MUMBAI: A study of state finances by RBI shows that while the fiscal deficit of Indian states has widened modestly in recent years, funding patterns have become more market-driven and disciplined, with growth headroom differing sharply between younger and more mature states.The consolidated gross fiscal deficit of states peaked at 4.1% of GDP in 2020-21 during the pandemic, before easing to below 3% for three years and rising again to 3.3% in 2024-25. RBI said the recent widening was driven by weaker revenue receipts, largely due to lower grants from the Centre, and higher capital spending. Part of the breach above 3% reflects 50-year, interest-free loans from the Centre, which are above normal borrowing limits. For 2025-26, states have budgeted the deficit at 3.3% of GDP, with higher revenues offset by higher expenditure.

.

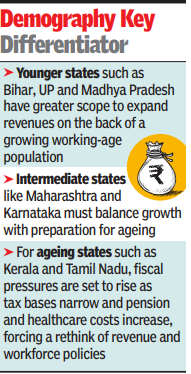

The consolidated deficit remains within the Centre’s ceiling of 3.5% of GDP, which includes a 0.5% allowance linked to power sector reforms. However, state-level positions vary widely. Sixteen states have budgeted deficits above 3% of GSDP for 2025-26, with 13 of them exceeding 3.5%, highlighting uneven fiscal space across states.Market borrowing has emerged as the main source of funding. According to RBI’s study, market loans are expected to finance about 76% of the consolidated fiscal deficit in 2025-26, compared with just over half before 2016-17. Gross market borrowing rose 6.6% to Rs 10.7 lakh crore in 2024-25 and is budgeted at Rs 12.5 lakh crore in 2025-26. By end-Sept 2025, states had raised Rs 4.7 lakh crore, 21% higher than a year earlier.The borrowing profile has also improved. States have increasingly issued longer-maturity securities, with a rising share of bonds beyond 10 and 15 years, and some issuing paper of over 20 years. Borrowing costs eased, with the weighted average yield falling to 7.2% in 2024-25 from 7.5% a year earlier, while spreads over central govt securities narrowed to 30 basis points.The quality of state finances has strengthened as well. The share of revenue deficit in the gross fiscal deficit has dropped from 46.1% in 2020-21 to a budgeted 6.9% in 2025-26, while the share of capital expenditure in total spending has risen from 13.4% to 18%.Demography is emerging as a key differentiator. Younger states such as Bihar, UP and Madhya Pradesh have greater scope to expand revenues on the back of a growing working-age population, while intermediate states like Maharashtra and Karnataka must balance growth with preparation for ageing. For ageing states such as Kerala and Tamil Nadu, fiscal pressures are set to rise as tax bases narrow and pension and healthcare costs increase, forcing a rethink of revenue and workforce policies.