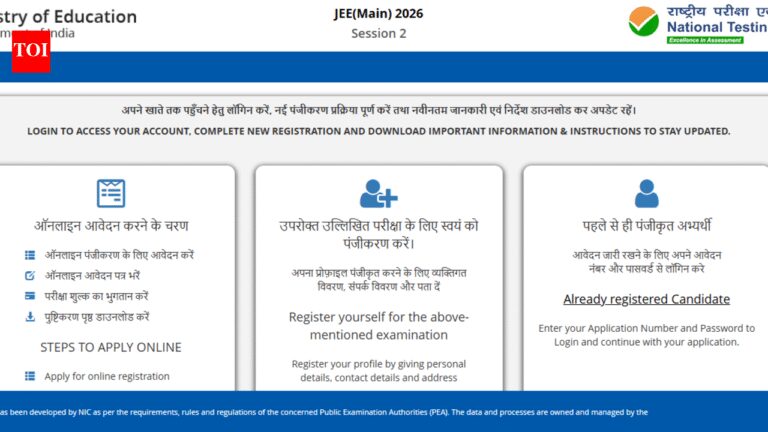

Today, the 2026–27 Union Budget was presented in the Parliament by the Finance Minister Nirmala Sitharaman. It’s a budget that loves travellers as at the heart of the Budget’s travel appeal is a sharp reduction of the Tax Collected at Source (TCS) on overseas tour packages. Yes, this time, the Budget didn’t just target economic growth; it also also signalled towards making dreams of international travels cheaper and more achievable. Let’s have a closer look at it:Cheaper international vacations through TCS rationalisationEarlier, Indian travellers wanting to book international tours faced a TCS structure: 5% on tour packages up to ₹10 lakh and 20% on amounts above ₹10 lakh. But as per the new Budget, the finance minister proposed a uniform TCS rate of 2% on the sale of overseas packages. This flat-rate reduction means that travellers will pay significantly less tax at the time of booking.It’s a welcoming move for travellers and industry leaders too. “The sharp reduction in TCS on overseas travel is an immediate demand stimulant for the sector and improves cash flows for both consumers and operators. More importantly, it signals the government’s intent to reduce friction in legitimate travel spending and support the formal travel economy,” said Kunal Gala, Partner in Deal Value Creation Services at BDO India. Affordability meets technology

Canva

Beyond tax cuts, the Budget also emphasises on technology-led governance in the travel sector. Hari Ganapathy, Co-Founder of Pickyourtrail, pointed out how these structural changes extend beyond the numbers: “From an outbound travel perspective, the emphasis on technology-led governance and the reduction in TCS on overseas tour packages meaningfully improve affordability, transparency, and ease of travel for Indian consumers.”Industry ReactionAs per a joint statement by Aloke Bajpai, Group CEO, and Rajnish Kumar, Group Co-CEO of ixigo, “This year’s budget has also taken steps to make international travel, both outbound and inbound, more accessible and affordable for Indian travellers. The proposal to reduce the TCS rate on overseas tour packages to a flat 2% … is a welcome move for making outbound tourism more amenable.”

Canva

Beyond making travel cheaper, the Budget sends a clear message that tourism is a strategic economic sector. Aviral Gupta, CEO of Zostel & Zo World, noted, “The Budget’s reduction of the tax on overseas tour programme packages from 5% to 2% is a positive step that simplifies outbound travel and reflects the growing scale of global tourism activity. The focus on experience quality — through the training of 10,000 certified tourist guides, investments in hospitality education, and the development of 15 archaeological and cultural sites into experiential destinations — marks a clear shift towards value-led tourism.”Impact on local economiesFor the hospitality sector, the Budget’s travel-friendly measures are expected to generate meaningful demand. Ayu Tripathi, Director of Aahana Resort, commented on how these changes might play out for service providers: though she was not quoted directly here, industry response generally underscores optimism that lower TCS, improved airport processes and hospitality training will enhance guest experiences — both for outbound and inbound travellers.Future of travel looking bright

Canva

India’s outbound travel market has grown rapidly in the last 10 years. There are over 10 million Indians who travel abroad every year for several purposes. The Budget’s measures, particularly the uniform 2% TCS, could strengthen this trend by lowering barriers to entry and making international travel more affordable for first-time and frequent travellers alike.