MUMBAI: RBI’s monetary policy committee on Wednesday unanimously voted to keep the repo rate unchanged at 5.5% with a neutral stance, while hiking FY26 growth forecast to 6.8% from 6.5%.“Since we last met in June, inflation has come down by about 1%. It is now at 2.6–2.7% compared with our earlier forecast. That’s the reason we now see more space opening up,” governor Sanjay Malhotra said. On growth, he added, “Growth has surprised us on the upside in Q1.

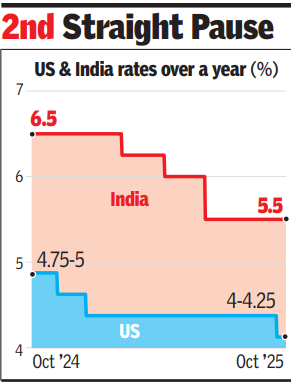

2nd straight pause

In Q3, Q4, and even for next year there has been a slight downward revision, mainly because of the 50% tariff that has come into play, though it is partly offset by GST… The revision is largely due to these trade-related developments, where negotiations are still ongoing.” RBI projects FY26 GDP growth at 6.8% (6.5% earlier) and inflation at 2.6% (3.1% earlier).Malhotra said India’s outlook remains resilient, supported by a good monsoon, rural demand, buoyant services, rising capacity use and GST rationalisation, though exports face tariff headwinds. Inflation has eased sharply on lower food prices and GST cuts, with prospects of staying contained given good sowing, grain stocks & benign supply.Since Feb 2025, RBI has cut rates by 100bps (1 percentage point) to support growth, with the impact still transmitting. The MPC noted easing inflation but flagged risks, while growth is evolving in line with projections.Malhotra said: “The current macroeconomic conditions and outlook have opened up policy space for further supporting growth, but it is prudent to wait for the impact of past actions and fiscal measures to play out. We remain watchful of global uncertainties and their spillovers.”