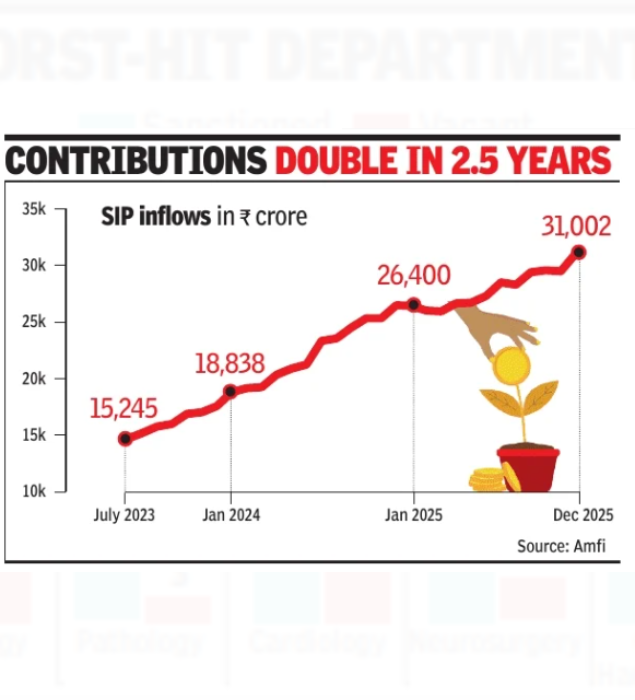

MUMBAI: Gross monthly inflows through systematic investment plans (SIPs) in mutual funds reached a new record high at Rs 31,002 crore in Dec, highlighting the growing importance of discipline in investing among retail investors in India.The month-on-month change in SIP flows was a substantial 5% jump in Dec, from Rs 29,529 crore in Nov, Amfi data showed. This jump came despite a volatile stock market, and strong selling by foreign funds while domestic funds were net buyers, industry players pointed out.

.

According to Feroze Azeez, joint CEO, Anand Rathi Wealth, “The data suggests that investors have consistently used market corrections as opportunities to invest more. Total SIP contributions of Rs 3.34 lakh crore in 2025 reflect long-term intent and confidence, rather than shortterm speculation.”The month saw a 0.7% dip in MF industry’s total assets under management, mainly due to strong outflows from debt funds by corporates to meet advance tax payment obligations in mid-Dec, Amfi chief Venkat Chalasani said. While Rs 47,308 crore was net outflow from liquid funds, Rs 40,464 crore went out of money market funds and another Rs 17,648 crore went out of ultra short duration funds, Amfi data showed. Investors also showed a strong preference for gold and silver funds during the month.