New labour codes 2025 explained: The new labour codes, effective November 21, 2025, have wide reaching implications for both employees and employers. Your salary, both take home and the Cost To Company (CTC), gratuity, provident fund will most likely see changes with the new rules. Earlier, varying definitions of ‘wages’ and ‘salary’ led to inconsistencies in calculating benefits, resulting in multiple interpretations and even frequent litigation. Under the new framework, all benefits will be calculated based on this new definition of wages.According to Puneet Gupta, Partner, EY India, the implementation of the four Labour Codes marks a significant transformation in India’s labour law framework, introducing uniformity and simplification in compliance through a common definition of ‘wages’. While this change enhances clarity, it also brings substantial cost implications for employers. “The most notable impact arises from the increased gratuity costs for employers,” Puneet Gupta tells TOI.

Gratuity is a completely tax-free payout that employees receive when they leave a company – provided they have served a certain period in service – this amount is set to go up with the new labour codes. How much will your gratuity go up? Why does the new definition of wages change your salary structure and gratuity amount? We explain:

New Definition of Wages Explained

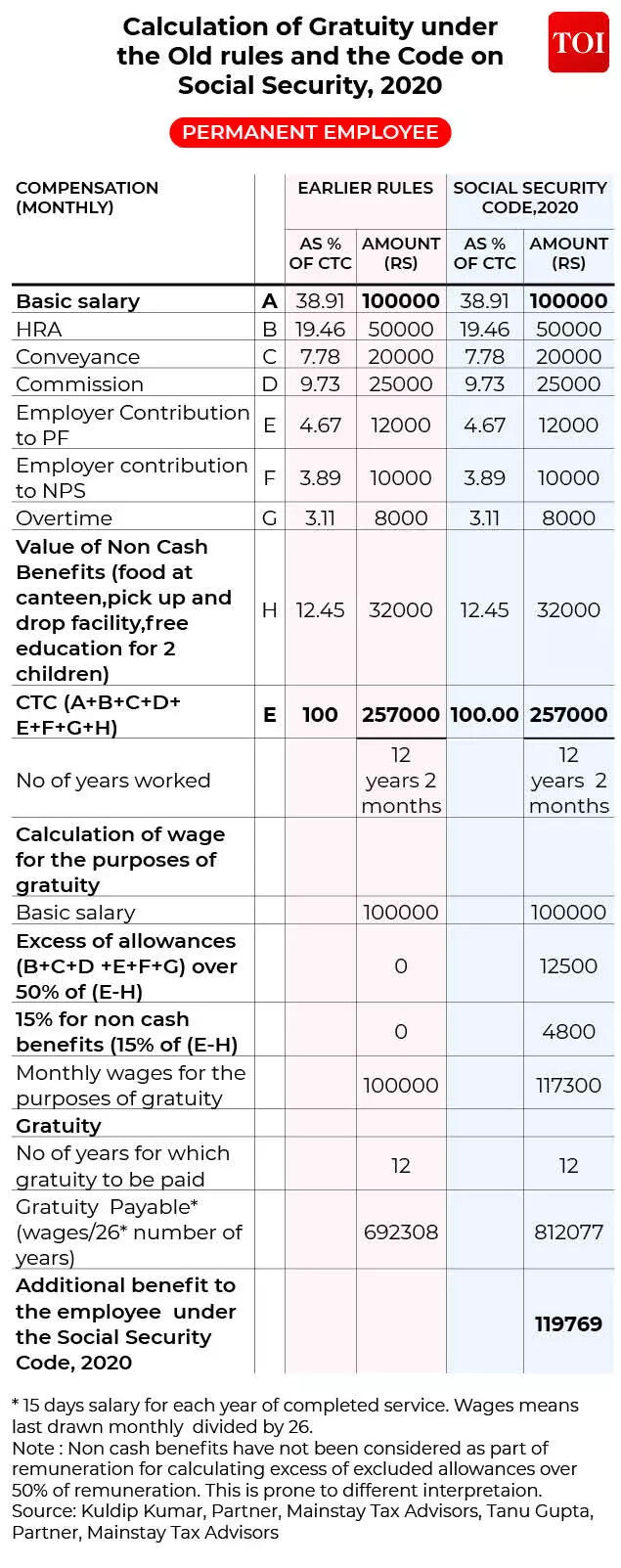

The Section 2(y) of the Code on Wages, 2019 defines wages; wages means all remuneration whether by way of salaries, allowances or otherwise, expressed in terms of money or capable of being so expressed which would, if the terms of employment, express or implied, were fulfilled, be payable to a person employed in respect of his employment or of work done in such employment, and includes –(i) basic pay;(ii) dearness allowance; and(iii) retaining allowance, if any,but does not include—(a) any bonus payable under any law for the time being in force, which does not form part of the remuneration payable under the terms of employment;(b) the value of any house-accommodation, or the supply of light, water, medical attendance or other amenity or service excluded by the appropriate Government;(c) any employer contribution to pension/provident fund, and accrued interest;(d) conveyance allowance or value of travelling concession;(e) any sum paid to defray special employment-related expenses;(f) house rent allowance;(g) remuneration payable under any award/settlement or order of a court/tribunal;(h) overtime allowance;(i) commission payable to the employee;(j) gratuity payable on termination; and(k) retrenchment compensation or other retirement benefit, or any ex gratia payment on termination.Kuldip Kumar, Partner, Mainstay Tax Advisors explains that if payments under clauses (a) to (i) exceed one-half (or such other percentage as may be notified) of all remuneration calculated under this clause, the excess shall be deemed remuneration and