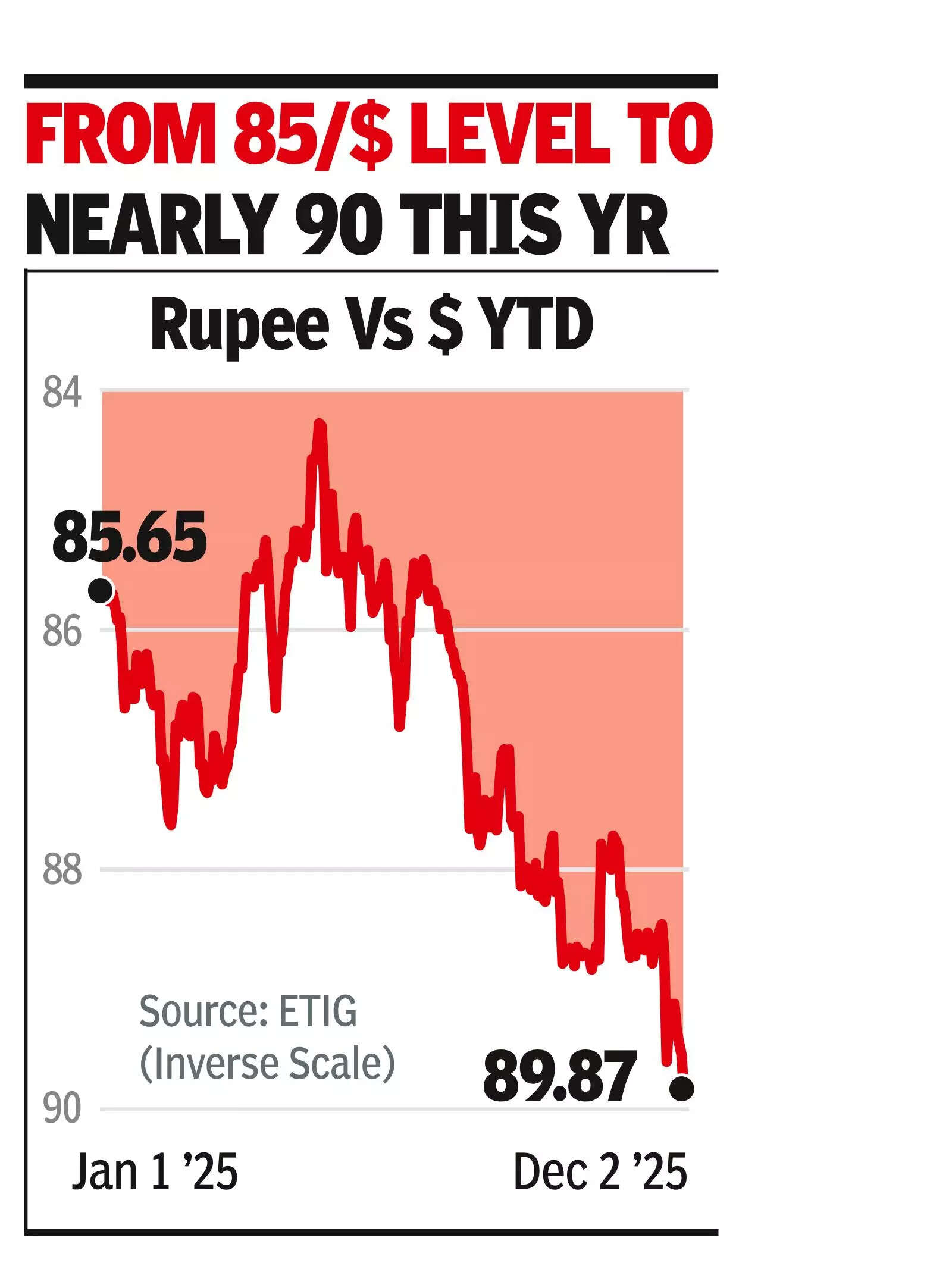

MUMBAI: The rupee fell to a record low on Tuesday, extending losses driven by the absence of a trade deal with the US that has weakened trade and portfolio inflows and pushed the currency into its fifth straight day of decline.The rupee touched 89.95 during the session before closing at 89.87, down 0.4%. Data from the Clearing Corporation showed that there were multiple bilateral trades at 90 after closing of the market. PTI also reported that the rupee traded above 90 on Tuesday. Strong domestic growth in the Sep quarter has not eased stress on the external sector, and traders expect more weakness even as RBI intervention aims to contain volatility.

“Rupee hasn’t broken 90 today, but it has already moved past earlier resistance and can trade in the 90–92 band ahead. Pressure on the current account is high and the capital flows that once offset it are missing. The outlook isn’t bullish — growth numbers look strong, but nominal growth has cooled, and that’s a concern. There’s a clear case for policy support to growth, yet the headline GDP strength may make it hard to justify,” said Ashhish Vaidya, head of treasury at DBS Bank.Heavy dollar demand from importers and reluctance from exporters have created an imbalance in the market and added pressure on the currency. The uneven flow has contributed to rising forward premiums, with the 1-month premium above 19 paisa and the 1-year implied yield at 2.33%.Other Asian currencies and the dollar index traded sideways through the session as investors held firm to expectations of a US rate cut in Dec. The rupee, however, has been among the weakest in the region this year, down 4.8%.