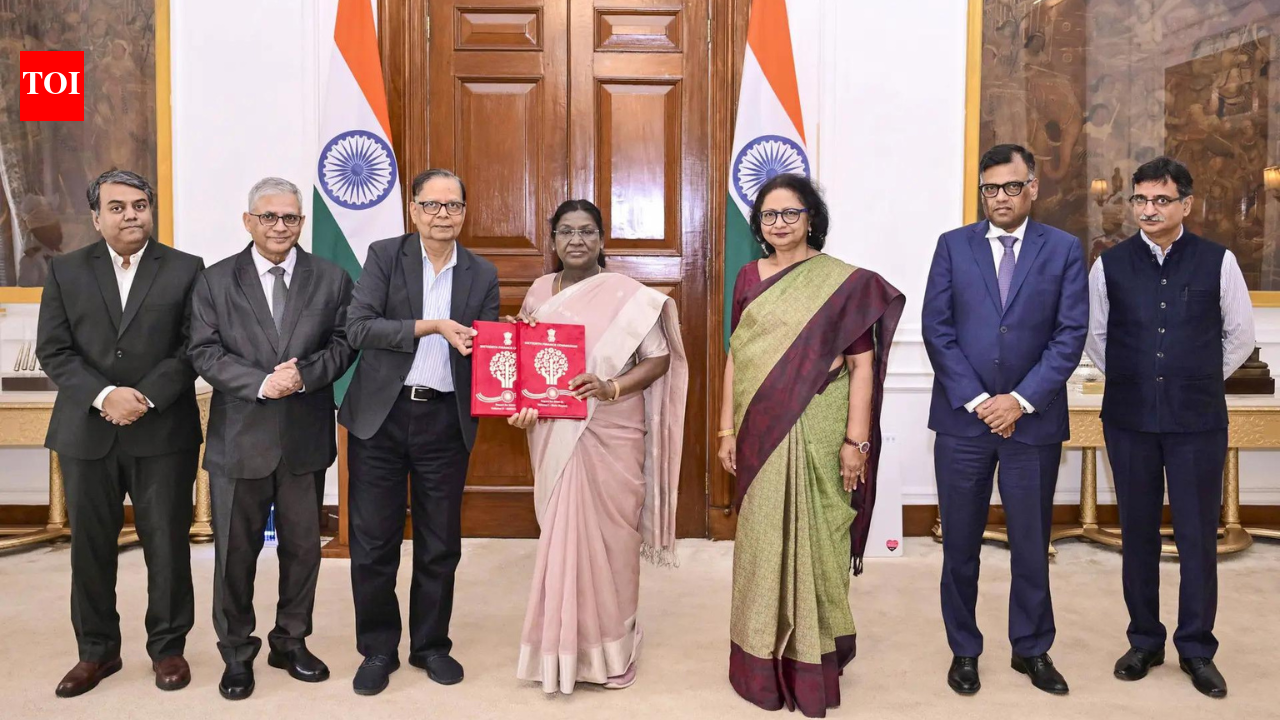

The 16th Finance Commission has recommended retaining states’ share in the divisible pool of central taxes at 41 per cent, while pitching for outcome-based spending, greater transparency in tax devolution data and stronger fiscal discipline at the state level. The panel said there is a need to improve efficiency in public spending and strengthen fiscal accountability frameworks across states.The Finance Commission is a constitutional body under Article 280 that recommends how the Union government’s tax revenues should be shared with states and how fiscal transfers should be structured. The 16th Finance Commission, with Dr Arvind Panagariya as Chairman, was set up on December 31, 2023 for the April 2026–March 2031 period. It was mandated to recommend vertical and horizontal tax devolution, principles for grants-in-aid from the Consolidated Fund of India, measures to strengthen state finances including support for panchayats and municipalities, and review funding arrangements for disaster management under the Disaster Management Act, 2005.The Commission stressed the need to rationalise centrally sponsored schemes by linking implementation with measurable, real-time output indicators. In its assessment, it noted that “there is a need to rationalize their structure by linking the implementation with measurable, real-time output indicators for efficient use of resources,” and suggested that the Union government appoint a high-powered committee to reassess such schemes and recommend closure of those not spending resources productively.On tax sharing transparency, the Commission recommended that the Union government annually disclose data on net tax proceeds certified by the Comptroller and Auditor General (CAG) under Article 279. It said this would help “bring in more transparency about the divisible pool and the actual devolution.”“Presently, for its award period, the Commission recommends retaining the States’ share in the divisible pool at its current level of 41 per cent,” the 16th Finance Commission said.Finance Minister Nirmala Sitharaman said the government has accepted the recommendation. “The Government has accepted the recommendation of the Commission to retain the vertical share of devolution at 41%. As recommended by the Commission, I have provided Rs 1.4 lakh crore to the States for the FY 2026-27 as Finance Commission Grants. These include Rural and Urban Local Body and Disaster Management Grants,” Sitharaman said.

