The Reserve Bank of India (RBI) on Wednesday lowered its FY26 inflation forecast to 2.6% from 3.1%, while revising India’s GDP growth upward to 6.8% on the back of a good monsoon and GST rate rationalisation. The central bank also kept the policy repo rate unchanged at 5.5% for the second straight review.The decision comes amid easing inflation, a good monsoon, and GST rate rationalisation, though global tariff uncertainties remain a key concern.

Repo rate unchanged

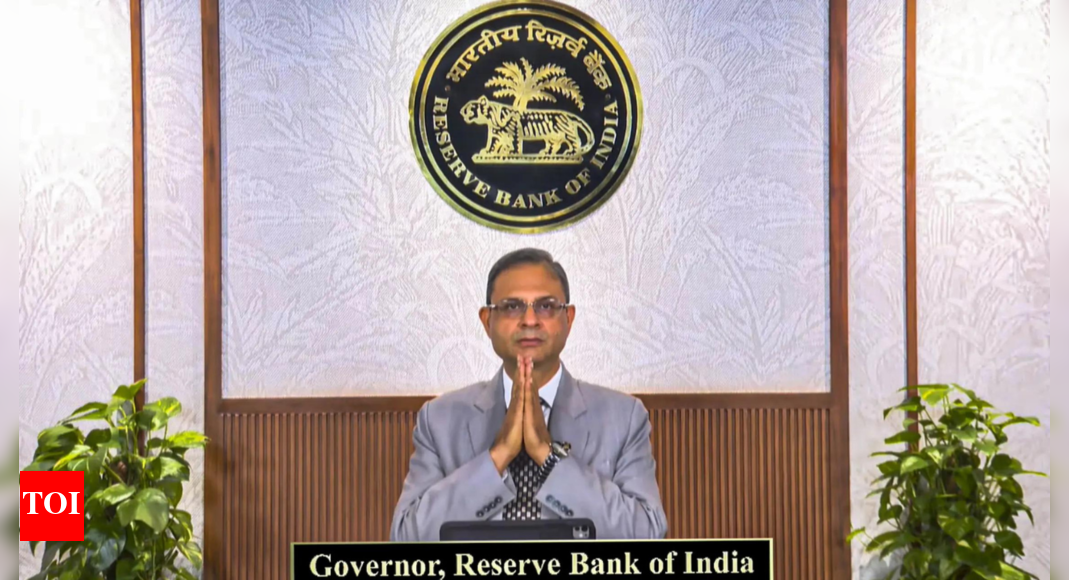

RBI Governor Sanjay Malhotra announced the fourth bi-monthly monetary policy of the current fiscal, stating that the Monetary Policy Committee (MPC) unanimously decided to maintain a neutral stance.While GST rate rationalisation will have a sobering impact on consumption and growth, tariff related developments may slow down the economic expansion in the second half of the current fiscal, Malhotra noted.Since February 2025, the RBI has reduced the policy rate by a total of 100 basis points: 25 bps each in February and April, and 50 bps in June, following easing retail inflation.

RBI projects inflation at 2.6%

For FY26, RBI now projects inflation at 2.6%, down from the earlier 3.1% estimate. The RBI Governor stated that, “the average headline inflation for 2025-26 has been revised lower from 3.7% projected in June and 3.1% in August, to 2.6% . Headline inflation for Q4:2025-26 and Q1:2026-27 too have been revised downwards and are broadly aligned with the target, despite unfavourable base effects.”Inflation has remained below 4% since February, easing to a six-year low of 2.07% in August due to lower food prices and favourable base effects.

RBI revises FY26 GDP growth to 6.8%

RBI has revised its GDP growth forecast for FY26 to 6.8%, citing a good monsoon and structural reforms, including GST rationalisation earlier announced by Prime Minister Narendra Modi.The quarterly estimates have been adjusted to 7% in Q2 (up from 6.7%), 6.4% in Q3 (down from 6.6%), and 6.2% in Q4 (down from 6.3%). For Q1 of FY27, growth is projected at 6.4% compared to the earlier forecast of 6.6%. The downward revisions for Q3, Q4 FY26 and Q1 FY27 are partly attributed to the impact of 50% US tariffs on Indian imports, which are expected to moderate export growth, according to RBI Governor.The governor said that, “the implementation of several growth-inducing structural reforms, including streamlining of GST are expected to offset some of the adverse effects of the external headwinds. Taking all these factors into account, real GDP growth for 2025-26 is now projected at 6.8% , with Q2 at 7.0% , Q3 at 6.4% , and Q4 at 6.2% . Real GDP growth for Q1:2026-27 is projected at 6.4% .” “The risks are evenly balanced,” he added.The downward revision for Q3, Q4 FY26 and Q1 FY27 reflects the impact of rising US tariffs, while the upward revision for Q2 FY26 benefits from strong domestic demand and favourable structural reforms.The RBI’s latest policy balances steady monetary conditions with cautious optimism on growth. While inflation remains under control, global trade uncertainties, particularly tariffs, continue to pose risks. With GDP growth projected at 6.8% for FY26, India’s economic trajectory appears stable, supported by structural reforms and a strong monsoon.