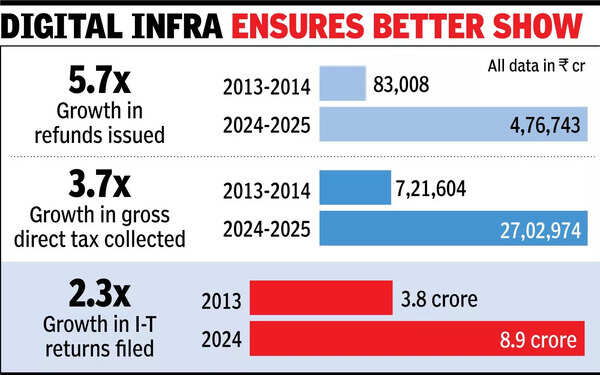

MUMBAI: Improvement in tax administration has resulted in a five-fold jump in income tax refunds, while direct tax collections rose three times over the last decade. The time taken has also fallen from 93 days to 17.“The massive increase in tax refunds and decrease in the number of days to issue refunds is due to improvements in tax administration, especially with the adoption of digital infrastructure, including end-to-end online filing and faceless assessment that enables faster and more accurate processing of income tax returns. The introduction of pre-filled returns, automation in refund processing, real-time TDS adjustments, and online grievance redress mechanisms has led to reduced delays and improved taxpayer experience,” said a source.Refunds as a proportion of gross tax collections were estimated at 17.6 per cent during the last financial year, compared with 11.5 per cent in 2013-2014. “It is a reflection of increased formalisation and voluntary participation in the tax system.

As the taxpayer base expands and advance tax payments and TDS mechanisms deepen, excess remittances become more common. The growing volume and share of refunds are thus not merely a statistical trend but a meaningful signal of systemic maturity. It demonstrates that India’s tax ecosystem is now firmly aligned with the principles of efficiency, transparency, and taxpayer facilitation,” a source argued.Even so far during the current fiscal year, there has been no let-up in refunds despite muted growth in gross collections. Direct tax collections are 3.2 per cent higher in the financial year up to July 10, but refunds were pegged 38 per cent higher, resulting in a fall in net collections.In the past, the government would often go slow on refunds to ensure that net collections were not impacted. But the Modigovernment has gone ahead with refunds, acknowledging that stopping it holds up cash flow for businesses, impacting overall economic activity.