Budget 2026 income tax expectations: Will FM Nirmala Sitharaman provide more reason to cheer for salaried and middle class taxpayers two years in a row? 2025 was a year of tax reforms – massive overhaul of the new income tax regime, introduction of the New Income Tax Act, and finally sweeping GST rate cuts and slabs rationalization. But what will Budget 2026 bring on the income tax front? The government has increasingly been nudging taxpayers to opt for the new income tax regime. For one – it was made the default regime two years ago, which means you have to explicitly opt for the old tax regime and in case you fail to file your income tax return within the due date, you are automatically switched to the new regime.Like every year, there is always an expectation of the common man from the government to rejig the tax slabs and provide more net disposable income in their hands. Going by the past trends any changes that are likely to be introduced would be limited to the new income tax regime.

New Income Tax Regime: What Tax Relief Was Announced Last Time?

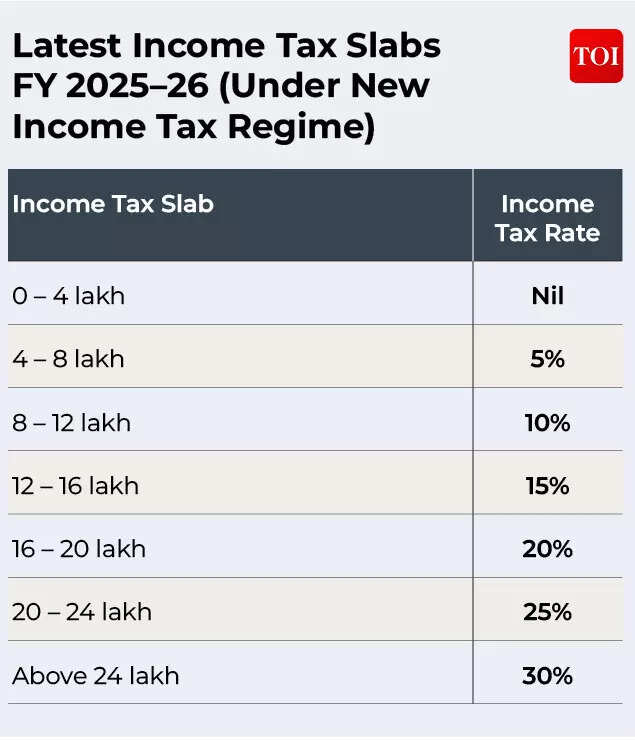

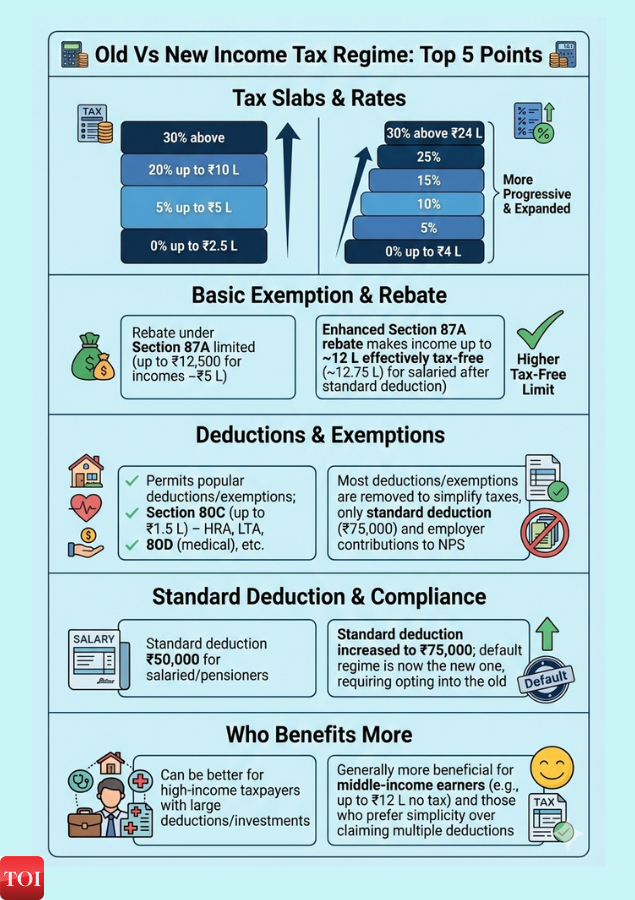

FM Nirmala Sitharaman had in her Budget speech last year announced: There will be no income tax payable up to income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000.

