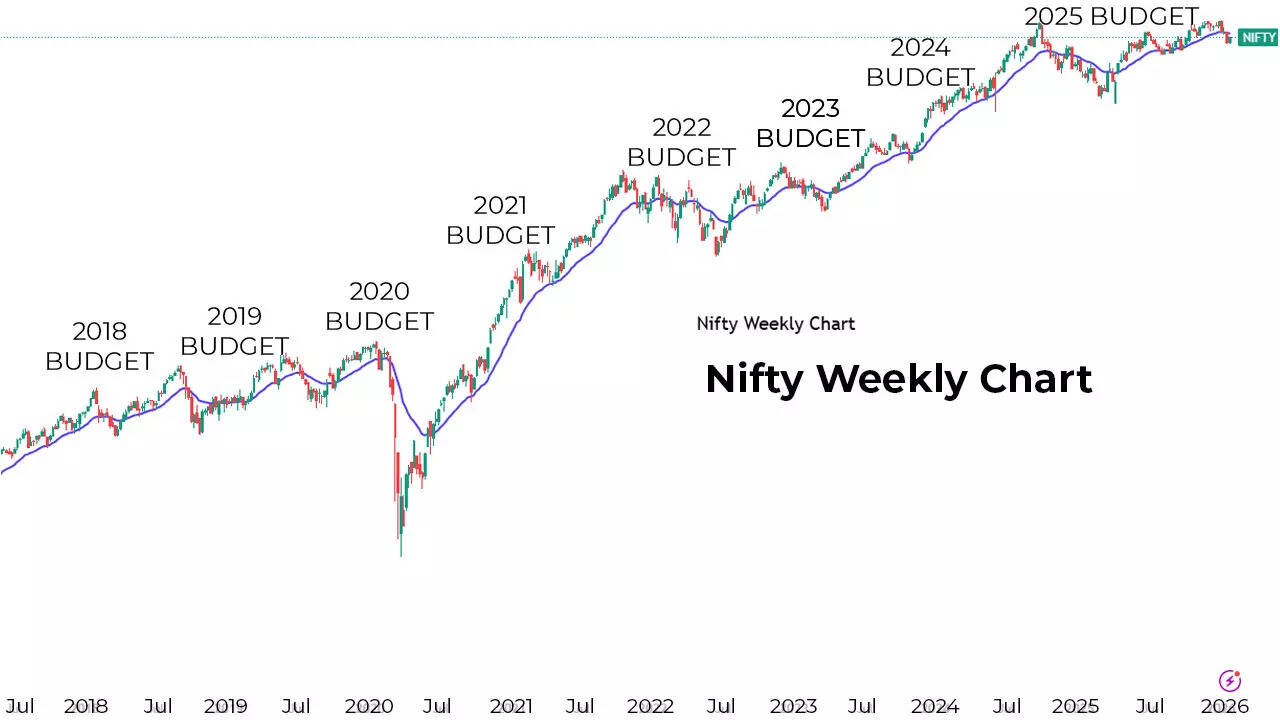

By Somil Mehta,The Union Budget is one of the most important events for Indian stock markets. Every year on February 1, investors closely watch how the Sensex and Nifty react to announcements on taxes, government spending, reforms, and fiscal discipline. There is always excitement, speculation, and nervousness around Budget Day. But history shows that market reactions on Budget Day are often mixed and unpredictable.If we look at market behaviour over the last decade or so, one thing becomes clear, Budget Day is rarely a one-way trade. While some Budgets have triggered sharp rallies, many others have seen muted or even negative reactions.Markets tend to respond positively when the Budget focuses on growth, infrastructure spending, and tax stability. For example, in 2017, Finance Minister Arun Jaitley avoided major tax hikes and provided relief to the middle class. This was well received by investors. The Sensex rose around 1.7%, while the Nifty gained close to 1.8%, making it one of the better Budget Day performances in that period.Another standout year was 2021, when Finance Minister Nirmala Sitharaman presented the Budget in the aftermath of the COVID-19 pandemic. The focus was clearly on economic recovery, higher capital expenditure, healthcare, and infrastructure. Markets responded strongly to this growth-oriented approach. The Sensex surged over 2%, while the Nifty rose nearly 2.7%, marking one of the strongest Budget Day rallies in recent years.However, not all Budgets have been market-friendly. In 2016, the announcement of higher dividend taxation disappointed investors. The Sensex closed lower that day, reflecting concerns about the impact on corporate profitability and investor returns. In 2018, long term capital gains tax in listed equities and equity mutual fund was introduced, which took markets by surprise. The indices closed modestly lower but fell sharply ~6.8% over the next few sessions. Similarly, 2023 saw a largely flat market reaction. While the Budget maintained fiscal discipline, it did not announce any major reforms that could excite traders in the short term.

Nifty performance on Budgets

The 2024 July Budget also led to a cautious market response. Changes related to capital gains taxation came as a surprise to some investors. Although the market reaction was not severe, both Sensex and Nifty ended the day slightly lower, showing how unexpected tax measures can affect sentiment even if the broader economy remains stable.One important point investors often overlook is that Budget Day performance does not always indicate the market’s next move. In several instances, markets that rose on Budget Day corrected in the following weeks, while some Budgets that initially disappointed investors later led to strong medium-term rallies once the impact of policies became clearer. Historically, post-Budget volatility has been common, and one-month returns after the Budget have often been mixed.On the other hand, sudden tax changes or lack of reform momentum can dampen sentiment.As we approach Union Budget 2026, market conditions are already volatile. Equity indices have corrected from recent highs, foreign portfolio investors have been net sellers, and global factors such as interest rates, geopolitical tensions, and trade policies continue to influence sentiment. In such an environment, Budget Day volatility is almost inevitable.For investors, history offers an important lesson, do not take oversized bets purely on Budget Day expectations. Short-term reactions can be misleading. A diversified portfolio, focus on quality stocks, and alignment with long-term themes tend to work better than trying to predict one-day market moves.In conclusion, the Union Budget often sets the tone, but it does not decide market direction in a single day. As Finance Minister Nirmala Sitharaman prepares to present Budget 2026, investors should stay cautious, watch policy intent closely, and remember that sustainable returns are built over time—not in one trading session.(Somil Mehta is Head of Retail Research at Mirae Asset ShareKhan.)(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)