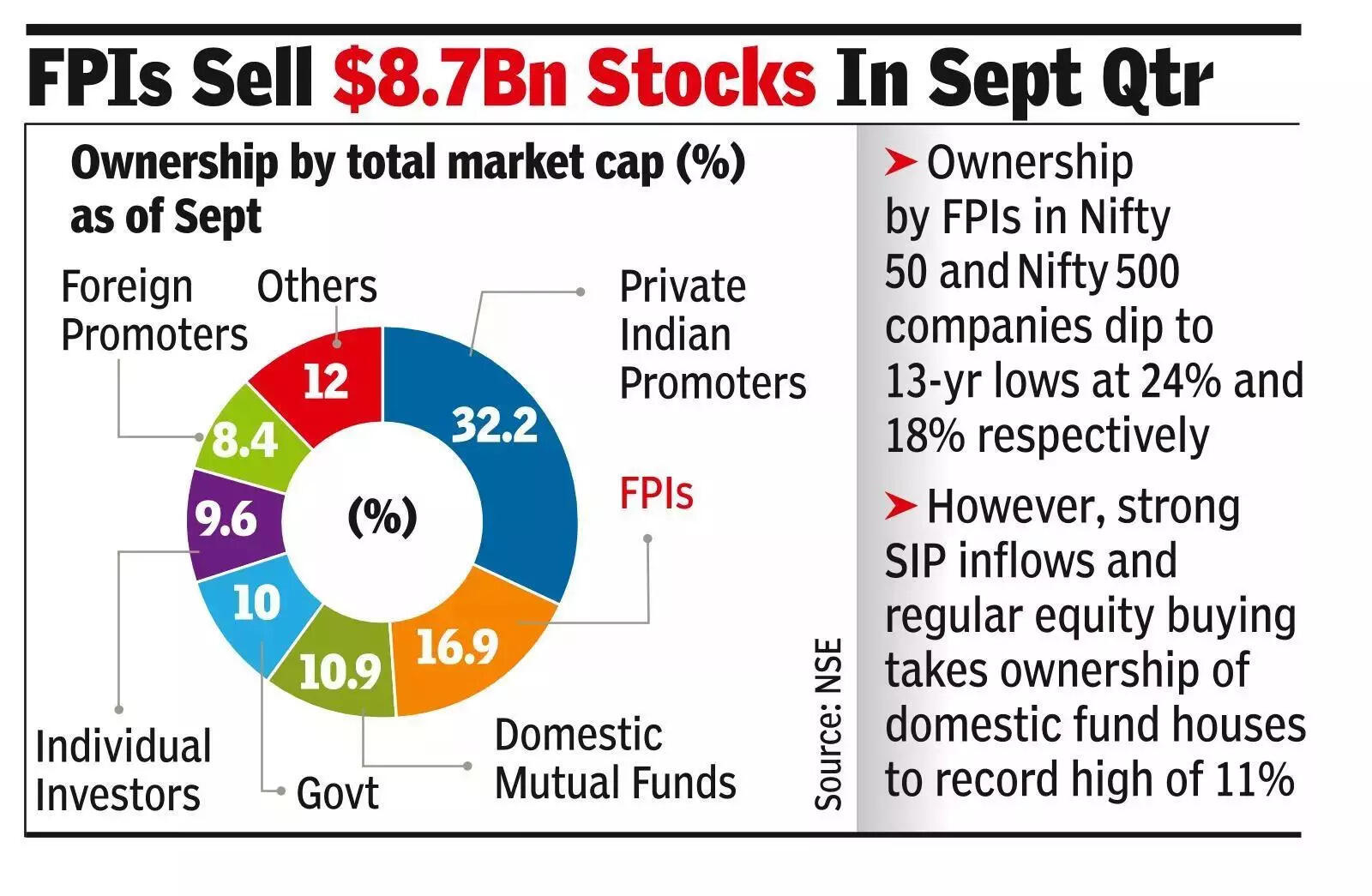

MUMBAI: With foreign funds slowing down their investments into Indian equities in the last few years, their aggregate holding in Indian companies has come down to 16.9%, the lowest level seen in over 15 years. In contrast, at 10.9% holding, domestic mutual funds (DMFs) are now at a life-high level, a report by NSE said.Researchers at NSE analysed all the shareholding data disclosed by the companies for the quarter ended Sept 2025. The report pointed out that the promoters of Nifty companies have been reducing their stakes, which at 40% was at a 23-year low. Domestic retail investors, however, continued to maintain their combined holding in Indian companies at 9.6%.The report, ‘Who Owns India Inc? – DMFs Extend Record Run as FPIs Hit 15-Year Lows’, also said that the ownership by foreign portfolio investors in Nifty and Nifty 500 companies also dipped to 24.1% and 18%, respectively, both at 13-year lows. “This can be ascribed to net (foreign fund) outflows of $8.7 billion during the quarter.”

The report pointed out that combined promoter holdings in all NSE-listed companies taken together remained steady at 50.1% for and 49.3% for Nifty 500 firms in September 2025. “Within Nifty 50, promoter ownership fell for the sixth consecutive quarter to a 23-year low of 40%,” it said.In case of MFs, the report said that the recent trend of strong SIP inflows and consistent equity buying helped domestic fund houses take their combined ownership to a record high of 10.9%, extending its nine-quarter streak of new highs. “Domestic institutional investors outpaced (foreign funds) for the fourth consecutive quarter, last seen in 2003, with the gap continuing to widen,” it said.The NSE analysis also found that direct equity ownership by individuals held steady at 9.6%. “Combined with mutual fund exposure, individual investors now control 18.75% of the market—the highest in 22 years.”