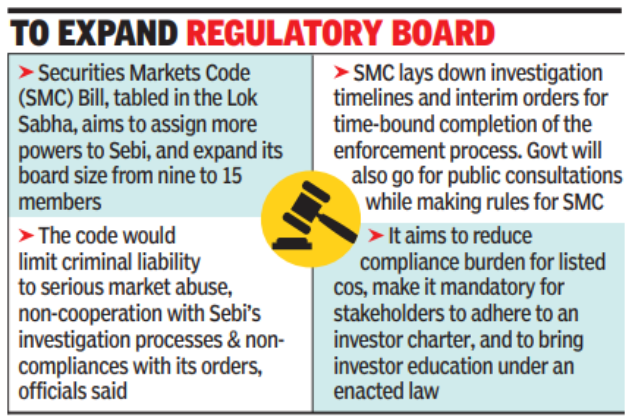

MUMBAI: Finance minister Nirmala Sitharaman on Thursday introduced the Securities Markets Code (SMC) Bill in the Lok Sabha that, among a host of objectives, aims to have a comprehensive legislation that would assign more powers to markets regulator Sebi, decriminalise several violations and expand its board size to 15 members from nine now.It also seeks to eliminate conflict of interest within the Sebi board and specifies that all regulator-led investigations should start within eight years from the day of violation of the law. The bill was referred to the parliamentary standing committee on finance for deeper examination.

The proposed law would aim to limit criminal liability to serious market abuse, non-cooperation with the investigation process of Sebi and non-compliance with Sebi orders, officials said. Other minor offences are decriminalised and will be subject to civil actions by the markets regulator, they said.The bill lays down timelines for investigations and interim orders for a time-bound completion of the enforcement process. This will provide clarity and certainty on the regulatory action to the market participants, they said.The SMC, announced in the last budget, is combining three existing legislations: Securities Contracts (Regulation) Act, 1956, Securities and Exchange Board of India Act, 1992, and Depositories Act, 1996. The bill was placed in the Lok Sabha a day after the Sebi board gave its nod to replace Sebi (Stock Brokers) Regulations 1992 with a new one and also agreed to make some major changes to Sebi (Mutual Funds) Regulations, 1996.The SMC as well as the changes being made by Sebi to its regulations are aimed at reducing compliance burden for the stakeholders in the market, make the laws and the regulations more relevant to the current market practices, and omit obsolete and redundant concepts. The SMC also aims to reduce compliance burden for all listed companies, make it mandatory for stakeholders to adhere to an investor charter, and to bring in investor education under an enacted law. The code mandates public consultation for all binding instruments issued by Sebi, such as regulations, subsidiary instructions, and also by-laws issued by Market Infrastructure Institutions (MIIs), govt officials explained. The govt will also go for public consultations while making rules under this code, they said.The code also aims to strengthen investor protection, promote investor education and awareness, and ensure effective and time-bound redressal of investor grievances, the officials said. Under this provision, Sebi would promote training of intermediaries and market participants, and NISM would be given statutory recognition under the SMC to provide training, conduct certification, and promote research in securities markets, the officials said.The bill also introduces global best practices in areas like regulatory governance, accountability, and transparency, and measures such as regulatory impact assessment, they said.