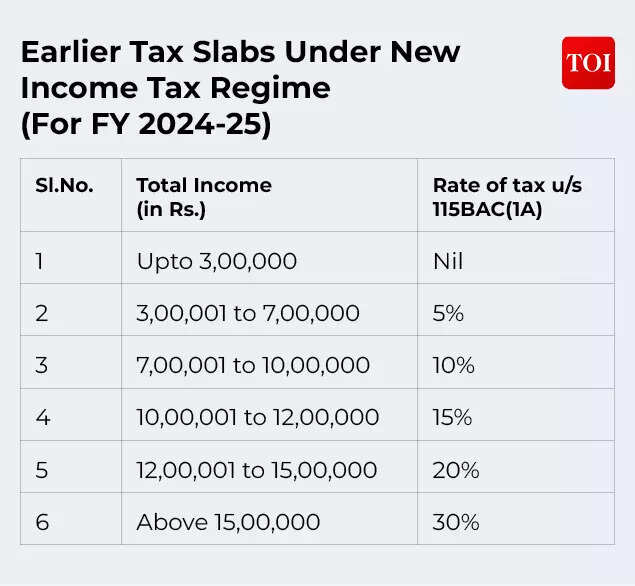

The income tax slabs and rates under the new income tax regime were also revised to hike the basic tax exemption limit from Rs 3 lakh to Rs 4 lakh.

