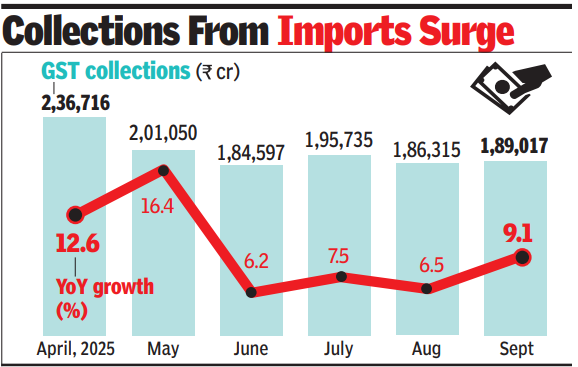

NEW DELHI: GST collections rose 9.1%, the fastest pace of expansion in four months, to Rs 1,89,017 crore in Sept, indicating that the impact of the announcement of a rate reduction did not significantly dent sales.Domestic collections in Sept — for transactions in Aug — were up 6.8% to Rs 1,36,525 crore as consumers deferred big ticket purchases, such as automobiles and white goods. In contrast, there was a 15.6% increase in the kitty from imports to Rs 52,492 crore.“The increase in gross GST collections indicates that there has not been any significant slowdown in economic activity in anticipation of the GST rate cuts during the month of Aug 2025 as this data relates to transactions in Aug 2025,” said MS Mani, partner at Deloitte India.

Collections from imports surge

On Aug 15, Prime Minister Narendra Modi announced the Centre’s push to reduce rates ahead of Diwali. GST Council decided on the reduction on Sept 3 with the new rates kicking in from Sept 22.Weak sales of products such as automobiles were visible on cess as collections fell 2.4% to Rs 11,652 crore. Cess on imports almost halved to Rs 462 crore, while it was 1.8% higher on domestic sales at Rs 11,190 crore.On a net basis, overall GST collections were 5% higher at Rs 1.6 lakh crore, as refunds soared 40% to Rs 28,657 crore. “Growth of about 7% in domestic GST revenues over Sept 2024 is encouraging, particularly because of a slowdown in demand in the second half of Aug, in anticipation of rate cuts. A 40% increase in refunds also means that businesses are realising cash faster, both in case of inverted duty cases and exports. Govt will be closely monitoring the collections for next couple of months now to see the impact due to massive rate cuts under GST 2.0 and the extent to which it enhances the consumption,” said Pratik Jain, partner at consulting firm Price Waterhouse & Co.Meghalaya, Sikkim and Madhya Pradesh notched up over 20% growth in collections, while Telangana, Himachal Pradesh, Delhi and Manipur were laggards, registering a fall in collections.