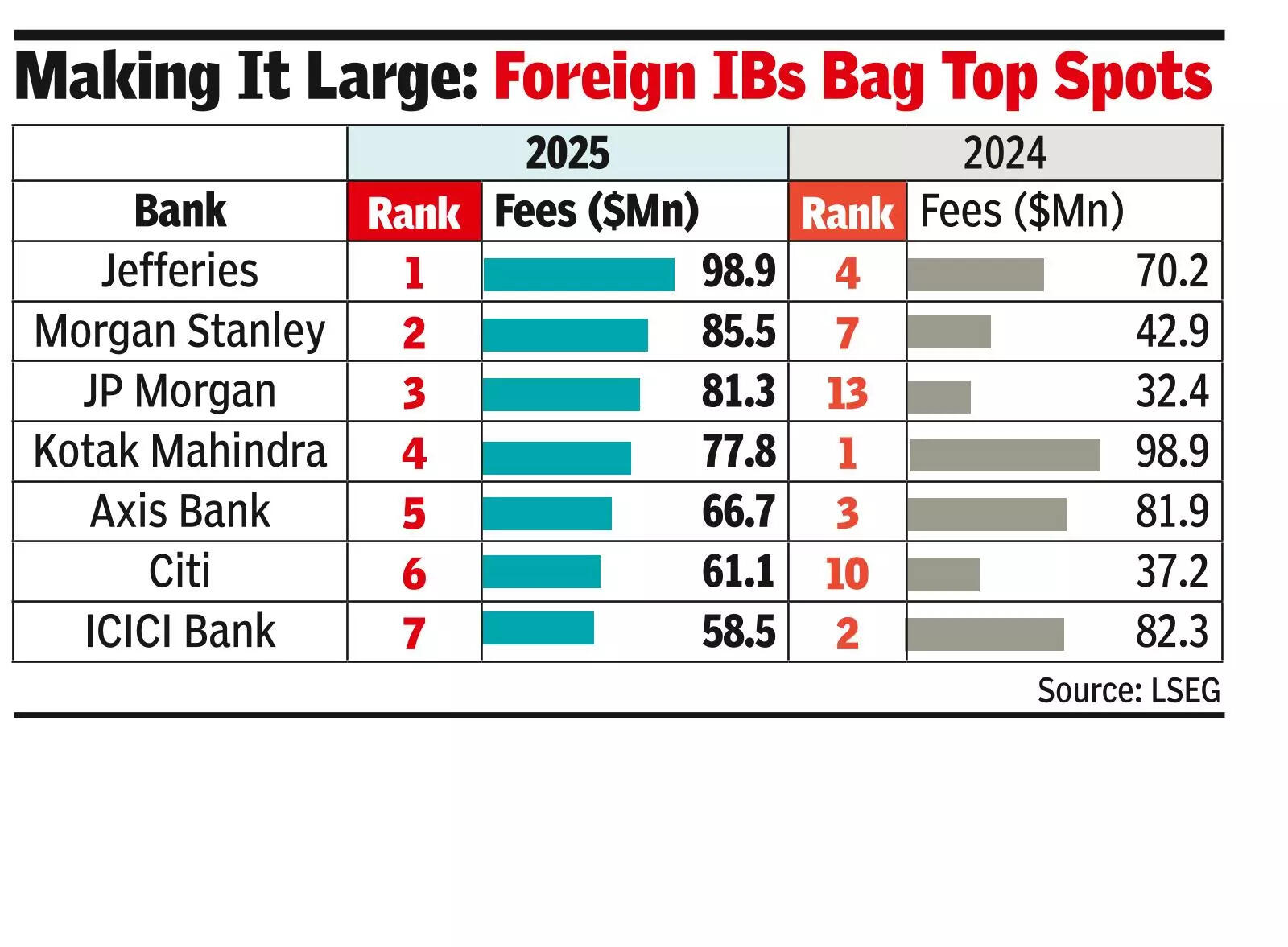

MUMBAI: India’s deal engines are humming louder than ever, and bankers are counting the spoils. Record IPOs and robust M&As lifted investment banking (IB) fees in India to $1.3 billion in 2025, with Jefferies’ bankers set to take home sizable gains as the American firm’s fees approached $100 million.Jefferies topped India’s IB fee league table with $98.9 million, climbing from fourth place in 2024 when it earned $70 million, according to LSEG. The rise caps a sharp ascent over the past five years: in 2021, Jefferies ranked 26th with just $12 million in fees.Morgan Stanley followed with $85 million, while JP Morgan secured third place with $81 million. In 2024, Morgan Stanley and JP Morgan ranked seventh and 13th, earning $43 million and $32 million, respectively.Fee charts are closely tracked in the industry as they influence bonus payouts for bankers, which foreign banks typically announce in January after the year-end break.

At $656mn, Equity Capital Mkts Generate Largest Share; M&A, Debt Mkts Follow

Equity capital markets (ECM) generated the largest share of fees at $656 million, followed by $396 million from mergers and acquisitions (M&A) advisory and $246 million from debt capital markets (excluding loan syndication), taking India’s total IB wallet to $1.3 billion, LSEG data showed.Fuelled by an IPO boom and strong block trades, ECM has led the fee pool over the past two years, whereas M&A advisory typically dominated in the earlier periods. “The Indian ECM market has come of age, and in the coming years there will be intense competition between ECM and M&A fees,” said Vikas Khattar, head of ECM at Ambit. “A strong ECM market instills confidence in large M&A deals by enabling acquirers to raise capital.”Foreign banks swept the top three spots in 2025, a sharp contrast to 2024 when domestic lenders Kotak Mahindra, ICICI, and Axis led the rankings. International banks typically focus on large-ticket transactions, and the surge in sizable ECM deals in 2025 drew greater participation from them, allowing them to capture a disproportionate share of fees and reshuffle the league tables of top banks.Samarth Jagnani, head of ECM at Morgan Stanley India, said on LinkedIn that the firm advised on 10 transactions exceeding $1 billion in 2025, reflecting the broader trend of foreign banks increasingly participating in high-value deals.Kotak Mahindra and Axis ranked fourth and fifth, earning $78 million and $67 million, respectively, while Citi rose to sixth with $61 million, up from 10th in 2024 when it earned $37 million. “Citi is decidedly one of the top banks on revenues which may not reflect in (LSEG) because cross-border deal fees are recorded in the foreign country,” said Rahul Saraf, head of IB at Citi India. With deal momentum strong, banks are expanding teams, even as bonus cycles differ-foreign bankers’ bonuses are linked to previous calendar year’s targets, while local banks follow the April-March financial year.“We increased the IB team strength by 23% last year and would look to increase by further 25%, given the strong pipeline we have and the underlying momentum of business,” said Saraf.