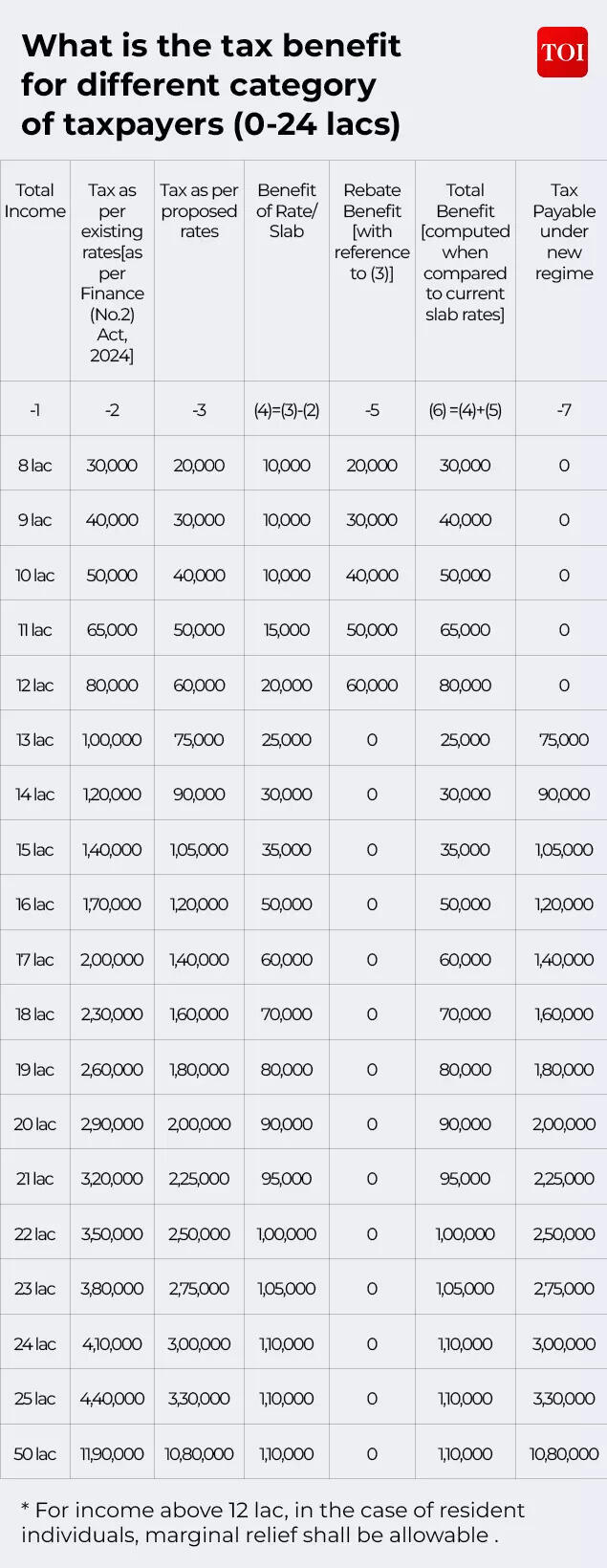

As FM Sitharaman said: A taxpayer in the new regime with an income of Rs 12 lakh will get a benefit of Rs 80,000 in tax (which is 100% of tax payable as per existing rates). A person having income of Rs 18 lakh will get a benefit of Rs 70,000 in tax (30% of tax payable as per existing rates). A person with an income of Rs 25 lakh gets a benefit of Rs 1,10,000 (25% of his tax payable as per existing rates).

But, after last year’s tax slab tweaks, is there still a case to make the new tax regime more attractive so that more taxpayers switch over? What are the top things that can be done?

Will New Income Tax Regime Be Made More Lucrative?

One important point to note is that after the changes made in Budget 2025, such as higher tax rebates and revised tax slabs, the new income tax Regime has become much more attractive for most taxpayers. Hence the adoption of the new regime is expected to be much higher when income tax returns for the ongoing financial year are filed later this year.Tax experts surveyed by Times of India Online are mostly of the view that no major changes to the income tax regime are likely in this year’s Budget.As Preeti Sharma, Partner – Tax and Regulatory Services, BDO India, if a taxpayer cannot claim sufficient deductions, the new income tax regime usually results in a lower tax burden.“Since the Government has already made major improvements to the new income tax regime in Budget 2025, big changes to tax slabs are unlikely in this year’s Budget,” she opines.The growing preference for the new income tax regime is already visible. Out of 7.28 crore income tax returns filed for AY 2024–25, around 72% were filed under the new income tax Regime, while only 28% chose the old tax regime. “This shows that most taxpayers now find the new tax regime simpler and more tax efficient,” Preeti Sharma said.Surabhi Marwah, Tax Partner at EY India also doesn’t expect any changes in the new income tax regime to be announced in this year’s budget. “The new tax regime has already been liberalised with lower slabs and higher rebates. In Parliament, the Minister of State for Finance clarified that the Personal Income-tax regime (without deductions) has been recently simplified with liberal slabs and increased rebates by Finance Act, 2025. The minister said that there is no further proposal under consideration in this regard’,” she told TOI.“Thus, the immediate focus is likely to be on stability and a smooth transition rather than introducing additional reforms. Any further refinements, if considered, are expected to follow a phased approach, aligning with the broader objective of tax certainty and compliance simplification,” she added.Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax, KPMG in India believes that given the significant overhaul in slab rates last year, it may be highly optimistic to expect a significant change to income slabs or tax rates this year as well. “More realistically, the focus may possibly be on incremental measures from ease of interpretation and rationalizing of compliances,” she tells TOI.Tanu Gupta, Partner at Mainstay Tax Advisors LLP feels that every tax relief is always welcome! In the past, the government has often provided further relief only to those who opted for the new tax regime while leaving the old regime unchanged, and this is likely the path it may continue to follow, she says.“Considering the significant tax relief provided last year, as well as the relief extended through changes in GST rates during the year, the government may leave personal tax rates unchanged this time. Additionally, there is pressure on government tax collections, and it needs more resources to support exports and businesses in navigating an uncertain global economic environment,” she tells TOI.

