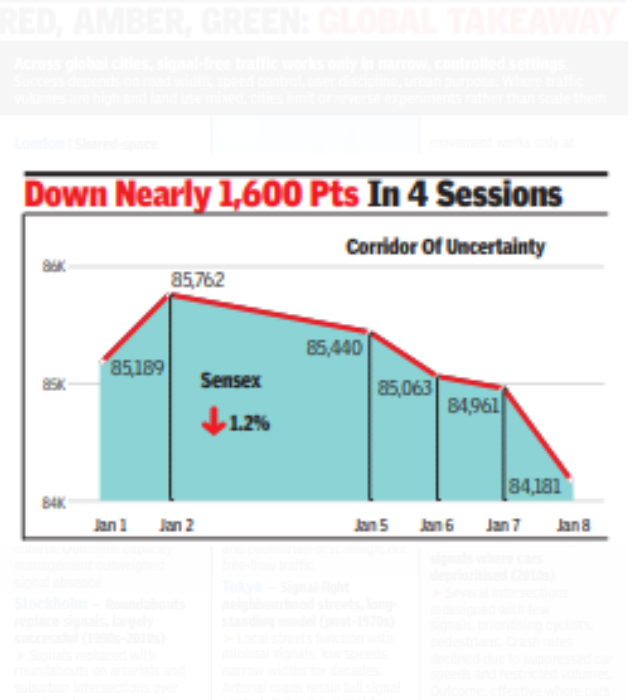

MUMBAI: A return of fears about higher US tariffs for Indian exports to the world’s largest economy pushed Dalal Street investors to press the ‘sell’ button on Thursday. This shaved off 780 points (close to 1%) from the sensex and 264 points from Nifty. Strong foreign fund selling and delay in signing of the US-India trade deal also weighed on investor sentiment, market players said. On Thursday, the US President Donald Trump signed a bill that could potentially put a 500% tariff on goods from India if it continues to buy oil from Russia. Already under pressure because of comparatively higher tariffs by the US, a further hike could weigh on India’s exports industry in a big way, market players said. The day’s session on the Street started on a marginally weak note with sensex down about 200 points, but the index lost ground through the session to close at 84,181 points, down 780 points or 0.9% on the day.

This was the fourth consecutive session of losses for sensex during which the index lost 1,581 points or 1.8%. Investors were left poorer by Rs 9 lakh crore with India’s total market capitalisation now at Rs 473 lakh crore, data from BSE showed. According to Vinod Nair of Geojit Investments, the Indian market extended the losing streak as investor sentiment turned cautious amid renewed concerns over US tariffs and persistent foreign fund outflows, overshadowing optimism around earnings growth. The negative sentiment also neutralised the good news about a robust estimated growth in India’s FY26 GDP, Nair wrote in a note to investors. Looking ahead, in the near term, markets are expected to remain cautious and trade range-bound, influenced by Q3 earnings and developments related to US tariffs on Indian exports to that country, Nair said. Additionally, ongoing geopolitical tensions and weak global market cues could also weigh on investor sentiment to keep the leading indices subdued, Siddhartha Khemka of Motilal Oswal Financial Services, said. During Thursday’s session, foreign funds were aggressive sellers with the end-of-the-day net selling at Rs 3,367 crore, data from BSE showed. In contrast, domestic funds were net buyers at Rs 3,701 crore. During the session, among sensex stocks, Reliance Industries, L&T and TCS contributed the most to the day’s fall in the index. On the other hand, higher closing in ICICI Bank, Eternal, Bajaj Finance and Bharat Electronics cushioned the slide, but only to some extent.