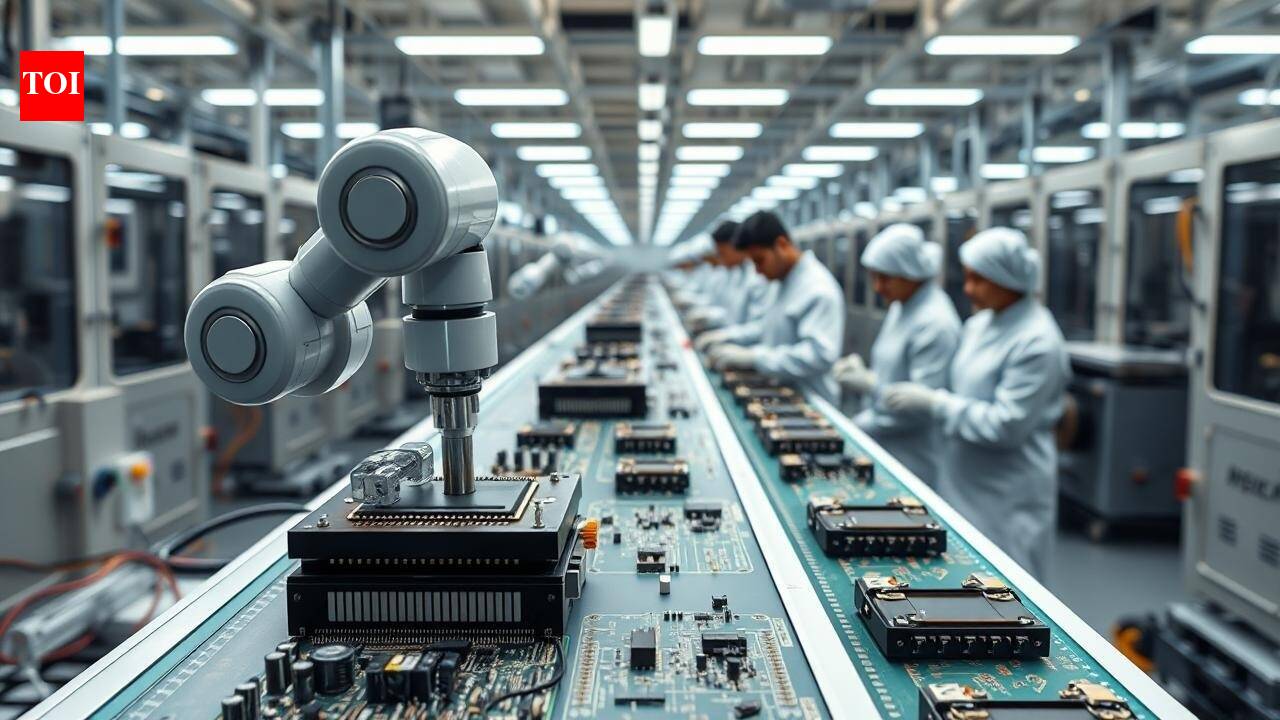

The IT industry body MAIT has urged the government to reduce basic customs duty on key electronic components and enhance tax incentives in the upcoming Union Budget to strengthen domestic manufacturing and improve global competitiveness.In its pre-Budget recommendations submitted to the finance and IT ministries, the Manufacturers’ Association for Information Technology (MAIT) proposed cutting basic customs duty on critical sub-assemblies such as camera modules, display assemblies and connectors from 10 per cent to 5 per cent to lower input costs and enhance competitiveness.Highlighting global uncertainties, MAIT said the Budget assumes “a role of paramount strategic importance” amid geopolitical tensions, supply chain disruptions and growing trade and tariff uncertainties. “Disruptions in global supply chains, geopolitical tensions, and the weaponisation of trade policies have highlighted the vulnerabilities inherent in over-reliance on imports,” the industry body said.Push for manufacturing, jobs and exportsMAIT called for strategic interventions in ICT adoption, AI integration, improved market access and enhanced credit guarantee coverage for micro and small enterprises, startups and export-focused MSMEs. To bolster domestic manufacturing, it stressed the need to rationalise import duties on components not currently made in India, as per news agency PTI.The association also recommended continued incentives for domestic mobile manufacturing, noting that the production-linked incentive (PLI) scheme for mobiles is set to end on March 31, 2026. India has emerged as a leader in mobile manufacturing and needs to build on the capacity created for both domestic use and exports, it said.Further, MAIT sought zero duty on parts and inputs for inductor coils, a cut in import tariffs on audio components from 15 per cent to 10 per cent, and an extension of the “import of goods for repair and return” period from seven years to 20 years to align with global practices.On direct taxes, MAIT proposed increasing the lower salary cap for deductions under Section 80JJAA from Rs 25,000 to Rs 50,000 to account for wage inflation and promote formal job creation.