Union Budget 2026: Every year, one of the main components of the Budget presentation is the income tax, as taxpayers keenly watch for changes in the slabs, tax rates and other factors — which may ease their tax burden! However, post Finance Minister Nirmala Sitharaman’s Union Budget speech, the income tax framework remains unchanged from the previous Budget.FM Nirmala Sitharaman, who presented her ninth consecutive Union Budget on Sunday, was the one who introduced the new tax regime. 6 years back, in 2020, taxpayers were offered another new choice of tax structure, the new income tax regime. Since then, taxpayers have constantly faced a choice: Go with the new tax regime or stay with the old one. Deciding between the two is quite a task as one offers promises of lower rates and simpler compliance while the other lures higher income earners with deductions and exemptions.

New Income Tax regime: Key tax rates, tax slabs & benefits

The new income tax regime was introduced to give middle-class taxpayers more relief. It also aims to simplify the tax system and make filing easier.

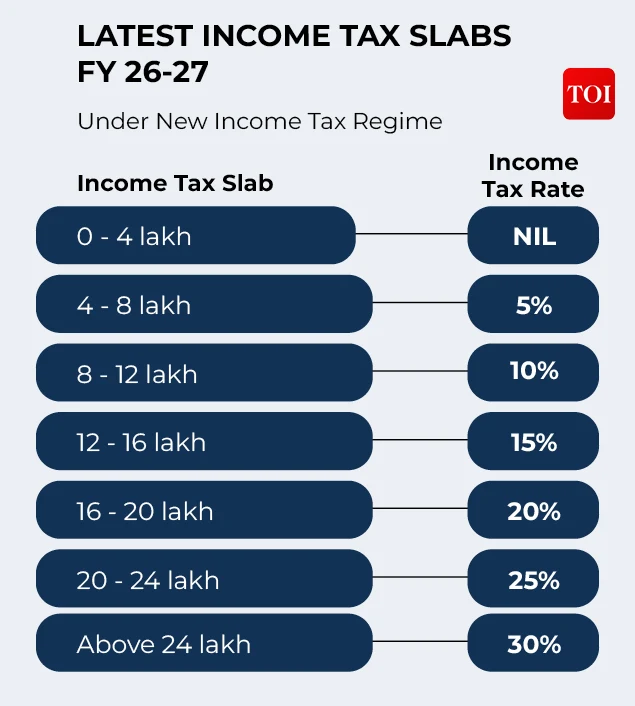

For FY 2026-2027, under the new tax regime, income up to Rs 4 lakh will remain completely tax-free. Beyond this, a progressive slab system is there, with rates increasing gradually based on income levels:

- Rs 4 – Rs 8 lakh: 5%

- Rs 8 – Rs 12 lakh: 10%

- Rs 12 – Rs 16 lakh: 15%

- Rs 16 – Rs 20 lakh: 20%

- Rs 20 Rs – Rs 24 lakh: 25%

- Above Rs 24 lakh: 30%

One of the key highlights of the new regime introduced in FY 2025-26, is the enhanced rebate. Previously, resident individuals with a total income up to Rs 7 lakh did not pay any tax. However, under the revised system effective FY 2025-26, this rebate limit has been hiked allowing individuals earning up to Rs 12 lakh to be completely tax-free. For salaried taxpayers, this threshold effectively rises to Rs 12.75 lakh, owing to a standard deduction of Rs 75,000.

Old income tax regime : Key tax rates, tax slabs & benefits

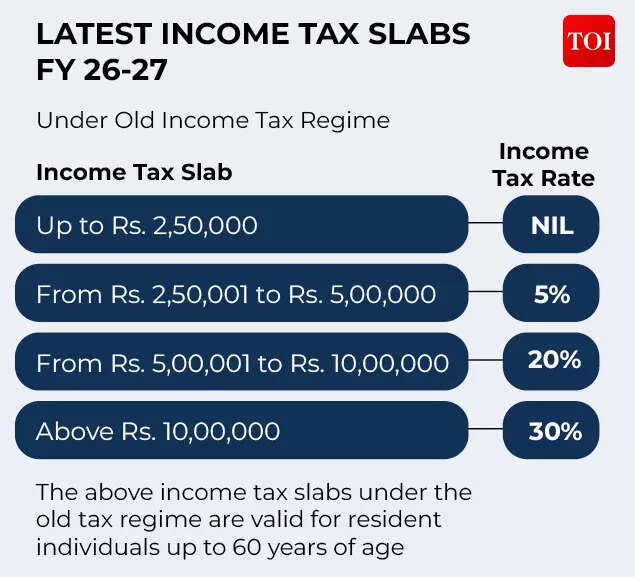

The old income tax regime continues to offer a higher number of exemptions and deductions, making it preferable for salaried taxpayers who claim substantial tax exemptions and deductions during the year.

However, the tax rates in the old tax regime are comparatively higher:

- Up to Rs 2,50,000: Nil

- From Rs 2,50,001 to Rs 5,00,000: 5%

- From Rs 5,00,001 to Rs 10,00,000: 20%

- Above Rs 10,00,000: 30%

Deductions commonly claimed under the old regime include House Rent Allowance (HRA), Leave Travel Allowance (LTA), Section 80C, medical insurance under Section 80D, additional NPS contribution under Section 80CCD (1B), and interest on housing loans for self-occupied property.