added to wages.Provided further that, for the purpose of equal wages to all genders and for payment of wages, the emoluments in clauses (d), (f), (g), and (h) shall be included in computation.Where any remuneration in kind is provided in lieu of wages, the value of such remuneration—up to 15% of total wages payable—shall be deemed part of wages, says Kuldip Kumar.To put it simply: the new definition of wages is now broader and goes beyond basic pay and DA. “When the excluded allowances listed above exceed 50% of the remuneration as calculated above, the excess is included in wages for gratuity computation. Additionally, if an employer provides non-cash benefits, up to 15% of wages may be added to wages for the purpose of determining gratuity liability,” explains Kuldip Kumar to TOI.Let’s understand the definition of wages through some examples: As is evident in the table above, earlier only basic salary and dearness allowance were considered for calculation of gratuity. Under the new labour codes, the ‘wage’ component of the salary – which has to be 50% of total salary is considered. This increases the salary that will be considered for gratuity payout.

What does the new definition of wages mean for your gratuity payout?

As per the Code on Social Security, 2020, gratuity is payable when employment is terminated – this could be due to the employee retiring, resigning or being asked to go. How is the gratuity amount calculated?It’s a simple formula: It is calculated for 15 days’ last drawn ‘wages’ for each completed year of service.Gratuity = (Last Drawn Salary × 15/26) × Number of Years of Service.Under the erstwhile gratuity law, this calculation was based on 15 days’ last drawn ‘basic salary’ for each year of service. Now, with the definition of wages changing, it could result in a higher gratuity payout for employees.Let’s understand this better with the help of an example:

Old vs new: Gratuity Calculations for Permanent Employee

In the chart above, a permanent employee gets a basic salary of Rs 100,000 per month, which is just 38.91% of the total monthly Cost to Company (CTC) of Rs 257,000.

- Under the old rules, the salary for gratuity purposes was Rs 100,000. Accordingly, the gratuity payable came to Rs 692,308

- However, under the new Code, because the excluded allowances are more than 50% of CTC, this excess of Rs 12,500 must be added to wages. Rs 4,800 is added as 15% of remuneration, which is remuneration minus value of non- cash benefits

- Therefore, the salary for gratuity purposes becomes Rs 117,300! As a result, under the new Code, the employee receives Rs 119,769 more as gratuity, i.e Rs 812,077/-

As is evident in the table above, with wages being considered for gratuity calculations instead of basic salary, the gratuity payout will go up. There may also be cases when two individuals with the same basic salary earlier will now have different gratuity payouts since their ‘wage’ amount may differ.

