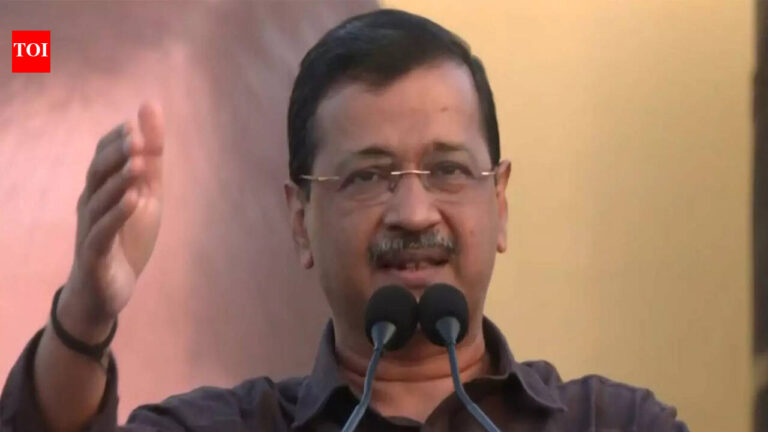

Gold and silver price prediction today: Gold and silver prices are exhibiting bullish momentum, reaching new highs, says Abhilash Koikkara, Head – Forex & Commodities, Nuvama Professional Clients Group. He shares his views on gold and silver:

MCX Gold Price Outlook:

Gold has surpassed the crucial psychological mark of $4,000, signaling strong bullish momentum and renewed investor confidence in the precious metal. This uptrend is supported by the pattern of higher highs and higher lows, indicating sustained buying interest and a robust technical structure. The rally in gold can be attributed to global economic uncertainty, rising geopolitical tensions, and continued interest from central banks diversifying their reserves away from fiat currencies. Additionally, expectations of lower interest rates and persistent inflation concerns have further boosted gold’s appeal as a safe-haven asset.On the MCX front, gold prices have shown remarkable strength, trading well above the ₹1,22,000 mark. The momentum remains positive, with the next potential target seen around ₹1,27,000, provided prices sustain above the immediate support level of ₹1,20,000. Any minor dips towards this support zone are likely to attract fresh buying interest from traders and investors. Overall, the outlook for gold remains optimistic in both international and domestic markets, with the bullish sentiment expected to continue in the near term. As long as prices hold above key support zones, gold is likely to maintain its upward trajectory, reflecting ongoing global demand and macroeconomic tailwinds.

MCX GOLD Trading Strategy:

- CMP: 122000

- Target: 127000

- Stop Loss: 120000

MCX Silver Price Outlook:

COMEX Silver is on the verge of reclaiming the $50 mark, a level last seen in 2011, marking a significant milestone in the ongoing bullish momentum. The metal’s resurgence reflects strong investment demand, robust industrial use—particularly in solar panels and electric vehicles—and a renewed interest in precious metals as a hedge against inflation. If silver successfully breaches the $50 resistance, the next potential targets lie at $56 and subsequently $60, which would reaffirm the long-term bullish trend. The recent price action highlights growing confidence among investors as silver continues to outperform many other commodities.On the MCX front, silver prices have maintained strong upward momentum, currently trading well above the ₹1,43,000 support level. If this level continues to hold, prices have the potential to rally towards ₹1,56,000 in the near term. The overall trend remains positive, supported by global cues and firm demand from both industrial and investment segments. Any corrective moves are likely to be short-lived, as long as silver sustains above its key support zones. With bullish technicals and strong fundamentals, silver appears poised to continue its upward journey, potentially testing multi-year highs and reaffirming its strength in the global precious metals space.

MCX SILVER Trading Strategy:

- CMP: 148000

- Target: 156000

- Stop loss: 143000

(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)