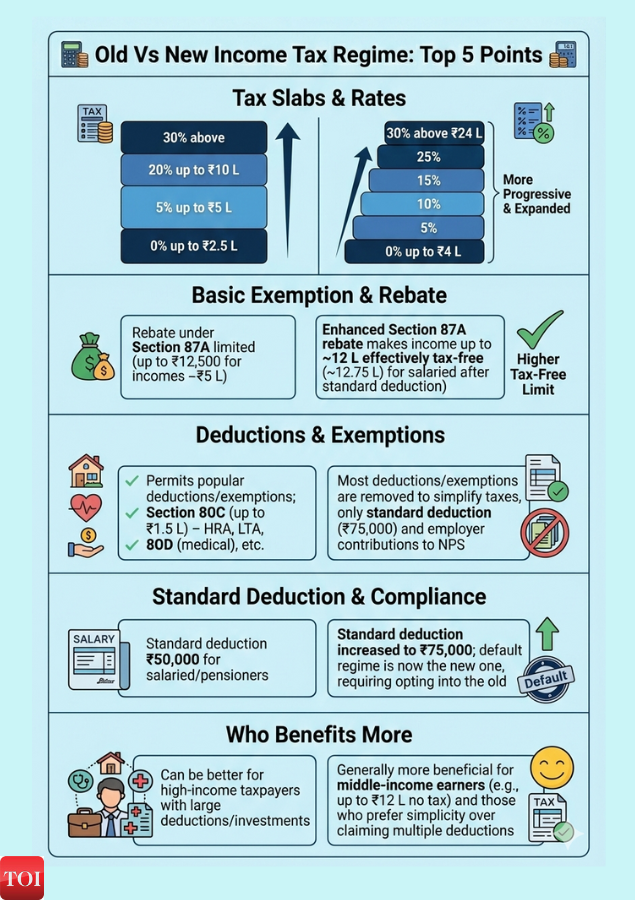

New vs old income tax regime: Which is better for you in FY 2026-27?

Every year, taxpayers have a fundamental query – which tax regime – new or old will reduce their tax outgo?For income levels up to Rs 12 lakh (Rs 12.75 lakh in the case of taxpayers), opting for the new tax regime means ZERO tax. So, there is no question of opting for the old tax regime. Let’s understand this with an example; at an income level of Rs 10 lakh, with just Section 80C exemptions of Rs 1.5 lakh availed, the tax burden under the old regime is Rs 75,400/- including cess. This amount is ZERO or NIL under the new regimeIt’s important to understand the thumb rule when deciding between the old and new income tax regimes.

The simplest way to do this is to add the total number of exemptions and deductions that you can avail. So add your House Rent Allowance or Home Loan interest, Leave Travel Allowance (LTA), Section 80C, NPS benefit of Rs 50,000, Section 80D for medical insurance, Section 80TTA for bank interest income, Section 80G for charity. If this number is lower than Rs 8 lakh for an income threshold of above Rs 24 lakh, then the new income tax regime is more beneficial for you, and your tax outgo under it will be lower than the old tax regime. If however, you are able to claim exemptions and deductions above Rs 8 lakh at income levels above Rs 24 lakh, then the old tax regime is the right choice for you.For incomes between Rs 12 lakh to Rs 24 lakh, this threshold limit will vary depending on the deductions and exemptions you can avail.

New highlights for taxpayers in Budget 2026 :

In Budget 2026, while the finance minister left core income tax structure untouched, a clutch of announcements were made to ease procedures and extend relief to different categories of taxpayers.

- Addressing compliance concerns, she offered taxpayers additional time to revise their income tax returns. The window for filing revised returns will now remain open until March 31 instead of December 31, with a nominal fee applicable.

- Individuals filing ITR-1 and ITR-2 will continue to adhere to the July 31 deadline. In contrast, non-audit business cases and trusts will be allowed to file returns up to August 31.

- The Budget proposed a full income tax exemption on interest awarded by motor accident claims tribunals. With this change, tax deduction at source on such interest will no longer apply.

- Several changes were introduced to tax collection at source. The TCS rate on overseas tour packages will be brought down to 2% from the earlier rates of 5% and 20%, and the requirement of a minimum transaction amount will be removed.

- TCS on education and medical expenses under the Liberalised Remittance Scheme will be reduced from 5% to 2%.

- The New Income tTax Act 2025 is effective from April 1, 2026 and the simpler tax return forms will be made available soon.

For income tax regime, however, there were no new changes.

Evolution of tax regime

Since 2020, India’s new tax regime has slowly evolved to become simpler and more generous, especially for middle-income taxpayers, while the old tax regime has remained unchanged.2020Finance minister Nirmala Sitharaman introduced the new tax regime to reduce complexity and dependence on tax professionals. It offered lower slab rates but removed most deductions. At the time, income up to Rs 2.5 lakh was exempt, the top 30% rate applied only beyond Rs 15 lakh, and Section 87A ensured zero tax up to Rs 5 lakh. Even without deductions, many taxpayers paid less tax under the new system than the old one. The new regime provided lower tax rates but higher but the old regime stood strong with deductions.2023The Union Budget 2023 marked a major shift. The basic exemption limit under the new regime was raised to Rs 3 lakh, and the Section 87A rebate was increased to Rs 7 lakh, making income up to that level tax-free, though the old regime stayed capped at Rs 5 lakh. Standard deduction benefits were introduced, surcharge at income above Rs 5 crore was cut from 37% to 25%, and the new regime became the default option.2024Taxpayers received more relief after standard deduction under the new regime increased to Rs 75,000 for salaried employees, and the family pension deduction raised to Rs 25,000, benefiting around four crore taxpayers.2025The biggest relief arrived when income up to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers after standard deduction) was made effectively tax-free under the new regime. The 30% tax slab threshold was also raised sharply from Rs 15 lakh to Rs 24 lakh.From 2020 to 2026, the new tax regime has been repeatedly liberalised with higher exemptions and lower effective taxes, while the old regime remains unchanged, offering higher rates, but with deductions and exemptions intact.