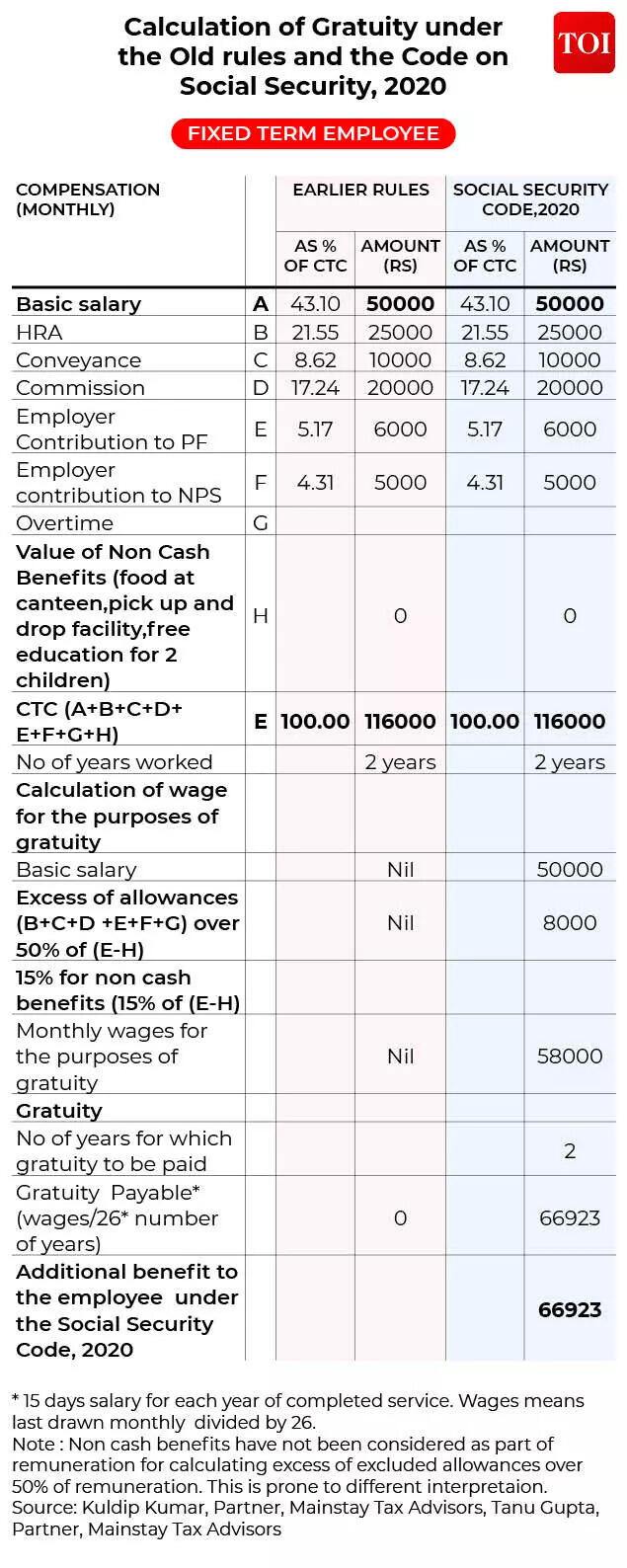

Gratuity Benefits For Fixed Term Employees:

One major change under the new labour codes is the eligibility criteria for gratuity. Earlier, an employee was required to complete five continuous years of service to be eligible for gratuity. The new Code now provides that fixed-term employees are eligible for gratuity after completing at least one year of continuous service. Under the old rules, such employees were not entitled to gratuity unless they completed five years.Kuldip Kumar of Mainstay Tax Advisors explains this better with an example:

Old vs new: Gratuity Payout calculations for fixed term employees

A fixed-term employee who has served for two years becomes eligible for gratuity and gets Rs 66,923 upon leaving employment.So who is a fixed term employee? Section 2(34) of the Code defines a fixed-term employee as one who is hired for a specified period. Such employees must receive working hours, wages, allowances, and benefits not less than those of permanent employees performing similar work and are entitled to all statutory benefits proportionately, even if their service does not meet the normal qualifying period.

Other Gratuity Changes of New Labour Codes

There are several other relevant changes that employers need to be aware of.According to Kuldip Kumar, gratuity must now be paid within 30 days from the date it becomes due. Failure to make timely payment will result in penal interest in addition to the gratuity amount. Non-payment of gratuity may also lead to prosecution and fines. For the second or subsequent defaults, the law provides for enhanced penalties.Fixed Term Employees are entitled to gratuity on a pro-rata basis. For example, if a fixed term employee has worked for one year and three months, the employee will be entitled to gratuity for one full year plus a proportionate amount for the additional three months. On the other hand, a regular employee is not entitled to gratuity on a pro-rata basis, although any period of service exceeding six months is rounded off to a full year for gratuity calculation.

Wages & Gratuity Payout: Important Clarifications needed

Kuldip Kumar says that one significant clarification needed relates to the definition of wages. “The definition should be simple and easy for employees to understand. However, the current definition is complex, and determining what must be included or excluded may lead to interpretational issues,” Kuldip Kumar tells TOI.Some of the issues he mentions are:

- Whether non-cash benefits should be included in the wage definition. As per the current definition, anything provided to an employee under the employment contract and capable of being expressed in monetary terms is considered wages. Employers can determine the monetary value of non-cash benefits such as pickup and drop facilities, free meals, free education for children, etc.

- What exactly constitutes “non-cash benefits”? These are not defined in the Code and may therefore lead to differing interpretations and potential litigation. For instance, whether stock options, employer-borne taxes, etc., qualify as non-cash benefits remains unclear, even though they may be treated differently under tax laws.

- Many employers now use compensation structures that include newer components such as variable pay, family health check-ups, insurance top-ups, etc. How these components should be treated under the wage definition is unclear.

- Employers frequently adopt different types of stock incentive plans, especially in the IT sector, to retain employees. It is unclear when the benefit to the employee should be considered—on grant, vesting, or realisation of monetary value.

- It is also unclear whether the Codes apply only to services rendered after 21 November 2025, or whether gratuity must be calculated under the new norms for past services already rendered, where the employee has not yet retired, Kuldip Kumar says.

ConclusionThere are two main changes in gratuity payouts that employees should be aware of:

- Gratuity payout may be higher now since definition of wages has become broader

- Fixed term employees are eligible for gratuity after 1 year of service.

“There is no doubt that employees will benefit from the enhanced gratuity provisions. However, these changes may create significant financial liabilities for employers for past services rendered before 21 November 2025. When finalising their financial statements for FY 2025–26, employers may need to make additional provisions in their books to account for this liability,” says Kuldip Kumar.“Whether any grandfathering provisions will be introduced to protect employers in respect of past service remains uncertain and will depend on the final rules once issued,” he adds.