MUMBAI: Silver appears to be the new gold – not just because its price has skyrocketed, but consumers are looking at it as an investment avenue, sparking demand for silver bars and coins at jewellery stores. Such is the rush that Jaipur’s Amrapali Jewels has now started selling silver bars to consumers on request. “Silver was never seen as a commodity before. But now, an investment mindset is setting in and people are looking to buy silver bars. The demand has been very healthy. Two things are defined by permanence – land and precious metals. In 10-15 years, silver will be the new gold,” said CEO & creative director Tarang Arora.

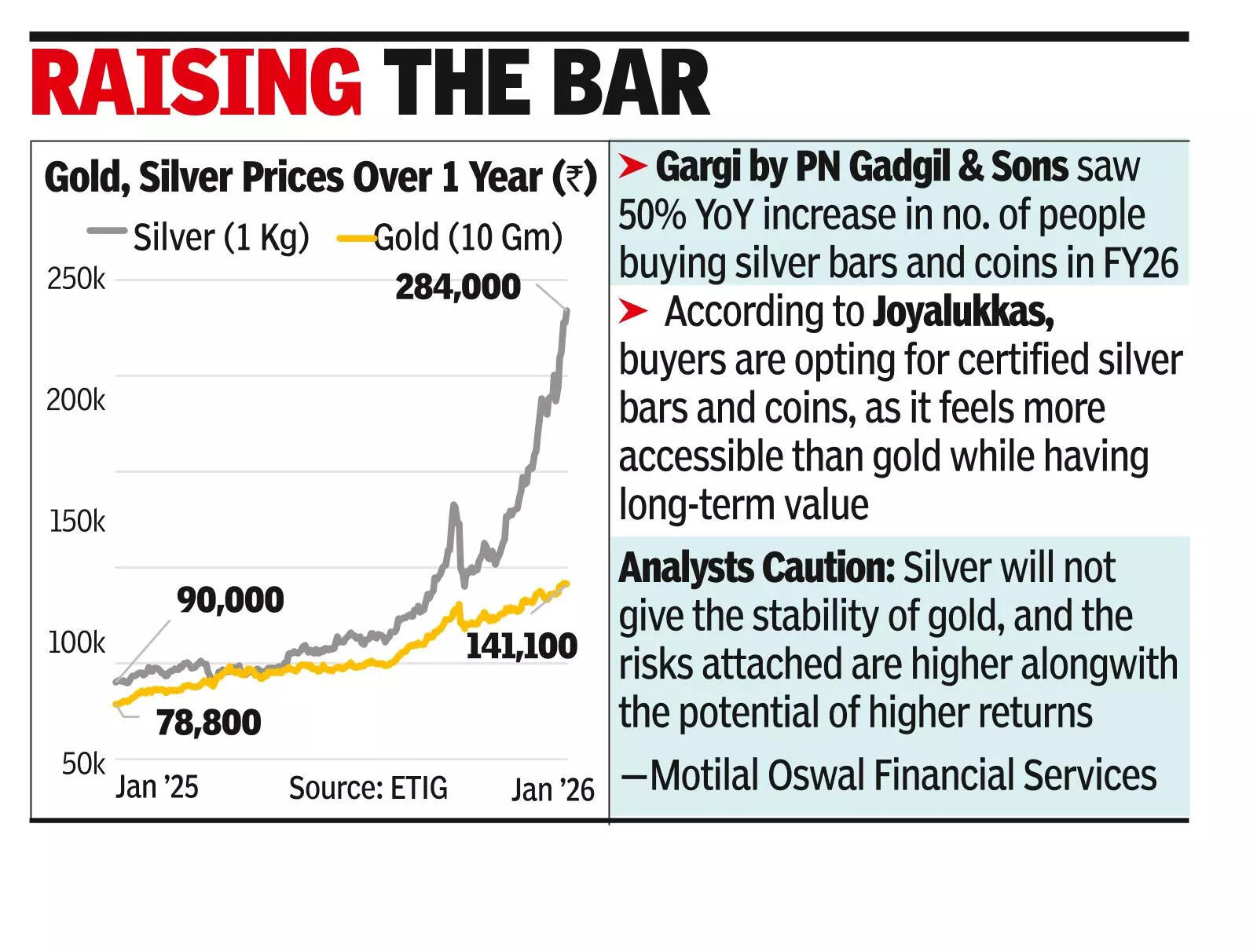

There has been a 50% year-on-year increase in the number of people buying silver bars and coins in FY26, said Aditya Modak, co-founder of Gargi by P N Gadgil & Sons. Some of the surge in demand for silver has also been led by the huge spike in prices of gold, making it beyond reach for many, said Modak. During Diwali, for gifting, corporates placed orders for silver coins of lower grammage because of the price rise but consumers didn’t hold back from investing. “In the past three months, there has been heavy buying of silver bars and bullion driven by FOMO,” said Modak, adding that it should subside a bit now.“Silver will not give the stability of gold. But has silver given higher returns than gold – yes, but then the risks attached are higher. The higher risk in silver comes with the potential of higher returns. In the longer term, there’s scope for silver (prices) to go higher (from the current levels) but in the short-term, there’s potential for correction,” said Kishore Narne, executive director at Motilal Oswal Financial Services.Last week, silver crossed the $90-per-ounce mark in the international market on the back of geopolitical tensions and higher demand from industries like EV, solar and semiconductors. The rub-off effect coupled with a weakening rupee pushed silver prices in the local spot markets to above Rs 3 lakh per kg mark. Whenever there’s a spike in silver prices, consumers are buying bars and coins, said Ajith Singh Rajapoopaty, business head at Shaya by CaratLane. The trend, Rajapoopaty said, continues. “During the Diwali period too, when prices were high, sales of silver coins increased to 30% of our overall business compared to 5% in usual times,” said Rajapoopaty. Analysts at HSBC expect a wide and volatile trading range for silver in 2026.