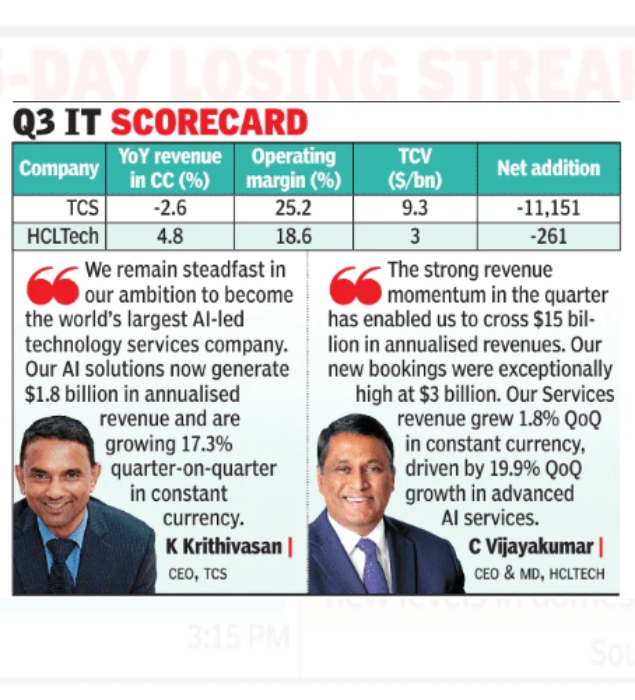

BENGALURU: TCS posted a muted showing in a seasonally weak Dec quarter marred by furloughs, while HCLTech emerged as a bright spot, with management underscoring resilience in demand.Global uncertainty weighs on spending, but demand for technology-led transformation remains strong, with discretionary spends emerging selectively even as cost-takeout deals dominate client priorities. Both firms’ net profit came under pressure, dragged by exceptional charges and restructuring costs.TCS’s revenue rose 0.8% sequentially in constant currency terms, while declining 2.6% year-on-year. In dollar terms, revenue was $7.5 billion, up 0.6% quarter-on-quarter. Operating margin remained flat at 25.2%.

Growth was led by consumer, energy, resources and utilities, life sciences and healthcare, communications, BFSI, and technology, software, and services.TCS recorded an incremental exceptional charge of Rs 2,128 crore, largely due to changes in wage definitions in the new labour codes, including Rs 1,816 crore for gratuity and Rs 312 crore for leave liability. HCL, meanwhile, absorbed a one-time cost impact of $109 million.“Among major markets, Europe continued to perform well, while North America remained sluggish. All next-generation service lines grew sequentially. Most client segments showed improvement on a last-twelve-month basis (LTM),” said TCS CEO Krithivasan.Annualised AI services revenue stood at $1.8 billion, up 17.3% quarter-on-quarter in constant currency. “In Q3, we won several large deals across markets and industries, including one mega deal in North America. We achieved a total contract value (TCV) of $9.3 billion. BFSI continues to show good growth momentum despite seasonality and furloughs,” he said.“While big tech firms invest heavily in AI infrastructure and build frontier AI capabilities, the broader industry faces geopolitical uncertainty, trade restrictions, and evolving data and AI regulations. Workforce restructuring continued, with major layoffs among top clients,” Krithivasan added.TCS reported a 14% yearon-year decline in net profit to Rs 10,657 crore, while HCLTech posted an 11% drop to Rs 4,076 crore.HCLTech’s constant currency revenue rose 4.2% quarter-on-quarter and 4.8% year-on-year. In dollar terms, revenue was $3.7 billion, up 4.1% sequentially and 7.4% from a year earlier.TCS’s headcount declined by 11,151 sequentially to 5.8 lakh and by 25,191 year-on-year. Though HCLTech added 2,852 freshers, its total headcount declined by 261 to 2.2 lakh employees.