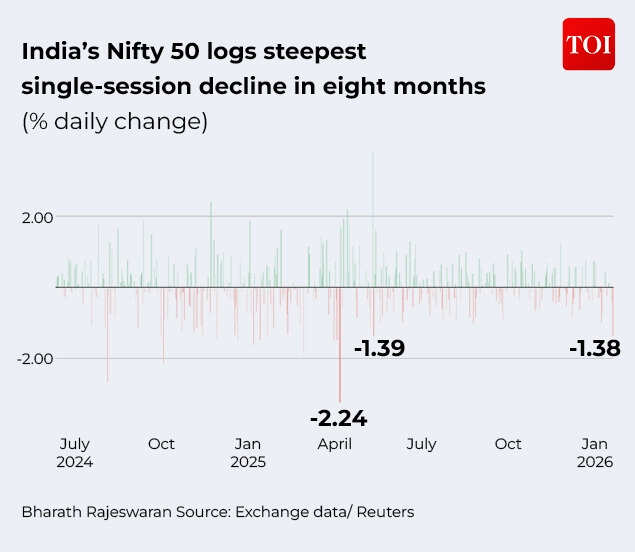

Stock markets saw a very sharp selloff on Tuesday, resulting in market capitalization dropping and investors’ wealth eroding by as much as Rs 9.86 lakh crore. Both Nifty50 and BSE Sensex declined by over 1%, dropping to over three-month lows as escalating geopolitical tensions due to US President Donald Trump’s persistent tariff threats and sustained foreign fund outflows battered market sentiment. The markets saw their lowest closing levels in over three months as a broad-based selloff, driven by weak corporate earnings, global trade concerns and persistent foreign fund outflows, unsettled investors. Losses were led by information technology stocks and heavyweight Reliance Industries.The NSE Nifty 50 fell 1.38 per cent to end at 25,232.5. Market participants pointed to a disappointing earnings season as a key factor behind the decline. The 30-share Sensex extended its losses, falling 1,065.71 points or 1.28 per cent to close at 82,180.47. During intraday trade, the index slid as much as 1,235.6 points or 1.48 per cent to a low of 82,010.58. The total market capitalisation of BSE-listed companies declined by Rs 9,86,093.96 crore to Rs 4,55,82,683.29 crore, or about $5.01 trillion.Foreign investors sold Indian equities worth about $3 billion in January, the largest monthly outflow since August. So far this month, the Nifty 50 has ended lower in nine of the 13 trading sessions.

Decoding Stock Market Crash

Among index heavyweights, Reliance Industries and ICICI Bank weighed on benchmarks after reporting third-quarter results that missed estimates. Reliance shares slipped 1.4 per cent, extending losses from the previous session.Information technology stocks emerged as the worst-performing sector, with the Nifty IT index sliding 2.1 per cent. Companies that have reported earnings so far have seen pressure on profitability due to the impact of India’s new labour codes. LTIMindtree dropped 6.7 per cent after posting a decline in quarterly profit, while Wipro fell 2.5 per cent, extending Monday’s slump following a weaker-than-expected outlook for the fourth quarter.

Nifty50 logs steepest single-session decline in 8 months

Selling pressure was visible across most frontline stocks. Eternal dropped 4.02 per cent, while Bajaj Finance fell 3.88 per cent. Sun Pharma, InterGlobe Aviation, Trent, Asian Paints, Mahindra and Mahindra, and Bajaj Finserv also ended sharply lower. HDFC Bank was the lone stock from the Sensex pack to finish in the positive territory.The broader market underperformed the benchmarks. The BSE smallcap index tumbled 2.74 per cent, while the midcap gauge declined 2.52 per cent. All sectoral indices on the BSE closed lower, with realty leading the losses at 5.21 per cent. Services slid 2.89 per cent, capital goods fell 2.76 per cent, consumer discretionary dropped 2.73 per cent, consumer durables declined 2.71 per cent, telecommunication eased 2.42 per cent, auto lost 2.36 per cent, and power slipped 2.23 per cent.Market participants pointed to rising global uncertainty as a key driver of the selloff.

What’s the road ahead for Indian stock markets?

Market experts have turned cautious on the back of global uncertainty. Vinod Nair, Head of Research at Geojit Investments Limited says, “Domestic markets remained cautious ahead of the US Supreme Court’s ruling on Trump-era tariffs, with renewed uncertainty over US trade policy prolonging the recent consolidation. Continued FII outflows, rising US and Japanese bond yields, and a weakening rupee weighed on investor confidence.” “Mid- and small-cap stocks underperformed the benchmarks, and sentiment was broadly negative across all sectors. In the near term, market sentiment will hinge on the earnings season, while geopolitical developments and global trade conditions remain important influences,” he says.The US Supreme Court did not deliver its verdict on the legality of Trump’s tariffs on Tuesday as well – something that will add to uncertainty on the global front.“The aggressive and often unpredictable use of tariffs by the US administration as a foreign policy tool is creating widespread unease among global market participants, triggering sharp volatility across financial markets. This has weighed heavily on risk assets while pushing safe-haven gold and silver prices higher. Fresh threats by US President Donald Trump to impose additional tariffs on European nations opposing the US move to take control of Greenland have triggered another bout of global equity selling, with Indian markets also witnessing broad-based pressure,” said Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm. He added that the Indian equity market ended the session firmly in the red due to weak global cues, cautious investor positioning and subdued risk appetite.Valuations are being reset, said Dharmesh Kant, head of equity research at Cholamandalam Securities. “While there have been outliers, most of the Nifty 50 companies that have reported December-quarter earnings have disappointed.”(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)