New Tax Regime: What More Can Be Done?

In recent years, the government has introduced several changes to the new income tax regime to make it more attractive for taxpayers. However, experts point out that despite the tax slabs being revised and rationalised, a section of taxpayers continues to opt for the old tax regime due to the availability of many deductions.While not expecting any major changes, Preeti Sharma of BDO India said that the government may come with the minor changes under the new income tax regime to make it even more attractive, especially for middle-class taxpayers.

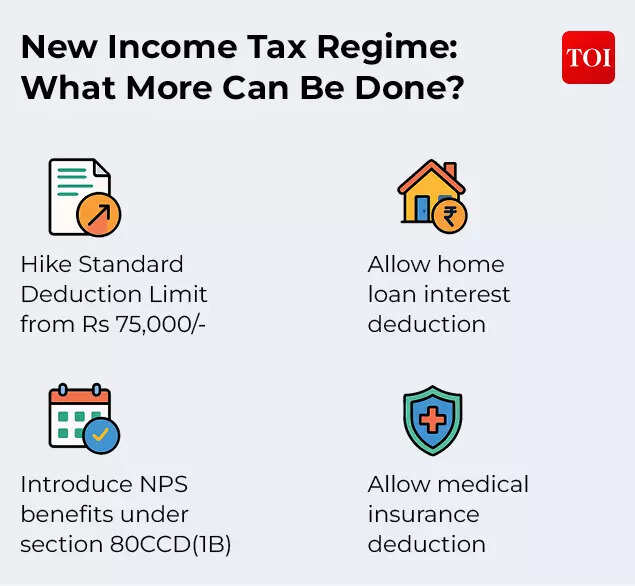

Chander Talreja, Partner, Vialto Partners says that to make the new income tax regime more attractive, the government may take steps to revisit the limit of deductions allowed in the new regime or consider introducing a new one. He lists the following moves:

- Firstly, the standard deduction limit may be increased from Rs 75,000 to Rs 90,000/-

- Secondly, the employer’s contribution to the

NPS is allowed as a deduction under the new income tax regime. For the non-salaried individuals, while this deduction is not applicable, they do not even get any deduction for their own contribution. This is a hardship and the government may consider introducing deduction in respect of an individual’s contribution to NPS under section 80CCD(1B), currently capped at Rs 50,000. This will benefit salaried as well as non-salaried individuals.

Akhil Chandna, Partner and Global People Solutions Leader, Grant Thornton Bharat also advocates for a hike in standard deduction limit. “To encourage broader adoption of the new regime, it is expected that the government may further increase the standard deduction limit. Additionally, certain reasonable deductions – such as those for health insurance and home loan interest – may also be allowed under the new regime,” he tells TOI.Radhika Viswanathan, Executive Director at Deloitte India sees scope for some limited measures for additional relief to taxpayers.

Despite the significant relief for resident taxpayers earning up to Rs 12 lakh (who now pay zero tax), taxpayers in the 12 lakhs to Rs 30 lakhs bracket, particularly those with home loans and insurance often continue to find the old regime more beneficial. To bridge this gap and accelerate a full transition to the new regime, the government could consider a few targeted measures, she says.Currently, the new regime does not allow any deduction for interest on self-occupied house property. “Introducing even a capped deduction (for example, up to Rs 2 lakhs) would significantly improve its appeal for millions of homeowners. Similarly, while employer contributions to NPS can be reduced from taxable income, employee contributions cannot, and allowing the same would bring parity and encourage retirement savings,” she tells TOI.“Further, with health insurance premiums rising year after year, many taxpayers incur substantial costs without any tax benefit under the new regime; a limited deduction for medical insurance could therefore enhance its attractiveness. While the government’s focus remains on simplification and large-scale deductions may be unlikely, selective relief in these areas could make the new regime far more compelling for a wider segment of taxpayers,” she adds.