GDP contribution added to horizontal devolution formula

For horizontal devolution — distribution among states — the Commission retained traditional parameters such as population, demographic performance, area, forest cover and per-capita income distance, while adding contribution to Gross Domestic Product (GDP) as a new criterion with 10 per cent weight. It said it relied on “population, demographic performance, area, forest, per-capita-income-distance and contribution of the State to Gross Domestic Product (GDP) as criteria.”The Commission said contribution to GDP works as a proxy for efficiency-linked indicators such as tax effort and fiscal discipline, while per-capita income distance captures equity-linked indicators such as development gaps.

Revenue deficit grants discontinued

The Commission said state revenue deficits largely stem from committed and discretionary expenditure and stressed that states have scope to increase revenues and rationalise spending. It noted that “the cause of revenue deficit of States lie in committed expenditures and discretionary expenditures and there is significant scope to increase revenues and rationalise expenditures.”It also warned that “the anticipation of revenue deficit grants by States weakens the incentive to undertake difficult but necessary fiscal reforms such as rationalizing subsidies, improving tax administration, or curbing revenue expenditures.”Continuing the declining trend recommended by the 15th Finance Commission, which reduced revenue deficit grants to near-zero by FY26, the 16th Finance Commission said it does not recommend revenue deficit grants, nor sector-specific or state-specific grants during its award period.

Local body funding linked to performance and transparency

The Commission recommended Rs 7,91,493 crore in grants for rural and urban local bodies for FY27 to FY31. It proposed classifying grants into basic and performance-linked components and emphasised that states should improve local revenue systems, including development of “citizen friendly GIS based property tax IT system for efficient enumeration, assessment and collection of property tax.”It also recommended stronger audit and reporting frameworks, noting that existing arrangements for technical guidance and supervision by the CAG “should be continued and strengthened to improve the quality of audit and accounts of local bodies.”

Disaster funding and real-time data monitoring push

The Commission recommended a total disaster management corpus of Rs 2,04,401 crore for states for FY27 to FY31. It also pushed for strengthening digital monitoring, recommending that the National Disaster Management Information System be transformed into a real-time transaction-level disaster data platform.It also recommended adding heatwave and lightning to the list of notified national disasters.

Fiscal consolidation and borrowing discipline tightened

The Commission recommended that states’ fiscal deficit remain capped at 3 per cent of GSDP, while the Union government should reduce fiscal deficit to 3.5 per cent of GDP by the end of the award period. It also recommended that states “completely discontinue the practice of incurring off-budget borrowings and bring all such borrowings onto their budgets.”

Subsidy rationalisation and PSU reform push

The Commission flagged rising subsidy burdens and said “borrowing for expenditure on schemes of subsidies and transfers is not sound fiscal policy,” while urging states to rationalise schemes and introduce sunset clauses.On public sector enterprises, it recommended evaluation of performance and said inactive PSUs “should be considered for immediate closure to reduce fiscal strain,” while also pushing states to explore state-level privatisation policies.Overall, the recommendations signal a shift towards performance-linked fiscal transfers, tighter borrowing discipline and greater transparency in Centre-state fiscal relations during the award period.